Insights

Private markets and the AI revolution

Artificial intelligence is rewriting the rules of private markets, and investors worldwide are racing to stay ahead.

July 2025

Sarah Salih

Head of Investment Services

North America

Artificial intelligence (AI) is now widely recognized as a transformative technology for investment organizations. However, there are many use cases under consideration across multiple operational areas, making it a challenge to recognize all the ways AI will shape our industry. Our 2025 Private Markets Study1 gives a clearer view of the different implementations that may contribute to that big picture.

It’s clear that North American institutional investors and asset managers are embracing the use of generative AI (GenAI) and large language models (LLMs) to improve their use of data in private markets operations, with Canadian institutions in particular leading the charge. A little over three quarters (77 percent) of North American respondents to our study said they were either using these technologies or planning to use them “to generate consistent, analyzable data from unstructured information related to [their] private markets investments.” Only 7 percent had actually implemented AI for improving operational efficiency, but a third (33 percent) were actively investing in specific use cases, and a further 37 percent were in an exploratory phase.

Across North America, results were broadly in line with global response rates; however, Canadian respondents in particular were approximately double the global average for actively using AI in their data operations (15 percent said they are doing so, compared to 8 percent globally).

Respondents in the United States were less bullish on the value of this technology, with just 4 percent currently using it and, strikingly, nearly a quarter (23 percent) saying they do not see the value of doing so (compared to just 10 percent globally). Nevertheless, a significant number of institutions in both countries saw a wide range of different applications for GenAI and LLMs in private markets. At the whole-of-fund or portfolio level, investment performance reporting was the main area of potential use, with nearly two thirds (62 percent) of respondents from North America saying they see value in the technology. 43 percent are also using or considering using it for managing and analyzing spread data in their private credit portfolios, while approximately a third saw GenAI and LLMs as having utility for capital calls and distribution documentation as well as for data related to subscriptions and redemptions.

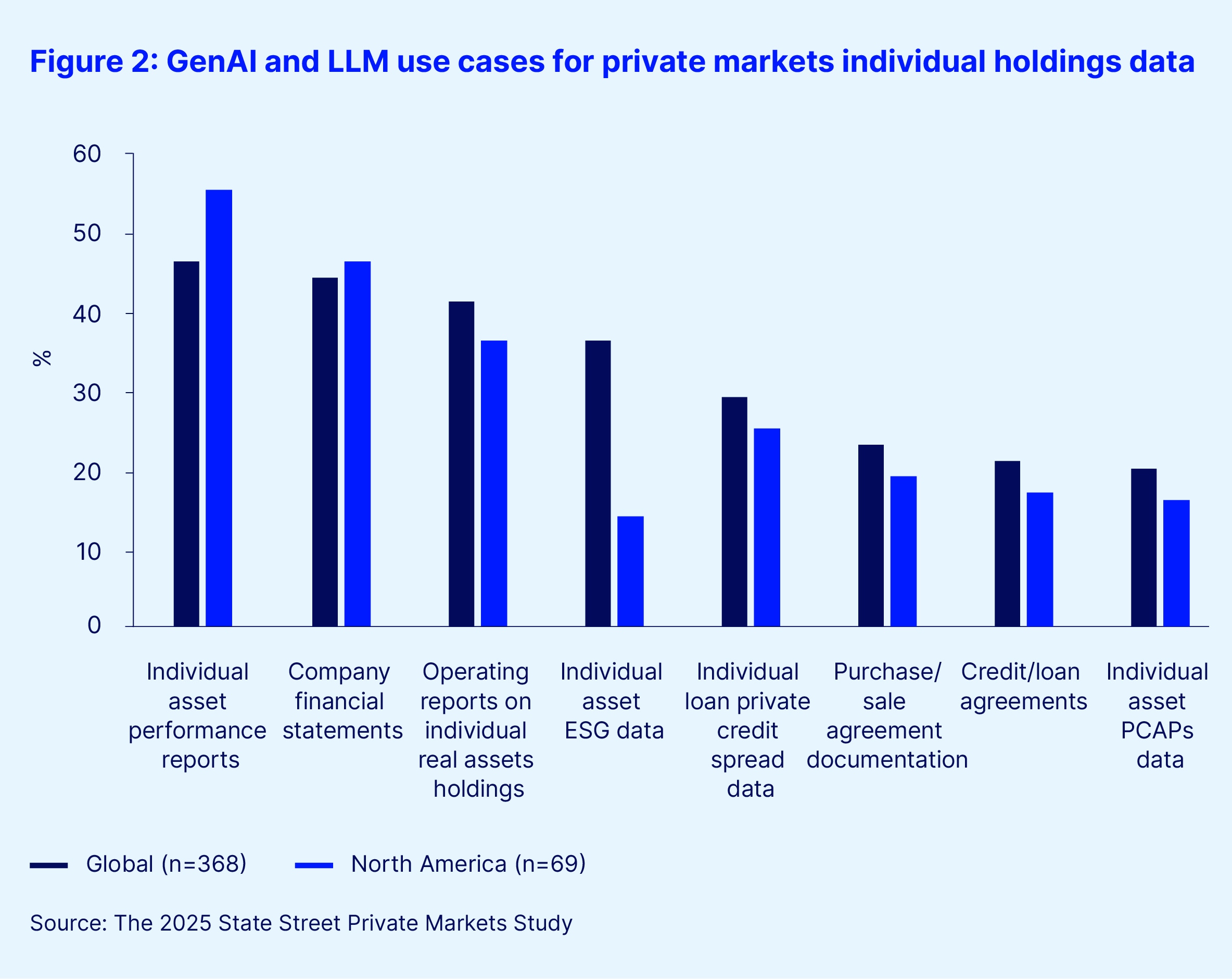

The survey results also show a wide range of use cases for data management and the analysis of individual holdings within private markets portfolios. Investment performance was again the most popular response (55 percent), but at least a quarter of respondents also saw applications for the technology in analyzing company financial statements, operating reports and credit spread data.

We took an in-depth look at this trend in a recent roundtable discussion with global investment institutions and other market participants. In addition to the role of AI and emerging technologies in transforming private markets operations, our study provides insights into the future of asset allocation, fundraising plans and retail distribution.