Insights

Regime-Based Portfolios

We introduce a more flexible way to forecast risk and return based on the most relevant historical periods.

May 2023

As economic regimes shift, investors who choose to adapt must build portfolios that match their evolving view of the future. Forecasts of asset risk and return should account for regime-specific trends. The question is how to implement this idea in practice. Typically, an analyst will find every time an economic indicator like inflation or growth was above (or below) a fixed threshold and they will pay equal attention to every data point that qualifies. While this approach seems sensible, it also has dramatic limitations.

Ideally, we should recognize that the regime labels of past events are not simple yes/no answers; they are ambiguous. We should pay more attention to some past events than others, based on their relevance, and weigh the impact of many variables, rather than just one.

Finally, we should also accept that some events are relevant to more than one regime. A statistical measure of relevance, based on the Mahalanobis distance, empowers investors to analyze these nuances of regimes with rigor.

In this report, we show how to estimate expected risk and return as weighted averages of the relevant past, and how these forecasts of asset performance lead to intuitive portfolios, optimized for a range of possible regimes.

Key highlights:

Wouldn’t it be convenient if all life’s experiences could be assigned to distinct categories, and cleanly filed away for reference? In reality, there are no such clear categories and even if there were, most memories would belong to more than one of them.

The same fact applies when we try to assign regime labels to the economic events of history. Regimes are nuanced and their labels are ambiguous. The concept of a ‘regime’ is useful for investing. It refers to dynamics that are different from average, and which are expected to prevail for some period of time. Creating a regime-specific optimal portfolio requires estimates for risk and return, which we can compute as weighted averages of what happened to assets in the relevant past.

Suppose we are concerned about a regime of high inflation and low growth. The conventional approach is to set thresholds and identify periods when inflation was greater than four percent and growth was also less than one percent, for example. Choosing these thresholds is rather arbitrary, and it is also possible that we end up with very few events or none. Moreover, does it make sense to give full weight to data points that are just barely above the threshold and completely ignore those just below it? And should we not pay more attention to extreme circumstances than moderate ones?

We can address these issues of nuance by adopting a new approach to regimes. First, define a regime in terms of multiple variables (for example, inflation of six percent and growth of zero percent). Next, use a measure of statistical relevance, based on a well-founded metric called the Mahalanobis distance, to calculate the relevance of every past observation to these prototypical regime circumstances, taking into account the similarity and informativeness of every past event.

Finally, focus on the most relevant history and forecast returns as relevance-weighted averages of past returns, variances as relevance-weighted averages of past squared deviations, and pairwise covariances as relevance-weighted averages of asset deviation products for a given pair. In the absence of regimes, we get back full-sample returns and covariances. When we do have regime views, we get regime-conditioned estimates. Events are not weighted equally, but by relevance. Since regimes are ambiguous, the same past observations can inform more than one of them.

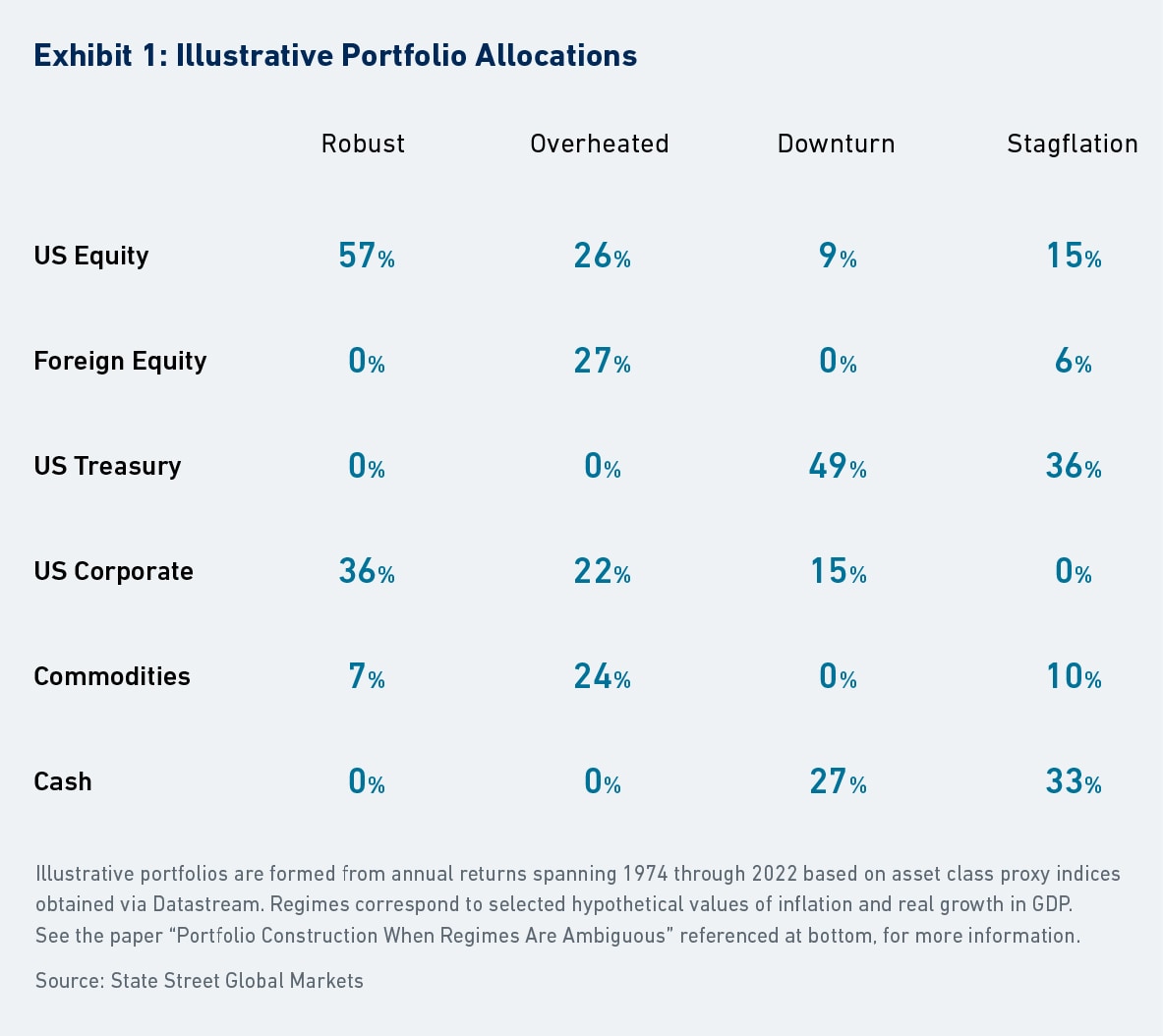

Exhibit 1 shows that portfolios formed from this method are intuitive. They are more transparent than a linear regression analysis, and more rigorous than binary regime labels. A bit of nuance can avoid the need for rigid, arbitrary choices.