Insights

Simply Having a Turbulent Crypto Time?

While the large percentage of monthly falls in Bitcoin over the summer of 2022 was not unusual, the destruction in market capitalization was.

March 2023

Michael Metcalfe

Global Head of Macro Strategy,

State Street Global Markets

The rushed withdrawal of global liquidity had been chilling enough for traditional assets in 2022, but industry scandals have increased the wind chill factor fourfold for crypto. It is suffering a near existential crisis that is on par with, or greater than, recent crises in traditional asset markets. However, just as we learned a lot about investor behavior in 1998 and 2008, and in the spirit of “what doesn’t kill you, makes you stronger”, significant lessons are emerging for Bitcoin from 2022. Better regulation, risk mitigation and transparency will all come at faster pace. And even though risk statistics now clearly reveal that Bitcoin is a levered technology play, rather than a safe haven, we still find a sliver of optimism in behavior on chain: The proportion of supply held by entities that hold for the longer-term has risen to a four-year high. Bitcoin will end the year much weaker than it began, but it will at least end it in what historically have been safer hands for when sentiment finally stabilizes.

What doesn’t kill you…

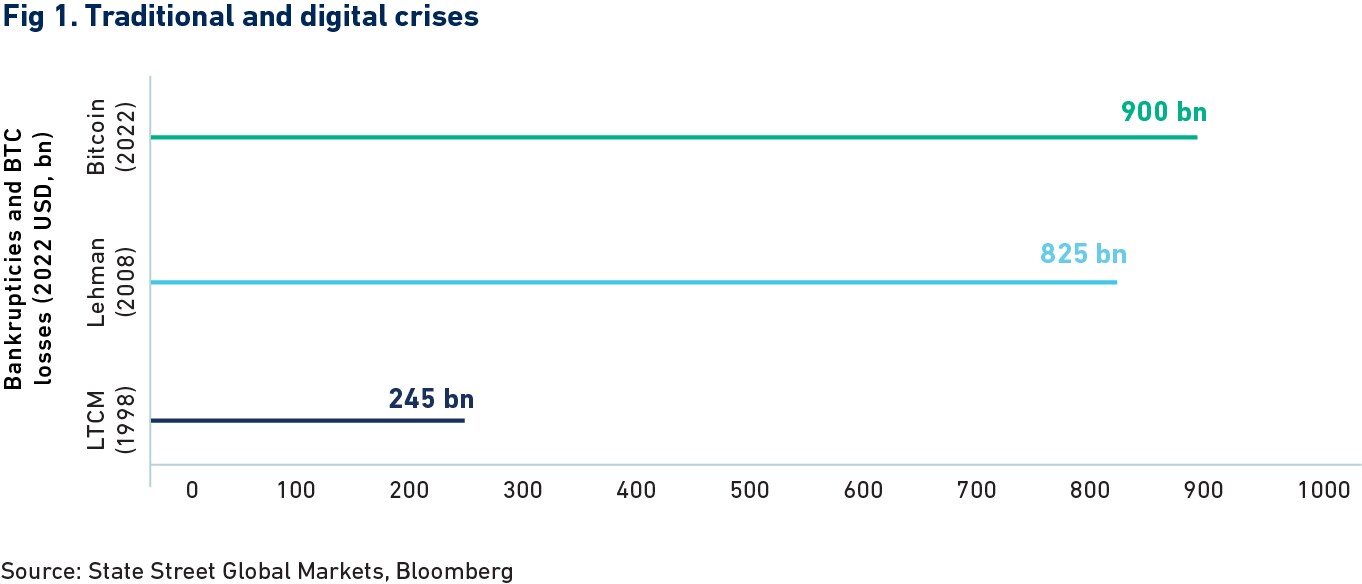

The main lesson from 2022 was not that Bitcoin is a volatile asset; that much has been apparent for years. It was that even with its rapid growth in size, reaching a market capitalization of US$1.2 trillion in November 2021, it has remained volatile and potentially systemic. So while the large percentage of monthly falls in Bitcoin over the summer of 2022 was not unusual, the destruction in market capitalization was. While direct estimates and comparisons should be taken with a healthy grain of salt, the loss in Bitcoin market cap appears to be on par with the collapse of Lehman Brothers and the LTCM collapse back in 1998, even adjusting for inflation (Figure 1).

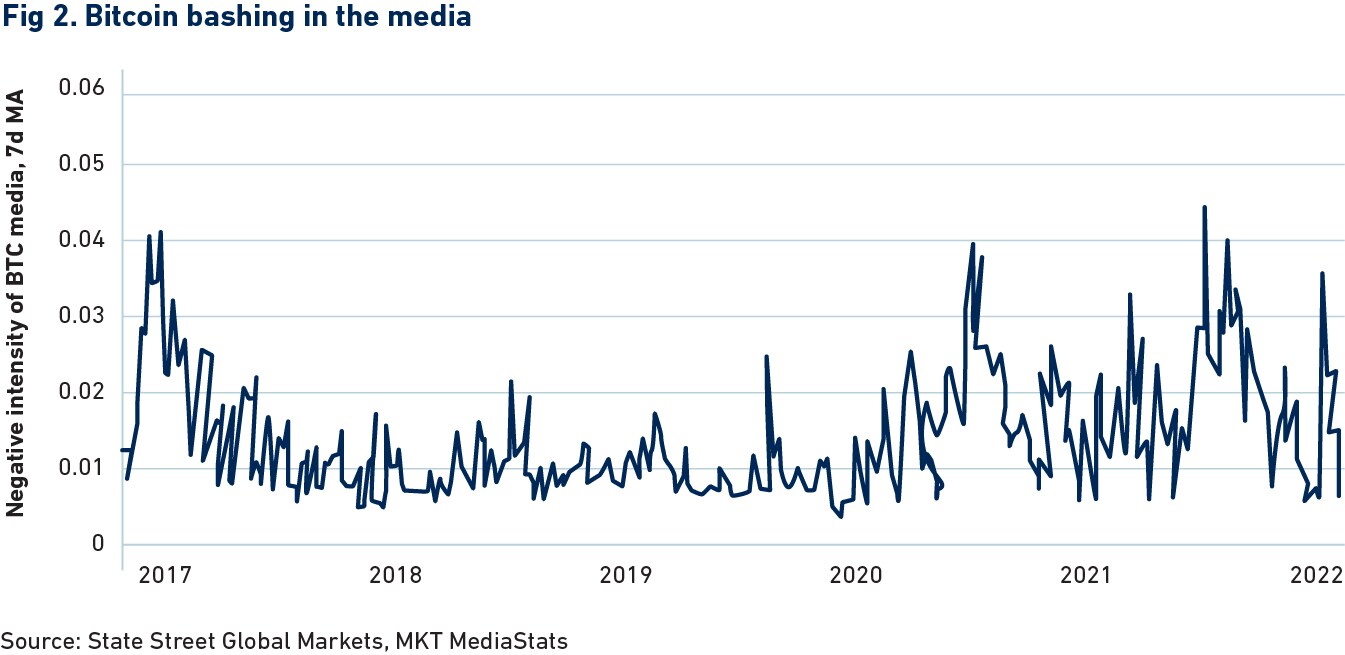

Given similar (or even more modest) seismic shocks destabilized established traditional asset markets for decades, it is not so surprising that this has elevated systemic concern throughout the digital ecosystem: a concern exacerbated in part by light regulation. However, in light of the significant loss of wealth that has now occurred, that seems certain to change. Bitcoin has become and remains too big not to regulate, especially given the prevalence of retail activity in the sector. In the same way a combination of regulatory and private sector action was required to restore public faith in traditional asset markets following the GFC, the same should now happen in for crypto. One small positive we would note here is that so far our media gauges (Figure 2) suggest that the intensity of negative coverage on Bitcoin, while having spiked in mid-November, has already begun to revert back to more average levels.

Risk characteristics: the long view

The size of 2022’s shock means it will not just shape regulatory behavior, it will also have an impact on the risk characteristics and the behavior of investors. As volatile as the recent moves in Bitcoin have been, the returns are not as unusual as you might think. Its performance in November was within the distribution of returns we would expect most (68%) of the time for an asset with that level of volatility. Curiously, it was the rally in treasuries in November that was much more usual relative to what is “normal” for US government bonds. Embedded in that treasury rally is hope that peak US rates have now been discounted, which might provide some hope for risky assets in 2023, a camp into which Bitcoin now firmly falls.

As we have discussed in prior Digital Digest editions, the risk characteristics of Bitcoin have been clear for some time. In November, the contrast of the exceptional performance of some traditional assets with poor Bitcoin returns is a form of diversification, but not the kind that investors might have been hoping for. And looking back further at weekly returns of Bitcoin over the past six, 12 and 36 months, Figure 3 shows a robust positive correlation with equities, even if it fell in November. Looking at conditional correlations is potentially even more troubling. If we only look at weeks in which US equities or treasuries have fallen, Bitcoin movements show a positive correlation with equities and treasuries. In other words, Bitcoin is positively correlated with traditional assets when they are going down.

So for now, even if the volatility of Bitcoin is not so unusual, the way it combines with traditional assets is not especially favorable. As Mark Kritzman, Megan Czasonis, Baykan Pamir and David Turkington detail in their paper, The Role of Cryptocurrencies in Investor Portfolios, this doesn’t mean they have no role at all. Robust return assumptions or preferences for potential lottery style payoffs can still justify optimal allocations. Both, however, require positive and constructive sentiment toward Bitcoin, so we go there next.

Holding characteristics: the even longer view

Unsurprisingly, aggregate measures of net capital inflows into Bitcoin, such as the change in realized market capitalization, continue to show significant outflows. The best we can say for Q4 is that at least the pace of outflows has not deteriorated beyond the levels seen over the summer. There is no evidence of investor panic – yet.

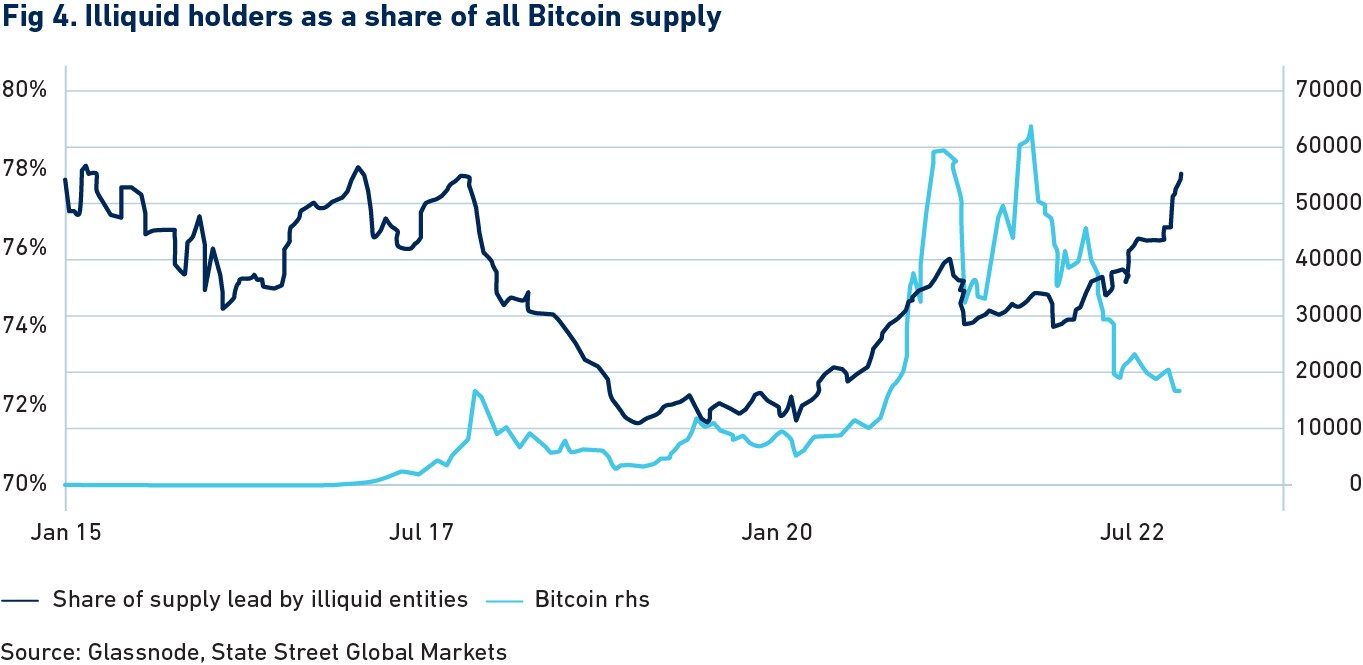

Meanwhile, digging into the characteristics of who is holding Bitcoin is also somewhat hopeful. Using metrics from Glassnode, we observe demand from long-term buy and hold investors. These defined are groups of “illiquid wallets” (entities) that typically accumulate coins over time and have an average holding period of five months or longer. Changes in the holdings of these illiquid wallets have the characteristics of the behavior of long-term investors, whose behavior we study in traditional asset markets. Just to stress this point, we do not know whether they are actually long-term institutional investors; only that they share behavioral characteristics. As we do for our measures of behavior in traditional markets, we standardize our measures into percentiles of past flows and holdings as a simple means to give relative importance to the set of flows we see in a given period.

These long-term, typically accumulating entities have sold Bitcoin three times this year; in January, May and again in September/October. Over the past month, however, their net buying is running at close to a two-year high at the expense of short-term holders. So amidst high asset market turbulence, it is the longer-term players that have stepped in to buy Bitcoin from shorter-term entities.

As a result of this buying, the holdings of this illiquid or long-term group of entities now account for more than 78% of all existing Bitcoin supply. As we detail in Figure 4, this is the highest reading in more than five years. Assuming that these entities stick to their past behavior of holding for extended periods and typically accumulating (rather than selling) coins, this should be constructive for Bitcoin. It is akin to a traditional asset that is largely held by long-term institutional investors, which is good news, as long as those investors remain committed to that asset!

And that’s enough for 2022

Bitcoin has suffered a systemic-sized crash in 2022. Looking far enough ahead, we would anticipate some structural positives will emerge for the digital assets that remain. And while it is yet to demonstrate that it is an effective diversifier against traditional assets, the fact that more Bitcoin supply is held today by entities that typically hold for longer periods of time is encouraging. Bitcoin appears to be in safer hands at the height of its crisis. And finally, the fact that recent media coverage has been less intense means that the selling of short-term investors could become less of a panic than it otherwise could have been. In that, along with hopes that peak US rates are also now discounted, there is some hope for the new year.