Insights

State Street PriceStats signals encouraging inflation trends

Inflation in the United States showed fresh signs of cooling at the start of 2026, per the latest State Street PriceStats index reading.

February 2026

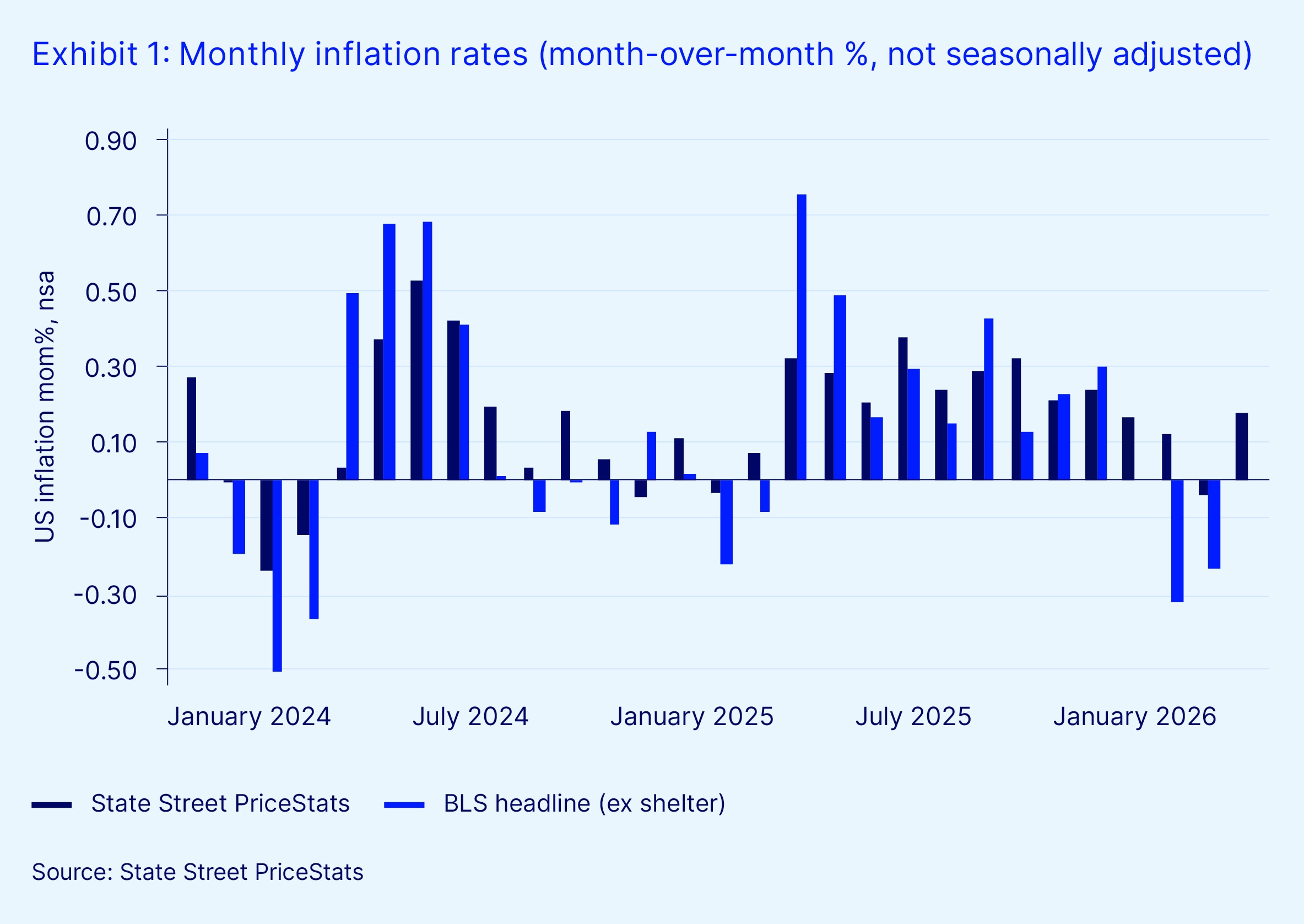

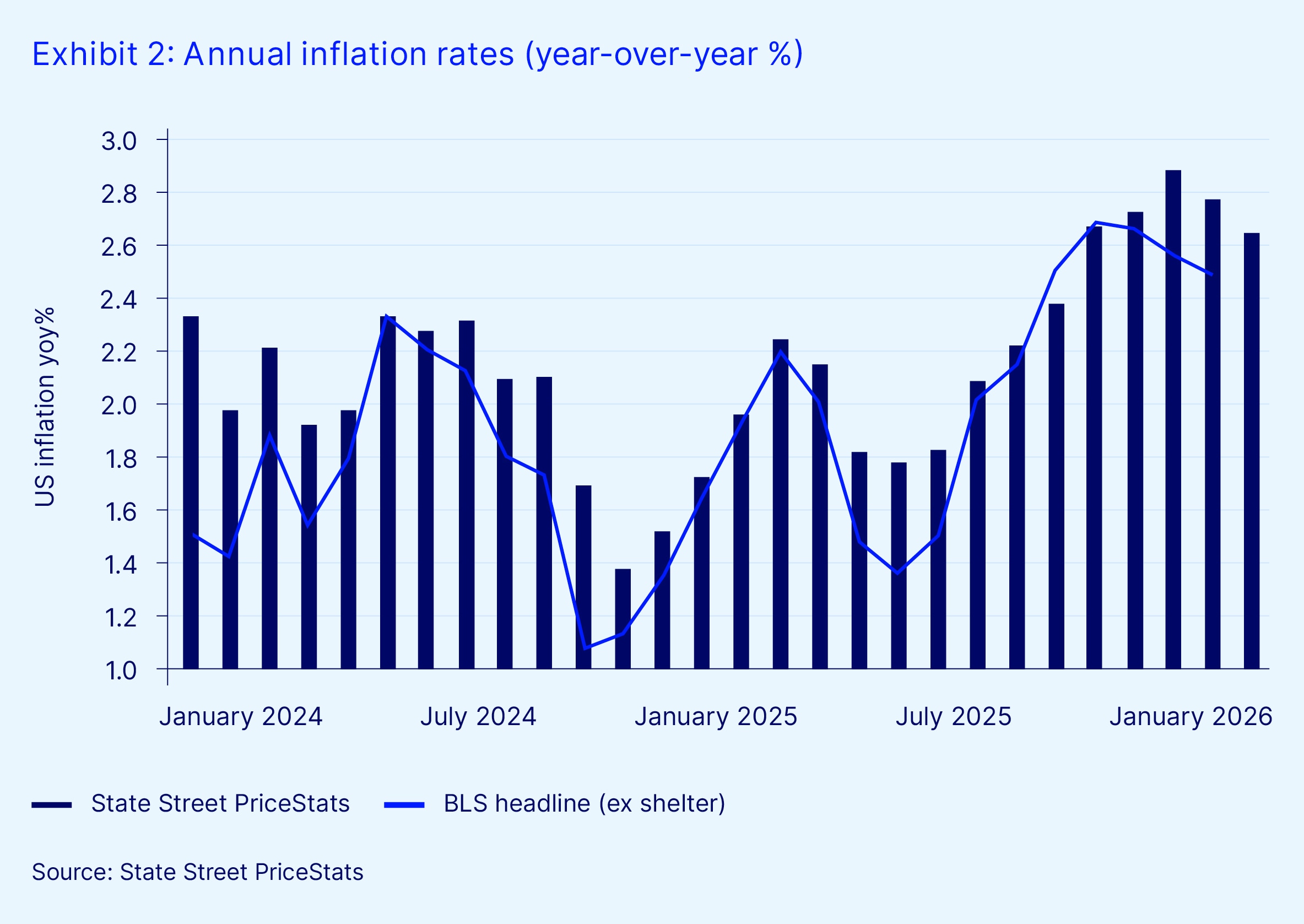

Prices edged slightly higher in January, rising 0.18 percent on a non-seasonally adjusted (NSA) basis following a 0.04 percent decline in December. But the more consequential shift came in the broader trend: Annual inflation eased to 2.61 percent, its lowest level since late September 2025. The data suggests that underlying price pressures continue to moderate, even as month-to-month readings fluctuate.

State Street PriceStats enables daily inflation measurement with just a three-day lag, offering timely insights that complement traditional government statistics. It serves as a valuable leading indicator and is especially useful during periods when government releases are delayed or unavailable. Its daily insights are increasingly relevant for policymakers, investors and analysts seeking to track inflation dynamics in real time.

Covering over 27 countries and multiple sectors — including food, health and transportation — State Street PriceStats uses consistent methodologies to ensure its indicators are comparable across geographies, time periods and official data sources.

State Street PriceStats captured a modest rebound in the price level at the start of the year. The 0.18 percent rise on NSA basis in January was marginally lower than the average rise seen for the month over the past five years and, more importantly, was below last January’s increase. As a result, the annual inflation rate continued its decline, falling by more than a tenth of a percentage point. Taken together, the latest data suggests that the disinflationary trend that characterized the end of last year has continued into the new year.

Underneath the headline State Street PriceStats measure, our sector series trends were once again a little less benign. The below average headline reading was driven largely by a sharp pullback in gasoline prices across January. By contrast, apparel, electronics and recreation equipment prices were unusually robust for the month: a reminder that we still cannot take disinflation in goods prices for granted even if, in theory, we should be past peak tariff pass-through.

If this pattern is replicated in the official inflation data, it would mark an encouraging start to the inflation trend in 2026. Investors will recall that January 2025 delivered an unexpectedly robust reading — the last month in which US core inflation surprised on the upside and impacted hopes for the Federal Reserve’s interest rate reductions at the time. A more benign start to 2026, as indicated by the State Street PriceStats data, would put further downside pressure on the annual inflation rates, particularly core Consumer Price Index (CPI). We have no doubt that the disinflation trend will be tested this year, especially given the anticipated boost to consumption from fiscal policy. However, if inflation is lower by the end of the first quarter — without a repeat of the tariff shock and alongside continued disinflation from the housing market — confidence in a return toward 2.0 percent inflation would only strengthen.

For more information or to request a demo, please contact dataintelligence@statestreet.com.

About the State Street PriceStats indicators

The State Street PriceStats series are designed to provide a low-latency and high-frequency view into inflation trends that are comparable to official CPI. The features of the process are as follows:

- Daily online price collection: State Street PriceStats collects price data daily from over 1,500 multi-line retailers using web scraping technologies, focusing on those with both online and physical stores. Research has shown that retailers tend to adjust online prices first.

- Data structuring and cleaning: Models then clean and standardize raw price data to ensure consistency across more than 40 million products, converting unstructured HTML into structured datasets ready for analysis.

- Categorization and quality checks: State Street PriceStats categorizes prices by economic sectors and sub-sectors, calculates performance statistics and applies a red-flag system with daily manual checks to resolve data anomalies.

- Index calculation using econometric techniques: State Street PriceStats computes daily inflation statistics using proprietary econometric methods and publishes the results with a three-day lag.

- Retailer and product selection: State Street PriceStats selects retailers based on market share and city presence and includes over 500,000 daily prices — far exceeding the 80,000 monthly prices used by the Bureau of Labor Statistics.

- Use of CPI weights and no quality adjustments. State Street PriceStats applies official CPI weights where possible and adjusts for online data characteristics, calculating price changes only from consecutive observations of identical products without applying standard quality adjustments.