Insights

Institutional Investor Indicators: September 2025

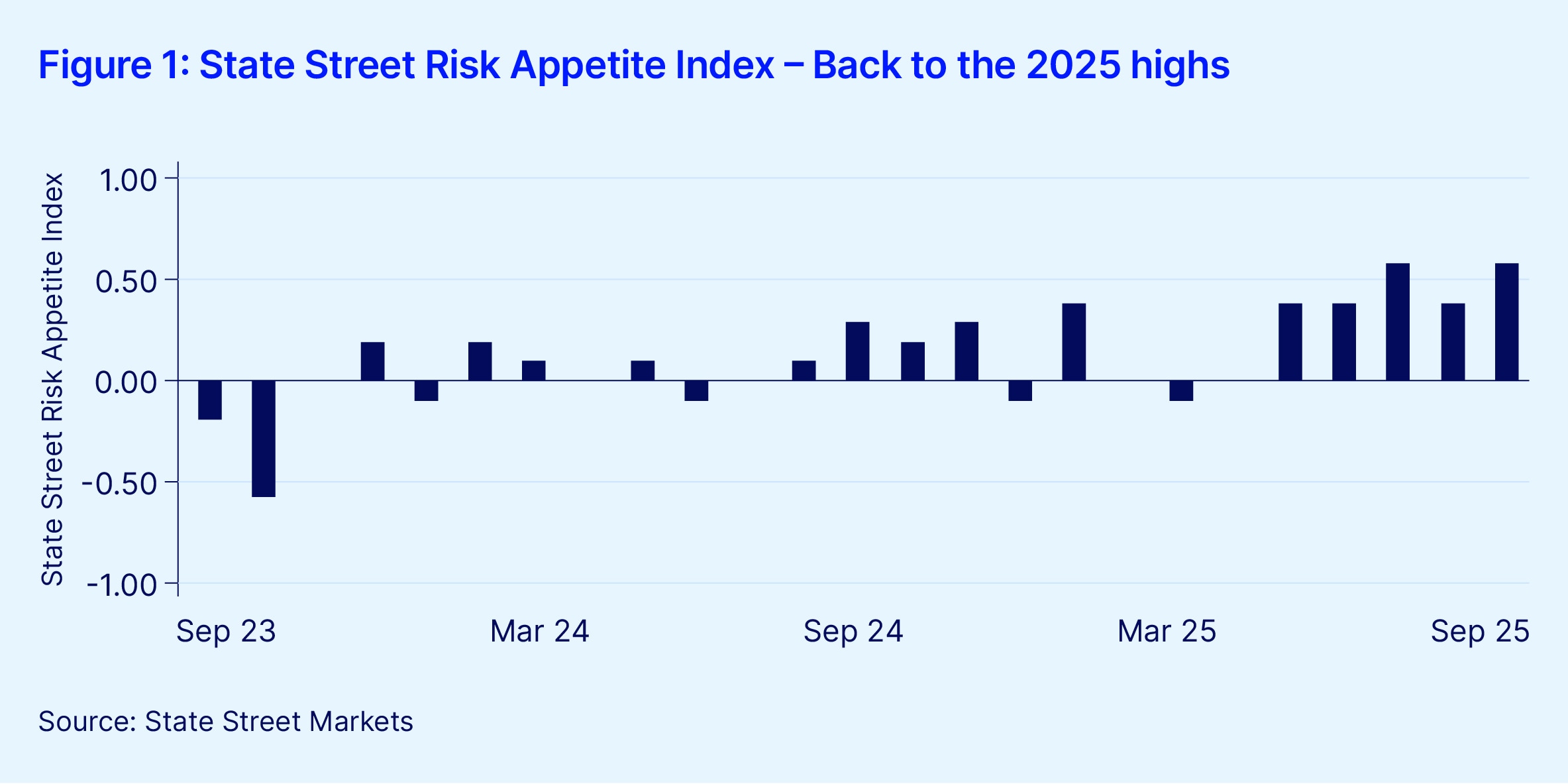

The State Street Risk Appetite Index remained firmly positive in September, sustaining a five-month streak of rising investor confidence and matching July’s peak.

October 2025

- Our Institutional Investor Holdings Indicator shows the aggregate holdings of institutional investors across three asset classes: stocks, bonds and cash. This simple information can tell us a lot about how investors view the economy and markets.

- Our Institutional Investor Risk Appetite Indicator is based on flows — buying and selling activity — rather than portfolio positions. It reveals whether investors, in aggregate, are buying risk or selling it. While the Holdings Indicator tells us about the current location, the Risk Appetite Indicator tells us about the direction of travel.

The State Street Risk Appetite Index remained in positive territory in September, continuing a five-month run of upbeat sentiment. Indeed, last month’s reading equaled July’s 2025 peak, as investors continued to embrace risk. The State Street Holdings Indicator shows that long-term investor allocations across equities, fixed income and cash were essentially unchanged through September. This illustrates that even as global yield curves steepen, investors are not yet being tempted back into duration assets, with fixed income allocations remaining meaningfully light compared with their long-run averages.

View September 2025 commentary by Lee Ferridge, head of Macro Strategy in the Americas for Markets.

Despite heightened geopolitical uncertainty in a number of major economies, somewhat mixed economic data and growing valuation concerns across a raft of pro-risk assets, our broad measures of risk appetite continued to show strong positivity through September. Equity markets continue to make fresh all-time highs seemingly every day and volatility measures remain subdued.

This positivity was clearly boosted by the United States Federal Reserve lowering interest rates in September for the first time this year, while also signaling that it would further ease twice before year-end, an extra cut compared with the message provided in June. Within the month, the asset allocation weight to equities, the riskiest asset class , was virtually unchanged – while the same is true for allocations to cash and fixed income assets. Investors are overweight risk and are happy to remain that way. Our broader suite of institutional flow indicators backs this message. Indeed, the sentiment reading from our Asset Behavioral Risk Scorecard shows a three-month moving average for sentiment at its most positive since January 2021. Political, economic and valuation concerns abound, but for now at least, investors are happy to ride the positive price wave.

Digging deeper, in foreign exchange (FX), dollar selling persists, even as the US dollar (USD) holdings now show the most pronounced underweight since early 2021. In relative terms, the USD underweight is easily the most significant of all the major currencies. In somewhat of a departure from last month, the pro-risk message from currencies is not just confined to USD selling. We now see a pronounced move into carry currencies, and with positioning in high-yield FX still underweight, there is every chance that this move back into carry can persist. Alongside the move to carry, we are also seeing buying of riskier commodity currencies such as the Canadian and Australian dollars. Meanwhile, flows to the euro and the Japanese yen (traditional funding currencies) have weakened, although demand for the Swiss franc remains robust.

In equities, North America remains easily the most favored region, with further buying of US equities adding to the existing overweight. However, September saw even stronger buying of Canadian stocks pushing that overweight above that of the US. Elsewhere, equity demand is probably best described as mixed, with last month’s buying of emerging market (EM) Asia equities losing momentum. Institutions also continue to unwind some of the inflows into European shares from earlier this year and positions in European equities are now back to underweight.

As for fixed income, as Figure 2 illustrates, overall demand remains tepid when it comes to developed markets. We are, however, starting to see renewed demand for EM fixed income assets as the carry theme highlighted in FX earlier is also being extended into longer-duration assets. In September, seven countries showed above-average demand for sovereign bonds and six of these were EM nations. Australia was the exception.