Insights

Future of Private Markets Study: How Private Markets Are Embracing ESG

According to our latest Private Markets Study, there is a growing expectation that private markets will play a greater role in investors’ ESG strategies as asset managers prepare to scale up their efforts.

In this article, the second in our Future of Private Markets Study series, we highlight the key trends and findings that show how private markets are embracing ESG.

April 2023

As their understanding of ESG and sustainability becomes more sophisticated, investors are becoming aware of the untapped potential of private markets and their crucial role in portfolios. Half of the respondents to our Private Markets Study 2023 – which surveyed 480 asset managers and asset owners – believe that private markets will provide better opportunities than public markets for making a significant ESG impact. These respondents include around 58 percent of insurers and 49 percent of asset owners, such as pension funds, family offices and private banks.

Private debt managers are more bullish about ESG prospects for private markets rather than any other sub-asset class. 60 percent of respondents expect private markets to make a greater impact than public markets, compared to only 20 percent of respondents who disagree.

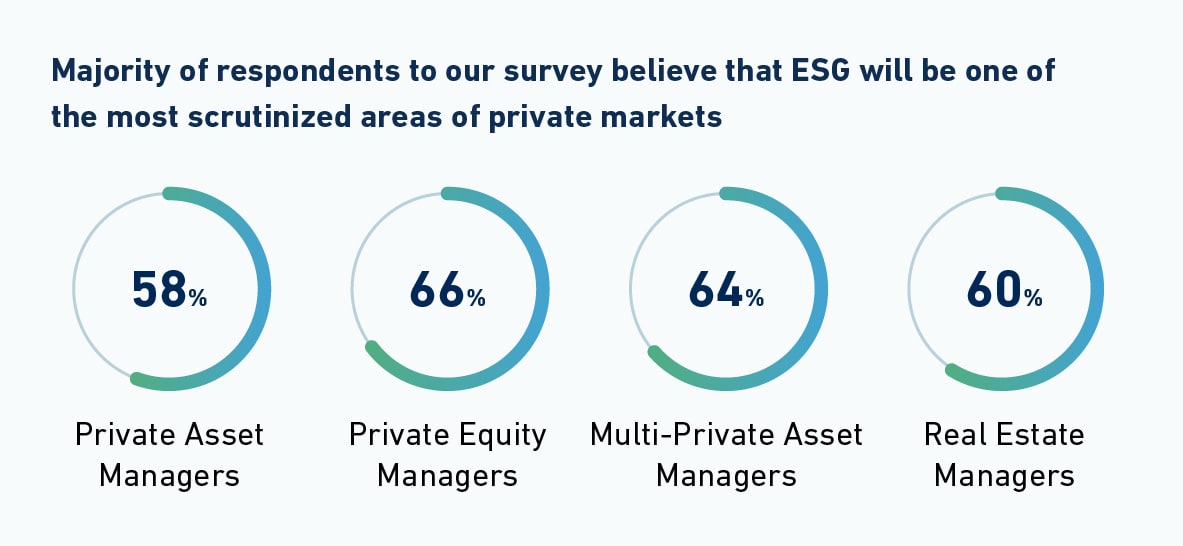

Driving retail adoption and increasing scrutiny

The growing interest in ESG investing is a key driver for the retail adoption of the asset class. 61.1 percent of private markets asset managers believe environmental and social elements will attract more retail demand for private assets, with managers of multi-private asset and real estate strategies leading the way.

As an asset class, private debt may already demonstrate high ESG standards, as managers prepare for increased scrutiny. 51.7 percent of private equity managers feel governance will likely be the greatest area of scrutiny for retail investors. Meanwhile, two-thirds of private debt managers believe carbon emissions and contributions to net-zero targets will receive the most scrutiny.

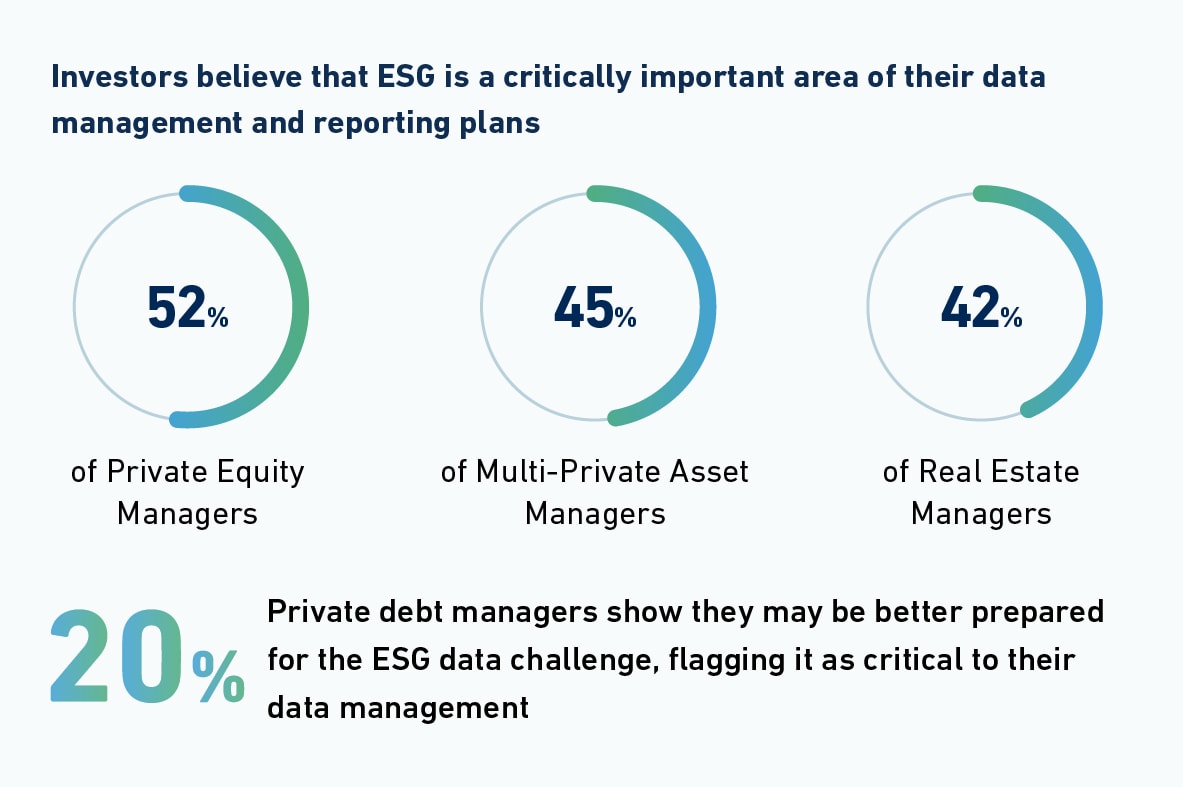

Different stages of preparation

As ESG plays a greater role in private markets, investors may see more demand for evidence of their investments having a positive impact. However, as a relatively new area for asset managers, quantifying ESG risk is considered a major challenge. Among the different sub-asset classes, private equity and private debt managers are best prepared for quantifying ESG risk.

In our 2023 Future of Private Markets Study, we will share insights on how organizations can rethink their ESG strategies for an enhanced private markets portfolio.