Insights

Digital asset allocations on the rise

Institutional investors are rapidly increasing digital asset allocations as tokenization and hybrid finance models reshape portfolio strategies.

October 2025

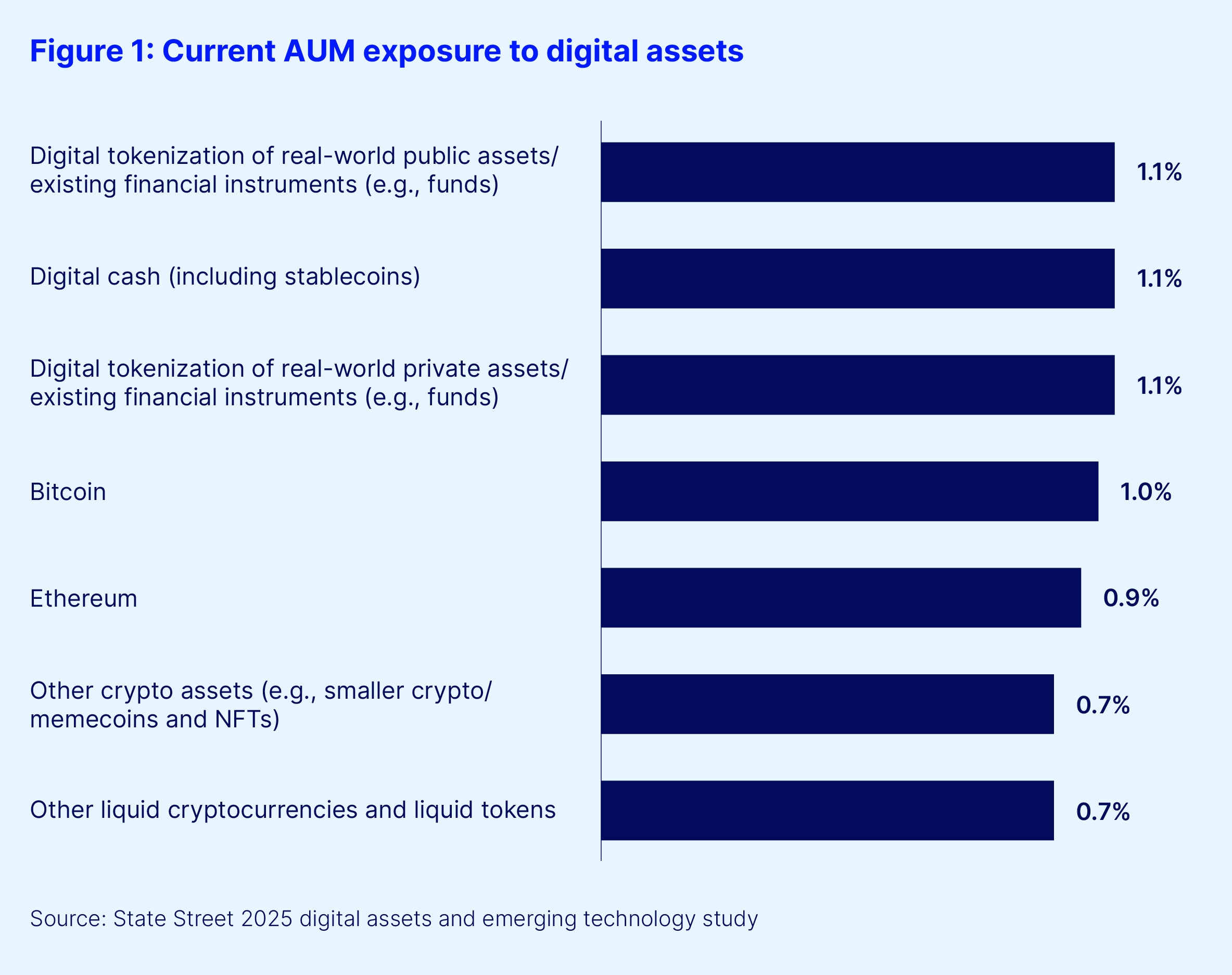

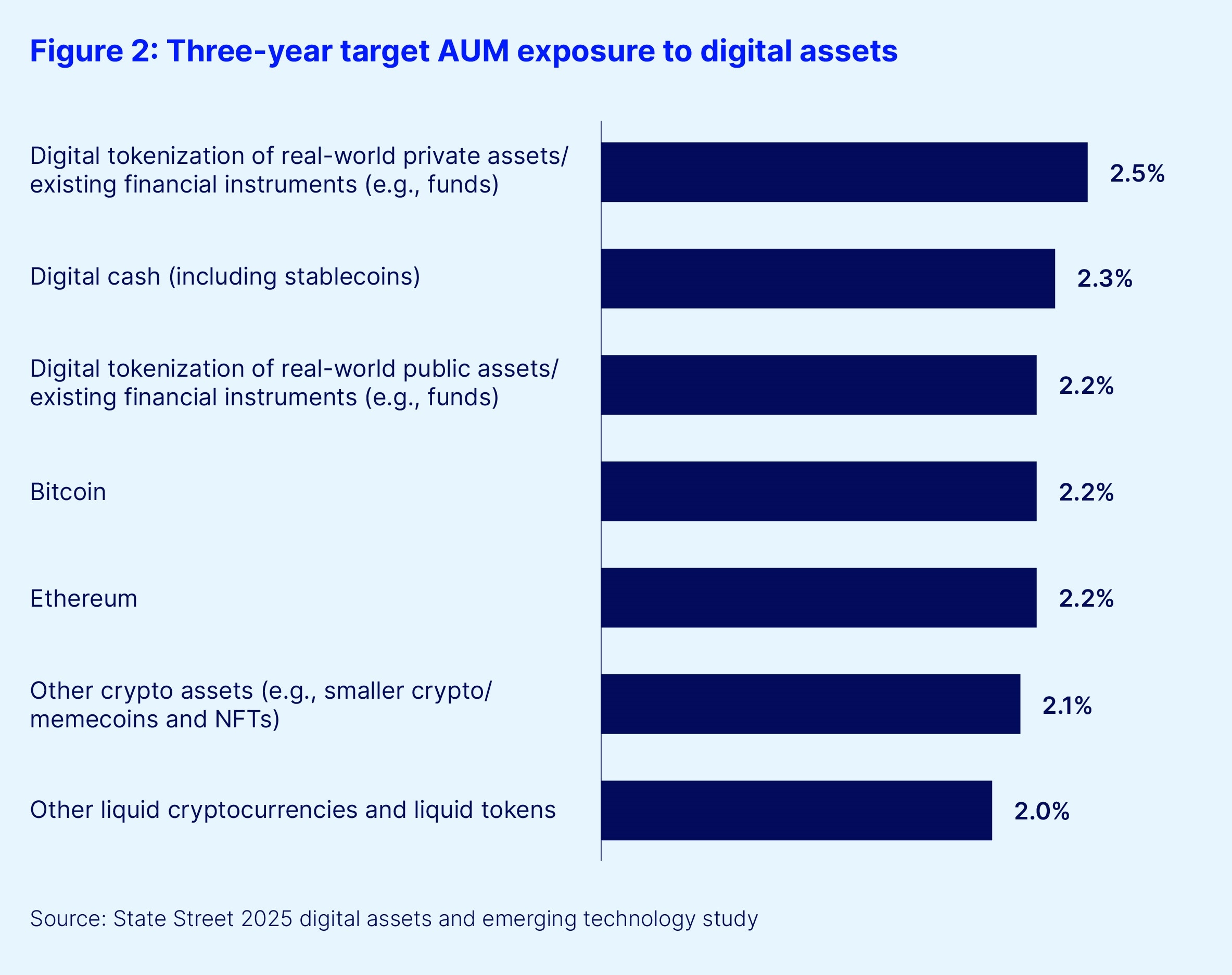

The average investment institution currently holds just under a 10th of its total assets under management (AUM) in digital assets, and that figure is projected to more than double over the next three years (see Figures 1 and 2).

According to the latest State Street Digital Assets and Emerging Technology Study, the average portfolio allocation across a range of digital assets currently stands at 7 percent, while target allocations are expected to rise to 16 percent within three years. The most common forms for these investments to take were digital cash and tokenized versions of listed equities or fixed income, with respondents holding an average of 1 percent of their portfolios in each.

Asset managers were somewhat more exposed to these assets than owners. Managers were twice as likely to have 2-5 percent of their portfolios in Bitcoin (14 percent, compared to 7 percent of owners) and marginally more likely to have 5 percent or more (5 percent versus 4 percent). Three times as many managers as owners had 5 percent or more of their AUM in Ethereum (6 percent to 2 percent). Surprisingly, as many as 6 percent of asset manager respondents had at least 5 percent in smaller cryptocurrencies, meme coins and non-fungible tokens (NFTs) (compared to just 1 percent of asset owners).

Across real-world asset tokenization-related exposures, asset managers are more advanced. They report more exposure to tokenization of public assets than asset owners (6 percent versus 1 percent), tokenization of private assets (5 percent versus 2 percent) and digital cash (7 percent versus 2 percent).

In last year’s research, we did not ask for percentage holdings or increases but simply whether respondents anticipated increasing their overall digital asset exposure. In that study, a third of respondents (33 percent) expected to keep their holdings of these assets steady, while half (50 percent) were planning increases in the following 12 months. On a five-year view, 69 percent were planning increases (and 26 percent were planning “significant” ones), compared to just 14 percent who were keeping their allocations steady. So, despite the absence of a like-for-like comparison, our research does show a consistent intention toward steady increases in digital asset allocations.

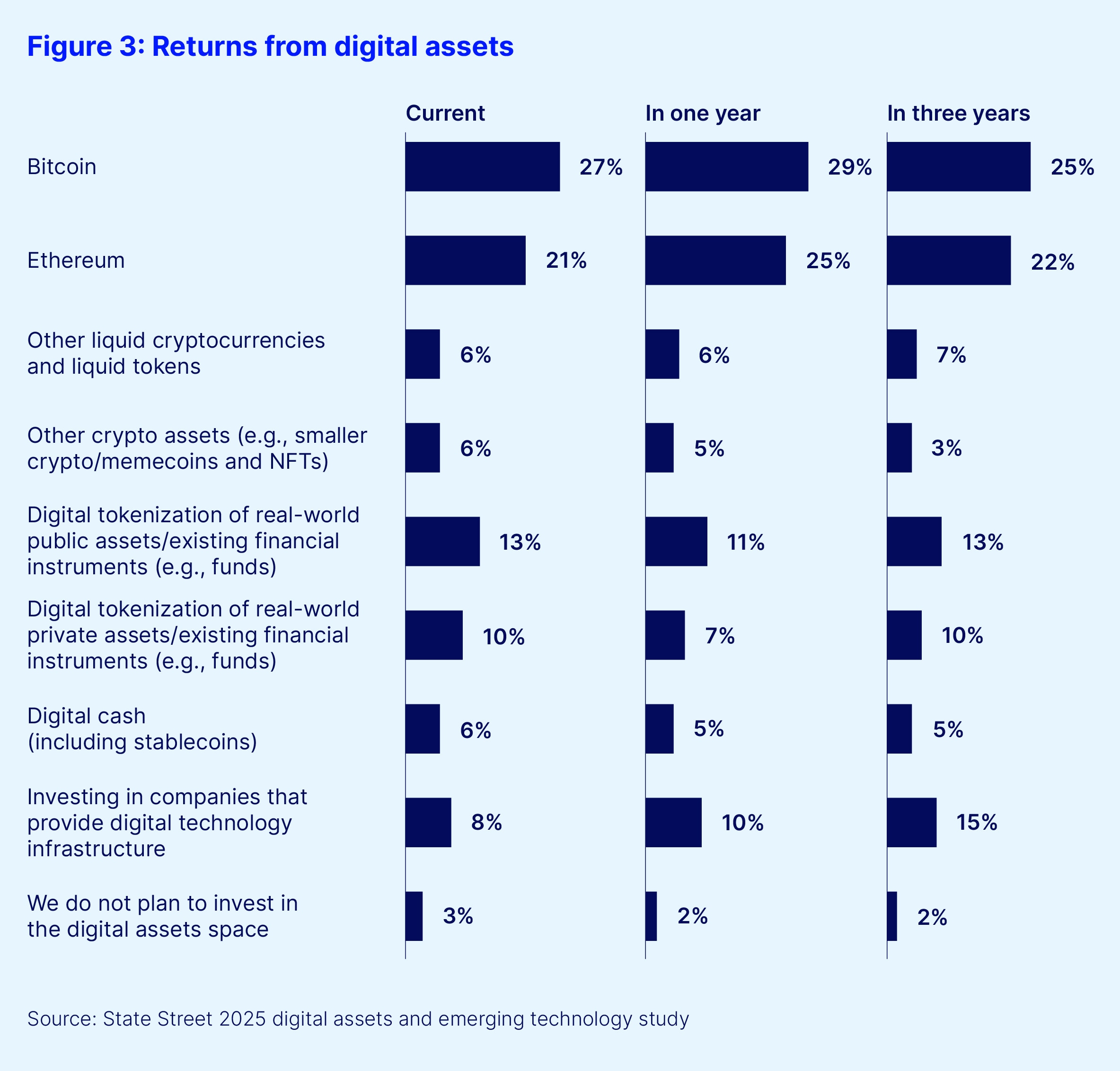

Despite stablecoins and tokenized real-world assets being the largest component of respondents’ digital asset allocations, cryptocurrencies are driving the bulk of their returns from digital assets. This trend is expected to continue over the near term (see Figure 3).

More than a quarter of respondents (27 percent) said Bitcoin generates the highest returns among their digital asset portfolios, while exactly a quarter predicted it will remain a top performer over the next three years. The next most popular choice was Ethereum, with 21 percent saying it was their current biggest returns generator, and 22 percent expecting this to still be the case in three years.

By comparison, only 13 percent saw the bulk of digital asset returns currently coming from tokenized public assets and 10 percent from private assets. These numbers are expected to remain unchanged over the next three years.

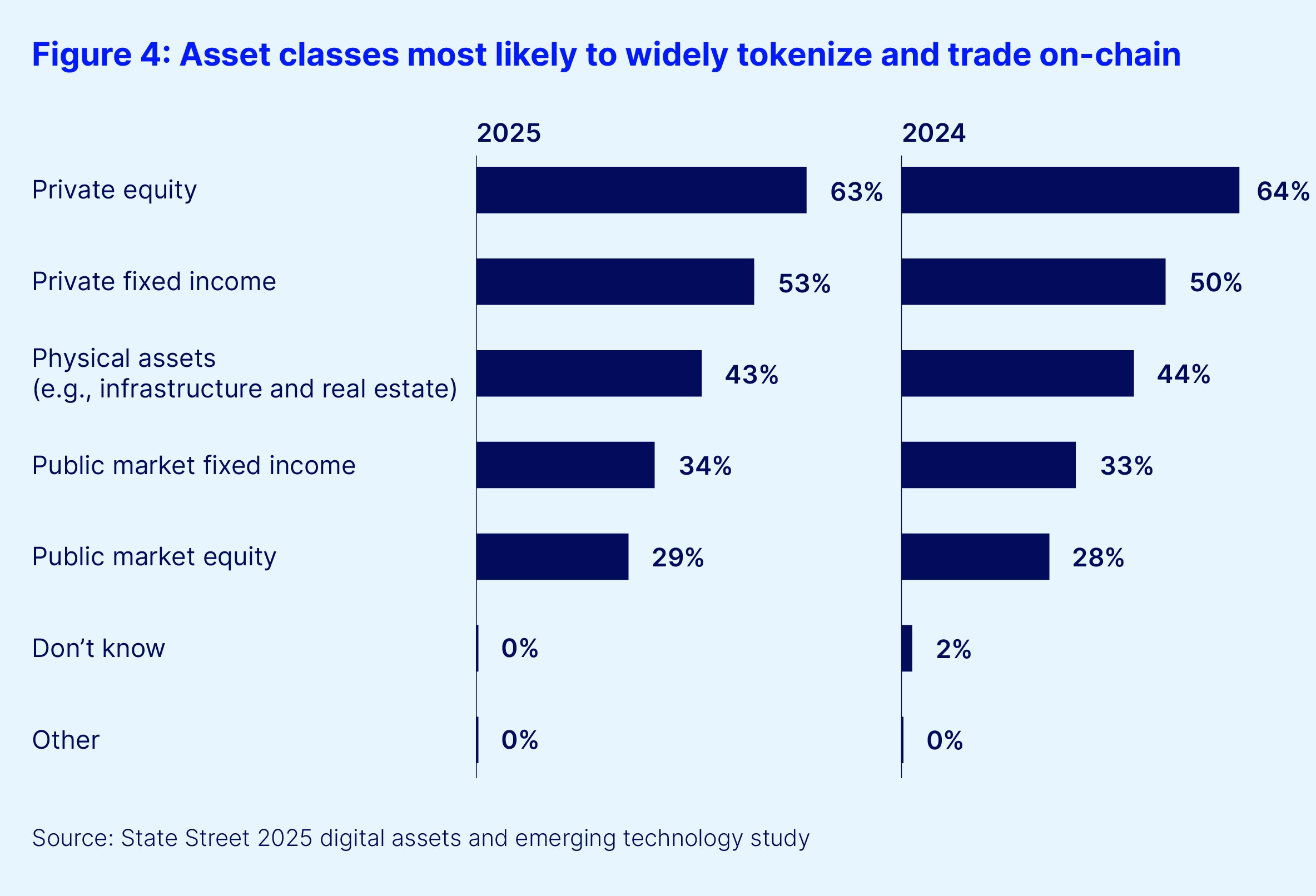

Looking further ahead, private assets are still the industry’s bet to become the first major beneficiary of tokenization. Our research shows most institutions expect digital assets will become mainstream within the next 10 years. As shown in Figure 4 below, respondents’ views on this matter have changed very little between this year and last year’s surveys.

Our research shows that the industry is already embracing digital assets in all their crypto, cash and tokenized mainstream asset class incarnations. Furthermore, they see these assets as a growing part of their portfolios.

However, they are cautious about the pace of this growth. By 2030, a little over half (52 percent) of respondents expect that between 10 and 24 percent of all investments will be made via digital assets or tokenized instruments, while only 1 percent think most investments will be made this way.