Insights

June 2022

Private Markets’ Accelerating Approach to Data Management

As the private markets industry acquires trillions in assets, investment managers are turning to holistic data solutions that will help them reach the next stage of their growth strategies.

While data management remains a considerable challenge for private markets firms, a recent executive panel, moderated by Tim Buchner, COO of State Street AlphaSM for Private Markets, highlights how the sector is becoming more sophisticated in its discussions and taking aggressive actions.

The data revolution has permeated every part of the industry, from the front to the back office. Unsurprisingly, it has created a vast data management challenge for investment managers.

This was the topic of discussion when I moderated a panel last month, “Orchestrating the Management, Governance and Utilization of Data,” at Private Equity International’s CFOs and COO Forum in New York. I was joined on stage by four industry executives: Jill Lampert from NGP Energy Capital Management, Omar Hassan of Cloverlay Partners, Jeff Bohl from Ontra and Daren Schneider of JLL Partners, as we considered how data management in private markets is fast evolving.

Getting a holistic view

While data management has been a challenge for private markets firms for some years, panelists agreed that the sector is having a more mature conversation about the issue now. The panelists also noted that a few years ago, managers were talking about data superficially, primarily focusing on how data could be better collected and warehoused across disparate sources.

It is becoming clear that investment managers are now seeking data solutions that will help them reach the next stage in their growth — where collection is still important but being able to normalize and utilize data at scale has taken center stage.

As the private markets industry has acquired trillions in assets over the years (through mainly spreadsheets and warehousing), firms have often lacked holistic views of their data solutions. This has created considerable inefficiency in an increasingly complex ecosystem.

Another issue that the panel highlighted is the lack of solutions to connect data across the myriad sources that exist in the front, middle and back office. Such point solutions are cobbled together by IT employees, which has created unscalable inefficiency to get a comprehensive view of their business and portfolio investments.

Cybersecurity was another pressing topic the panel discussed. In the past, panelists recalled that cybersecurity was heavily focused on governance of data and security of their infrastructure. Now, the panelists talked about how they are seeing greater evidence of cyberattacks on their portfolio companies, particularly since sanctions were imposed on Russia following its invasion of Ukraine. We discussed the increasing importance for investment managers to stay educated — spreading the word on key trends and best practices to portfolio companies about the criticality of their data architecture, processes to manage and govern data, and the importance of cyber or information security to help protect them from the constant risk of data loss, breaches and attacks.

According to the panelists, the incredible growth of private markets has created new challenges. We discussed the difficulty some older firms face bridging their historical tenured asset datasets with datasets of more recent investments to run automated analysis and sensitivities often requested by investors. In most cases, panelists discussed the need to hire more employees to manage and collate such data, but all panelists agreed that throwing more bodies at the problem is not a scalable or long-term solution. Instead, we discussed the critical nature of creating a platform that is flexible enough to support such diversity while recognizing the need to maintain some human intervention for oversight and governance.

Cautiously optimistic

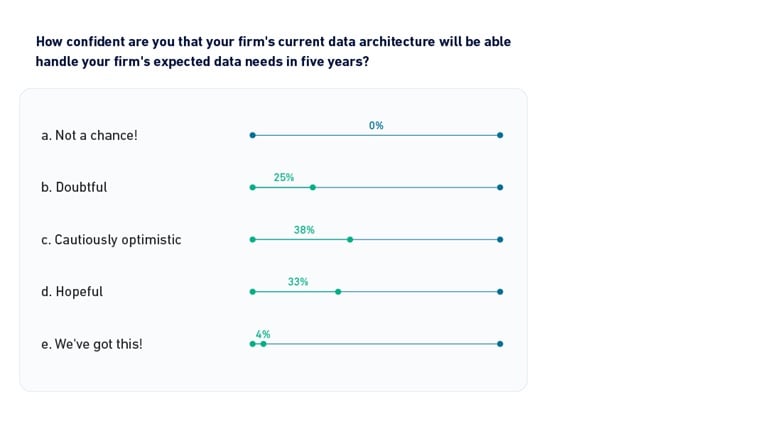

When we asked the audience, ‘How confident are you that your firm’s current data architecture will be able to handle your firm’s expected data needs in five years?’, we were surprised by the response. One-quarter of respondents were doubtful that their firm’s data architecture could handle their data needs in five years’ time. About 38 percent were cautiously optimistic, a further 33 percent were hopeful, but only 4 percent said “we got this” and were fully confident.

The panelists agreed that if this would have been the case three years back, everybody would have said “we got this,” as many firms at that time under-appreciated and under-estimated how difficult and essential data management is. Now, however, most firms understand how critical it is to their business.

It has also become increasingly clear that most firms – the panelists included – are taking measurable steps to better manage data and derive repeatable insight.

However, not all firms have the resources or know-how to do this at scale and with repeatable success. We discussed the importance of private market firms getting in-the-game and remaining consistent whether investing in-house or outsourcing to a trusted partner.

At State Street, we know how important end-to-end data management is for private markets managers. Our proprietary solution, State Street AlphaSM for Private Markets provides you with technology and services across the investment lifecycle to help improve the speed of decision-making, reduce operating costs and deliver trust to investors.

Related Insights