Insights

Rethinking real estate data strategies

Granular data plays a crucial role for relatively illiquid and opaque markets, including real estate.

October 2023

Anthony Ross

Managing Director,

State Street Client Solutions,

Real Estate

Ross Anderson

Vice President,

State Street Alpha® platform,

Private Markets

Does the reset in values allow for a great reboot in data strategy for the asset class?

The value of data, in terms of providing transparency and deep analysis, is widely recognized across nearly all industries, including asset management. For markets that are relatively illiquid and opaque – such as real estate – granular data can provide a competitive edge.

Gaining a detailed perspective of a current real estate portfolio can help an owner to quickly identify potential opportunities in the areas where they already own buildings.

On the other hand, in the case of a major event, such as the recent COVID-19 pandemic, owners in possession of reliable and consistent data can determine which properties are affected and respond accordingly.

Establishing systems that streamline data usage from front-office to back-office administration can provide the basis for deeper insights into the performance of assets and the markets they are located in. Precise data can help with cost optimization, and can even help find ways to add value to a property through redevelopment or repositioning.

Recognizing these opportunities is greatly enhanced by combining financial and non-financial real estate data, creating meaningful and actionable reporting. Asset managers can rely on the most granular historical and market data, utilized in generating better quality forecasts and improved decision making, which can contribute towards achieving alpha.

That data can also populate artificial intelligence (AI) solutions, which support data validation and tolerance checks. In addition, insights can be generated through identifying patterns in their asset data sets, which a portfolio manager or controller can consider alongside their investment thesis. For example, AI can match data related to footfalls in a shopping mall with clauses in a tenant’s lease, and track for underlying terms against evolving market conditions. It can also flag any data anomalies or upcoming lease expirations requiring human intervention.

Missing pieces

Unfortunately, it is difficult for most real estate owners to achieve such feats with their data.

Many asset managers do not have access to the platforms, internal databases or systems to aggregate different types of data into a single source. Their systems are not integrated enough to achieve data centralization, or they are unable to create a universal real estate data model. Most part of the valuable data is siloed, such as in individual spreadsheets with bespoke terms that require translations for analysis and reporting.

Owners may be able to gather the necessary data for accounting purposes, but often struggle to integrate it with non-financial data, operating metrics, price forecasts or social trends data, which might highlight property value implications. Combining these data types can provide asset owners with data insights into their portfolios.

Some real estate asset managers have built bespoke systems to achieve harmonization, and some firms with vertical integration may seem to have control across the lifecycle of their assets. However, these solutions have their own limitations as the portfolio expands in size and complexity, and reaches into different jurisdictions.

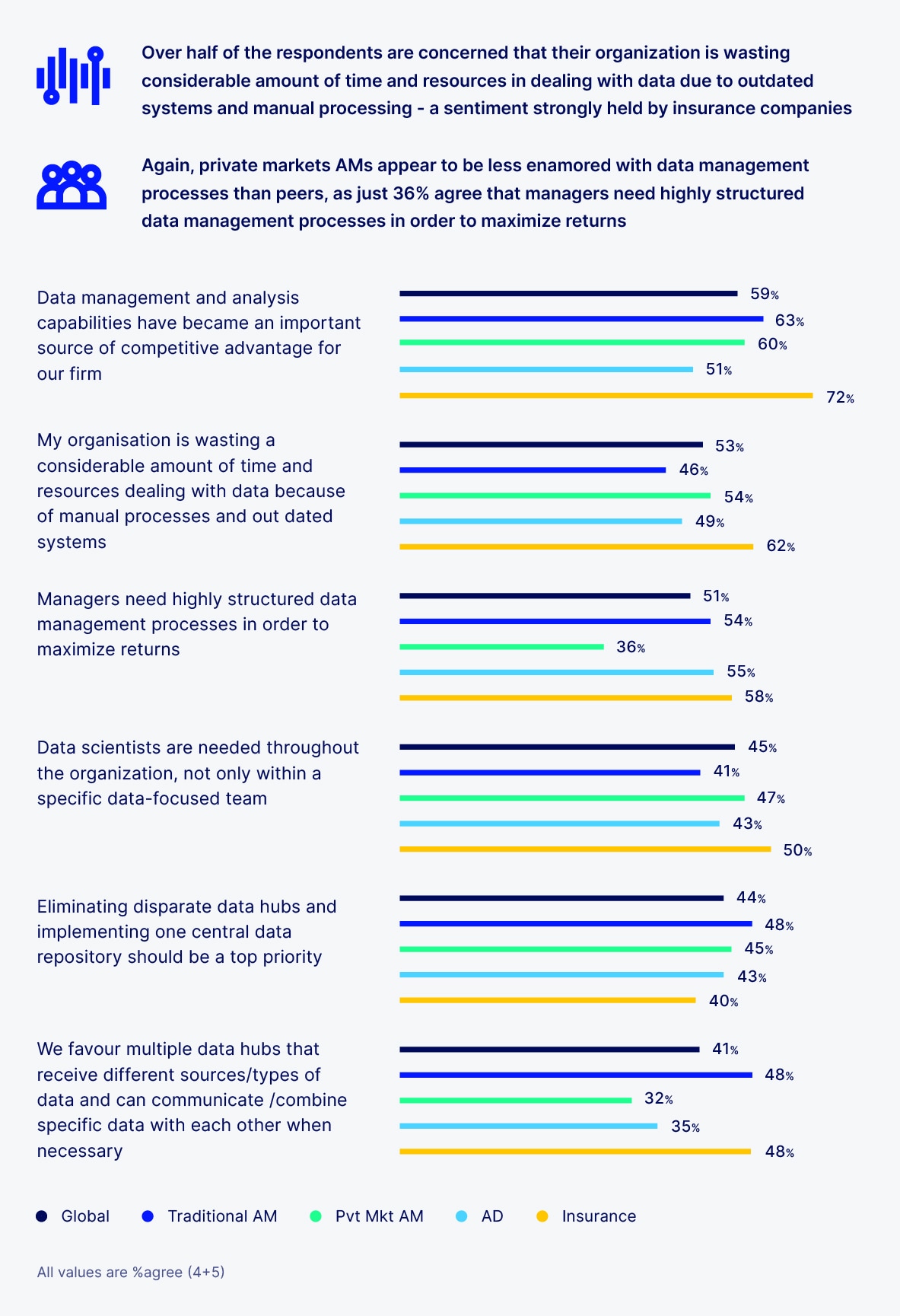

Our private markets survey, conducted in February 2023, identified the importance for managers to find the right solution that reduces time spent on disparate data, and the importance of single source data and robust data processes to enable better data management and analysis to increase their competitive advantage.

Owners who outsource the management of their portfolios – an increasingly common practice – find themselves dealing with different property managers across multiple regions based on their distinct expertise. Each manager files monthly or even weekly reports that include the nuances of specific market and lease terms. The volumes of data pile up very quickly, and there is a raft of reconciliation issues to consider when trying to normalize this data across a portfolio. Commercial real estate might be subject to global market forces; however, much of the data and metrics that underpin these assets is local.

Typically, it takes one or more analysts multiple hours or even days to aggregate, check, reconcile and normalize the data from these reports to make it usable for accounting, budgeting, analysis, risk management, reporting and forecasting purposes. This results in talent engaging significantly in mundane repetitive tasks that could otherwise be redeployed more profitably on value-enhancing work.

Focusing on core skills

Asset managers spend a significant amount of time on these data activities, which can be substantially reduced through a more holistic approach to data. However, managing data effectively is a specialist skill, particularly on the technology side, which increasingly involves complex AI and machine learning solutions.

Asset managers should be able to focus on their core strengths of managing and transforming their real estate portfolios and uncovering new investment opportunities, rather than investing in streamlining, formatting and normalizing data.

Instead of manual processes or expensive bespoke systems at risk of becoming obsolete, real estate managers can outsource their data management to a specialist administrator. This gives real estate owners the benefit of tapping into scale, automation and greater efficiency to keep pace with ever-changing technologies.

Once data can be transformed into a validated “universal real estate data model,” it can be presented in a single interface, which can make generating valuable insights easier and more timely across all platforms. This provides asset owners with an opportunity to create tailored reports with respect to accounting and risk management.

Managers can also ingest greater volumes of data around individual buildings and then analyze it effectively. Meanwhile, this frees up talent to concentrate on the value-added areas of the business that require a human touch, such as investor relations, fundraising and sourcing properties.

Greater data granularity and attributes on investments are now available to real estate managers, who are a part of larger investment firms or pension plans that invest in private and public assets. This enables them to better service their internal stakeholders’ and investors’ needs, and also aids risk models and improves total fund analysis requirements.

Becoming more agile

The spread of digitization into real assets offers owners an opportunity to achieve more. Also, it helps them meet the growing data demands of pension funds, insurers and wealth managers who invest in real estate funds. There is greater demand for granular data not only about the performance of individual assets, but also ESG data. The latter is particularly a priority for Europe-based investors.

For example, a growing source of demand for granular data stems from the reporting requirements related to the Task Force on Climate-related Financial Disclosures (TCFD), which is supported by 99 countries.

Reduced deal activity has provided a great opportunity to real estate asset managers to upgrade and streamline their data systems. It helps them be more agile and respond quickly to changing market conditions and emerging opportunities.

Once real estate markets gain momentum, the digitally savvy real estate owners will have an edge over their analog competitors.