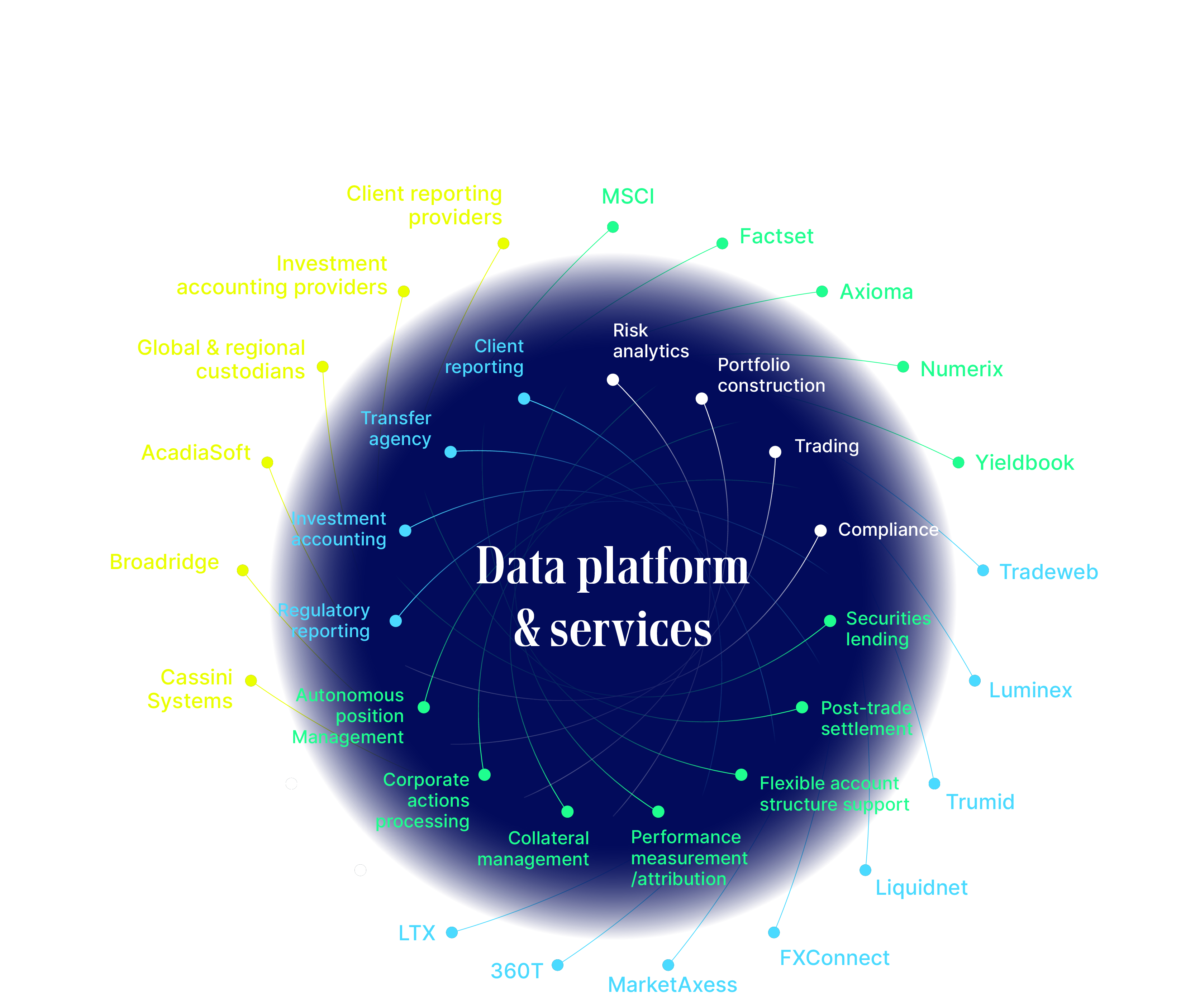

Work seamlessly across your organization with real-time, data-driven insights.

Alpha empowers portfolio managers, traders and risk teams with a shared view of holdings, exposures and orders. Using a trusted data source and integrated portfolio analytics, you can manage risk more effectively, surface investment opportunities faster and source liquidity across asset classes.

-

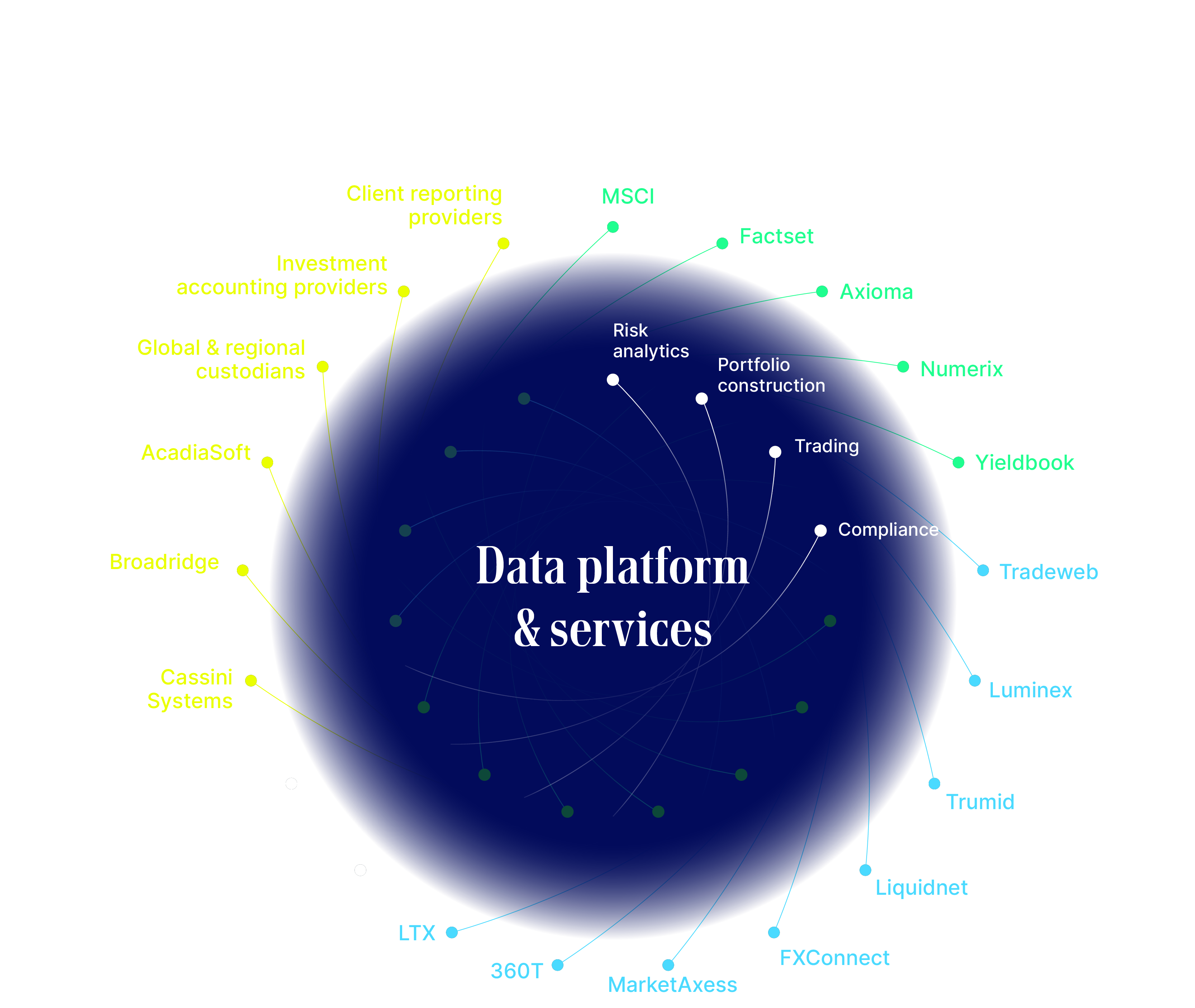

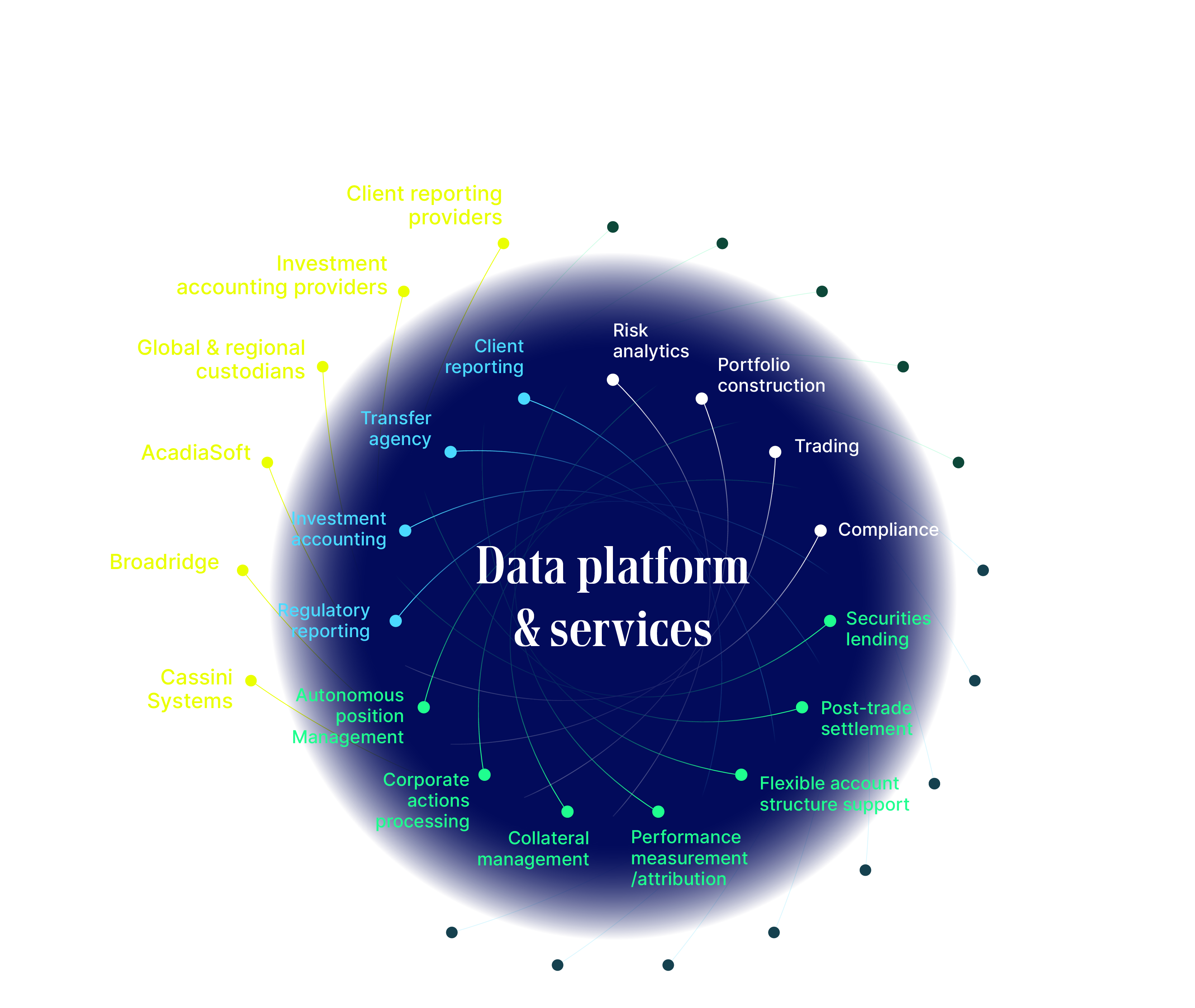

Front-office capabilities:

Portfolio construction, risk analytics, trading and compliance.

-

Portfolio and risk analytics partners:

MSCI, Qontigo, FactSet, YieldBook, Northfield

-

Liquidity and trading partners:

MarketAxess, Tradeweb, Trumid, Liquidnet, LTX, FXConnect, 360T, Luminex

-

Technology partners:

Microsoft®, Snowflake®