Insights

The digital euro and the US dollar: Strategic evolution in a fragmented global financial order

As digital finance reshapes global monetary dynamics, the digital euro emerges as Europe’s strategic response, aimed not at dethroning the US dollar, but at safeguarding monetary sovereignty, enhancing payment resilience and asserting relevance in a tokenized financial future.

July 2025

Ramu Thiagarajan

Head of Thought Leadership, State Street

Chris Rowland

Head of Custody, Digital and Fund Services Product, State Street

Elliot Hentov

Head of Macro Policy Research, State Street Investment Management

The European Central Bank’s (ECB) Digital Euro Project, now in its formal preparation phase as of late 2023, has embarked on a multi-year effort to explore a digital euro — a retail central bank digital currency (CBDC) designed to modernize sovereign money, improve payment efficiency and strengthen Europe’s monetary autonomy. The digital euro is not simply a technological upgrade, but a strategic response to declining cash use, the rise of private digital assets and growing geopolitical frictions in the global financial system.

While its initial scope is retail, the ECB has signaled openness to future wholesale applications, positioning the digital euro as a potential public alternative to United States dollar-backed stablecoins and China’s e-CNY in tokenized capital markets. The digital euro is also being framed as a geopolitical instrument designed to reduce Europe’s dependence on foreign payment platforms, and to preserve sovereignty in an increasingly digitized and dollarized global economy.

Yet the digital euro faces significant constraints. The US dollar (USD) retains deep-rooted advantages including, most notably, liquid capital markets, global network effects and trusted institutions. Even with digital enhancements, the euro is unlikely to materially displace the USD in reserve, trade or financial market roles in the near term. Any gains in the euro’s international usage or reserve role are expected to be incremental, not structural.

The digital euro is best understood as a strategic safeguard, not a disruptive revolution. Its core value lies in protecting European monetary sovereignty, enhancing domestic payment resilience and preparing the eurozone for a digitized global financial system. Whether it gains international traction will depend on regulatory leadership, capital market integration and timing — particularly as USD stablecoins scale rapidly in the absence of direct US public alternatives.

Recent headlines highlighting the breakdown in correlation between US Treasuries and the USD underscore growing investor unease about the dollar’s long-term status. Against this backdrop, the digital euro’s development takes on heightened relevance — not as a direct challenger, but as a signal of shifting monetary dynamics.

In a world of accelerating digital finance and strategic competition, standing still is not an option — and the digital euro ensures the eurozone will not be left behind.

Introduction: Redefining sovereign money in the digital age

The relentless advance of digitalization and evolving geopolitics have prompted central banks across the globe to explore the potential of CBDCs. Indeed, well over 100 countries, representing the lion's share of global gross domestic product (GDP), are now engaged in some form of CBDC development, from initial research to advanced pilot programs.1 This trend reflects growing recognition among monetary authorities that the very nature of money and payments is changing driven by declining cash usage, the emergence of private digital assets like stablecoins, and a strategic desire to bolster the efficiency and resilience of payment systems.

Against this backdrop, the European Central Bank's (ECB) investigation into a potential digital euro2 has attracted significant global attention. Moving into a formal preparation phase in late 2023, the Digital Euro Project is far more than a simple technological upgrade. It represents a strategic response to a complex interplay of economic pressures, technological opportunities and geopolitical considerations facing the eurozone. The prospect of one of the world's major currency blocs introducing a CBDC inevitably sparks debate about its potential ripple effects across the international monetary system. This article first explores the digital euro’s design and its internal effects on eurozone monetary policy and financial stability, before evaluating its potential challenge to USD dominance.

The digital euro: Design priorities and policy objectives

The digital euro is initially conceived as a retail CBDC — essentially an electronic form of central bank money issued by the Eurosystem (the ECB and the national central banks of the euro area). It would function as a direct liability of the central bank, carrying the same risk-free status as physical banknotes and coins, but designed for digital use by all citizens and firms for everyday payments. Crucially, the ECB emphasizes that the digital euro aims to complement physical cash, not replace it; its commitment to maintain the availability and acceptance of banknotes remains firm.

By contrast, the US Federal Reserve has adopted a deliberately cautious stance to a potential digital dollar. It continues to study the implications of a retail or wholesale CBDC, emphasizing unresolved questions around privacy, financial stability and legislative authority. The Fed has repeatedly stated it would not move forward without explicit support from both the executive branch and Congress, underscoring a slower, more consultative trajectory than that taken by the ECB.3

While the final design is still being refined, several key features shape the digital euro’s potential form and function:

- Accessibility: The digital euro is designed for the general public to use for everyday payments and will be offered free of charge for basic use, initially to eurozone residents, but potentially expanding over time. This supports the ECB’s goal of promoting financial inclusion.

- Functionality: It is intended primarily as a means of payment (peer-to-peer, in-store, e-commerce) with both online and offline capabilities to enhance resilience and mimic cash usability. It is explicitly not intended to serve as an investment vehicle.

- Privacy: A high-level of privacy is envisioned. The Eurosystem would not be able to directly identify users from online transaction data, while offline payments would provide cash-like anonymity. Intermediaries (banks, payment providers) would remain responsible for anti-money laundering (AML) and know-your-customer (KYC) compliance.

- Safeguards for stability: To avoid destabilizing the banking system, the digital euro would be non-interest-bearing and subject to individual holding limits (e.g., EUR€1,500- EUR€4,000 as discussed by the ECB4). These measures are designed to discourage its use as a large-scale store of value and to limit deposit outflows from commercial banks.

- Distribution: An intermediated model is planned, leveraging existing banks and payment service providers (PSPs) to distribute the digital euro and manage customer relationships, thereby avoiding a direct relationship between the ECB and millions of end users.

- Legal tender: Its proposed legal tender status would require merchants across the euro area to accept it, ensuring broad usability.

The ECB's motivations are multifaceted. First, it aims to adapt to the digital age as cash usage declines, ensuring the euro remains a relevant “monetary anchor.” Much like the Fed’s FedNow instant payment rail, and private sector platforms such as Zelle (for domestic peer-to-peer) and SWIFT Go (for low-value cross-border transfers), the digital euro seeks to consolidate fragmented retail and small business payment infrastructures into a single interoperable distributed ledger technology (DLT)-powered solution.

Second, it aims to foster innovation and competition in the payments sector while promoting financial inclusion. This aligns with a third objective, safeguarding Europe’s strategic autonomy by reducing dependence on non-European payment giants such as global card networks and Big Tech firms.

At the same time, authorities are keen to avoid undermining financial stability. Accordingly, the digital euro's design prioritizes minimizing disruption to the existing financial ecosystem.

In theory, introducing a new central bank liability could complicate the ECB's liquidity forecasting. However, safeguards, and in particular holding limits, are meant to cap the overall stock of digital euro in circulation and prevent major dislocations. Its non-interest-bearing nature also aims to limit interference with monetary policy transmission, especially in negative interest rate environments. While some argue that a CBDC could improve policy transmission, the current digital euro design – with its emphasis on stability – suggests it is unlikely to be used as an active monetary policy tool. Its primary role in this regard appears defensive: ensuring central bank money remains relevant in an increasingly digital economy.

Banks, meanwhile, are exploring tokenized deposits (i.e., regulated digital representations of bank deposits recorded on distributed ledgers) as a private sector complement or alternative to stablecoins and CBDCs. These innovations could smooth the transition toward full tokenization of currency and financial infrastructure.

Stability and sovereignty: Safeguards for a strategic digital euro

Ensuring financial stability remains the foremost objective of the ECB’s digital euro initiative. The primary domestic risk stems from potential bank disintermediation — a scenario in which households or firms shifting deposits en masse from commercial banks to the perceived safety of central bank-issued money, especially during times of market stress. These digital bank runs could undermine the banking sector’s role in credit intermediation by depleting stable, low-cost funding and increasing reliance on more volatile or expensive wholesale markets.

To mitigate the risks, the ECB has proposed a set of calibrated safeguards. Chief among them are individual holding limits, currently modeled in the EUR€3,000-EUR€4,000 range. These are designed to ensure that the digital euro cannot function as a large-scale store of value. Additionally, the CBDC will be non-interest-bearing,reducing the incentive for savers to reallocate commercial deposits into central bank liabilities.

The ECB is also exploring a "reverse waterfall" mechanism, under which excess digital euro balances could be automatically swept back into users’ commercial bank accounts. This would reinforce deposit stability and protect the traditional funding base of banks. Another constraint under consideration is the exclusion of non-financial corporates from holding digital euro balances, to prevent concentrated liquidity shifts during episodes of market volatility.

ECB simulations indicate that with appropriately calibrated limits the impact on bank liquidity should be manageable.5 Some research suggests that even tighter thresholds (e.g., EUR€1,500-EUR€2,500) may enhance system stability by encouraging gradual deleveraging in times of uncertainty, while reducing the risk of sudden outflows that could trigger systemic stress.6

Importantly, the digital euro’s design reflects a broader strategic objective: the integrity of the traditional banking model. By ensuring the digital euro does not displace commercial bank deposits at scale, the ECB aims to maintain banks’ capacity to finance the real economy and support economic growth.

Taken together, these safeguards should be understood not just as risk-mitigation tools, but as structural components of Europe’s strategic autonomy.7 In other words, the digital euro is not only a response to technological and financial innovation, it is also a geopolitical instrument, shaped by growing concerns over dependence on US firms and the proliferation of alternative digital currencies, including USD-linked stablecoins and China's e-CNY.

The US dollar’s enduring dominance: Structural advantages and global reach

Any assessment of the digital euro's international prospects must reckon with the USD’s deeply entrenched role in the global financial system. For decades, the dollar has reigned supreme, underpinned by the scale, credibility and liquidity of US financial markets and institutions.

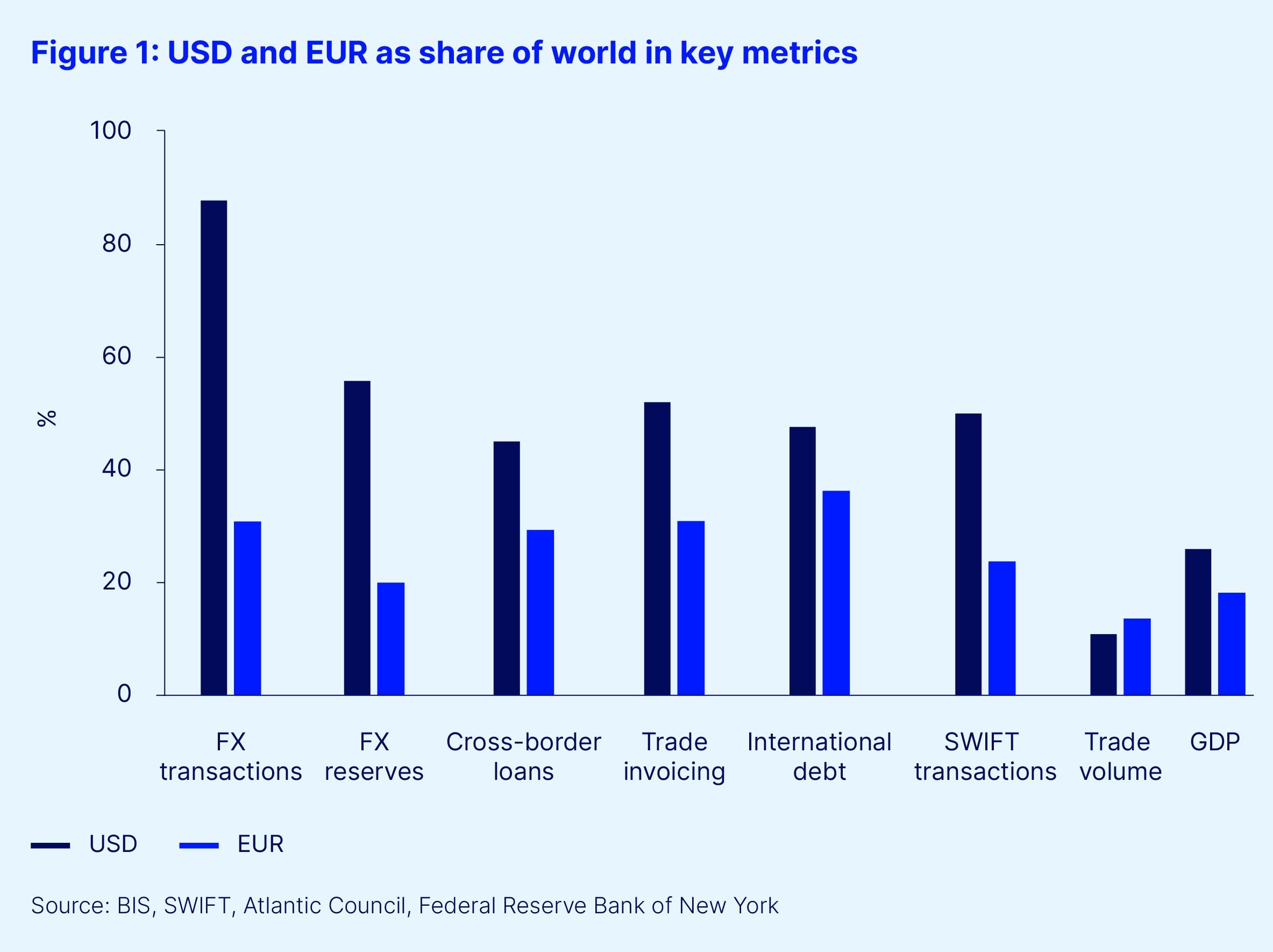

Key indicators, as shown in Figure 1, illustrate the depth of this dominance:

- Global reserves: The dollar constitutes roughly 58 percent of official foreign exchange reserves, dwarfing the euro's 20 percent share. While the dollar's share has declined modestly from peaks above 70 percent, reserve diversification has largely favored emerging market currencies rather than traditional rivals.

- Trade invoicing: The USD remains the leading currency for global trade outside the euro area, particularly in commodities, manufacturing and emerging market transactions.

- Financial markets: Nearly half of international debt securities are issued in USD, and the dollar continues to dominate cross-border banking claims and liabilities.

- Foreign exchange (FX) transactions: The dollar features in nearly 88 percent of all global FX trades — by far the most liquid and accessible currency in the world.

This preeminence stems from several foundational strengths: the sheer scale and dynamism of the US economy, the unmatched depth and liquidity of its financial markets (especially the US Treasury markets), and widespread trust in US institutions and the rule of law. Perhaps most critically, powerful network effects reinforce the dollar’s dominance — it is the currency of choice precisely because everyone else uses it.

The Fed’s ability to act as a global lender of last resort via liquidity swap lines with foreign central banks further solidifies the USD’s centrality, especially during crises.

This unique position grants the US an “exorbitant privilege,” structurally lower borrowing costs and considerable geopolitical leverage via control of the global dollar-based financial plumbing. While the precise extent of these advantages is debated, and signs of de-dollarization continue to emerge, the dollar's structural advantages remain formidable. Any challenge to USD dominance, including via CBDCs like the digital euro, must therefore be viewed through the lens of these enduring structural realities.

Global ripples: Where the digital euro may shift the tides

While the digital euro is not poised to unseat the USD as the world’s reserve currency, its digital architecture and regulatory positioning could reshape the international monetary landscape at the margins, particularly as global finance becomes increasingly tokenized.

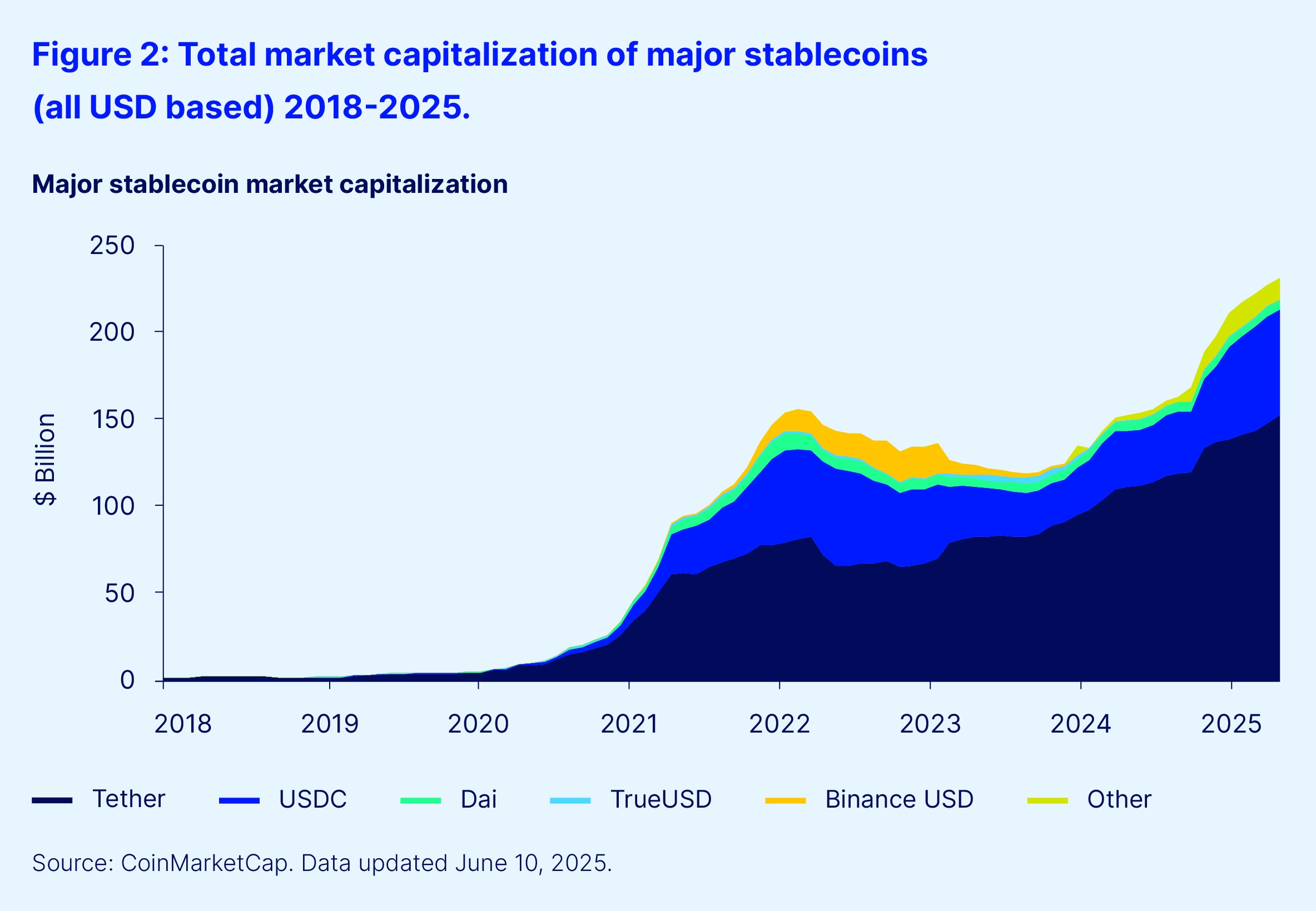

One of the digital euro’s key differentiators lies in its potential to serve as a sovereign-backed, blockchain-compatible payment instrument. By contrast, the US has deliberately refrained from pursuing CBDC development, instead allowing USD-backed stablecoins to become the de facto settlement medium in blockchain-based finance. Today, stablecoins, especially asset-backed variants, collectively exceed US$200 billion in market capitalization and facilitate trillions in annual transaction volume (see Figure 2).

However, stablecoins remain a form of private money; even when fully backed by government securities, they function similar to money market funds. They introduce counterparty, redemption and regulatory risks, characteristics that distinguish them from central bank liabilities. In this context, the ECB offering a blockchain version of central bank money is a key differentiator.

A purely retail CBDC would do little to shift the global order. But once the retail infrastructure is established and the technological rollout is proven, the ECB could extend the digital euro into wholesale applications. This would be particularly valuable as traditional capital markets increasingly embrace blockchain-based tokenization. In that environment, having a central bank-issued settlement currency would confer a significant competitive edge, supporting real-time, cross-border and automated financial transactions with legal certainty.

Fnality, while not a CBDC, operates in close regulatory alignment and could serve as complementary infrastructure to future wholesale CBDCs. Its goal, introducing central bank money into tokenized interbank markets, could reduce intraday liquidity needs and unlock institutional use cases.8

Regulatory positioning and the MiCA advantage

CBDCs also have the potential to radically streamline cross-border payments, which remain notoriously slow, costly and opaque. By reducing dependency on correspondent banking networks, CBDCs could enable real-time, 24/7 international settlement with lower costs and fewer intermediaries, especially if deployed through interoperable, standards-based platforms. Pilot projects around the world are beginning to validate these efficiencies.

Furthermore, initiatives exploring multi-CBDC (m-CBDC) arrangements — allowing direct exchange between national digital currencies via shared infrastructure or linked systems — could fundamentally reshape the global payments landscape. Projects like mBridge9 (involving several Asian and Middle Eastern central banks) and Agorá10 (a BIS-led collaboration among major Western central banks) demonstrate a clear intent to bypass the traditional dollar-based financial plumbing. As we explained in a 2023 paper,11 these efforts carry broad geopolitical implications, with nearly all participants seeking viable alternatives to the current dollar-mediated structure.

That said, significant technical and governance challenges remain. Platform standardization, jurisdictional alignment, interoperability between blockchains and the development of neutral governance models are all unresolved. Without coordinated global frameworks, fragmentation and security risks could undermine the promise of these systems.

In this context, the ECB has explicitly linked the digital euro to its ambition of strengthening the euro's international role and supporting Europe's monetary autonomy. A successful, efficient digital euro — especially one with cross-border capabilities and a wholesale layer — could enhance the euro’s attractiveness for international trade and financial transactions, potentially boosting its reserve currency status and reducing reliance on US-controlled infrastructure. The recent history of US financial sanctions further only reinforces global demand for viable non-USD alternatives.

Timing, however, is critical. Should US legislation establish a regulatory framework for payment stablecoins advance in 202512 as proposed by current administration, a surge in USD-pegged digital instruments could entrench American dominance over tokenized finance well before the digital euro achieves material scale.

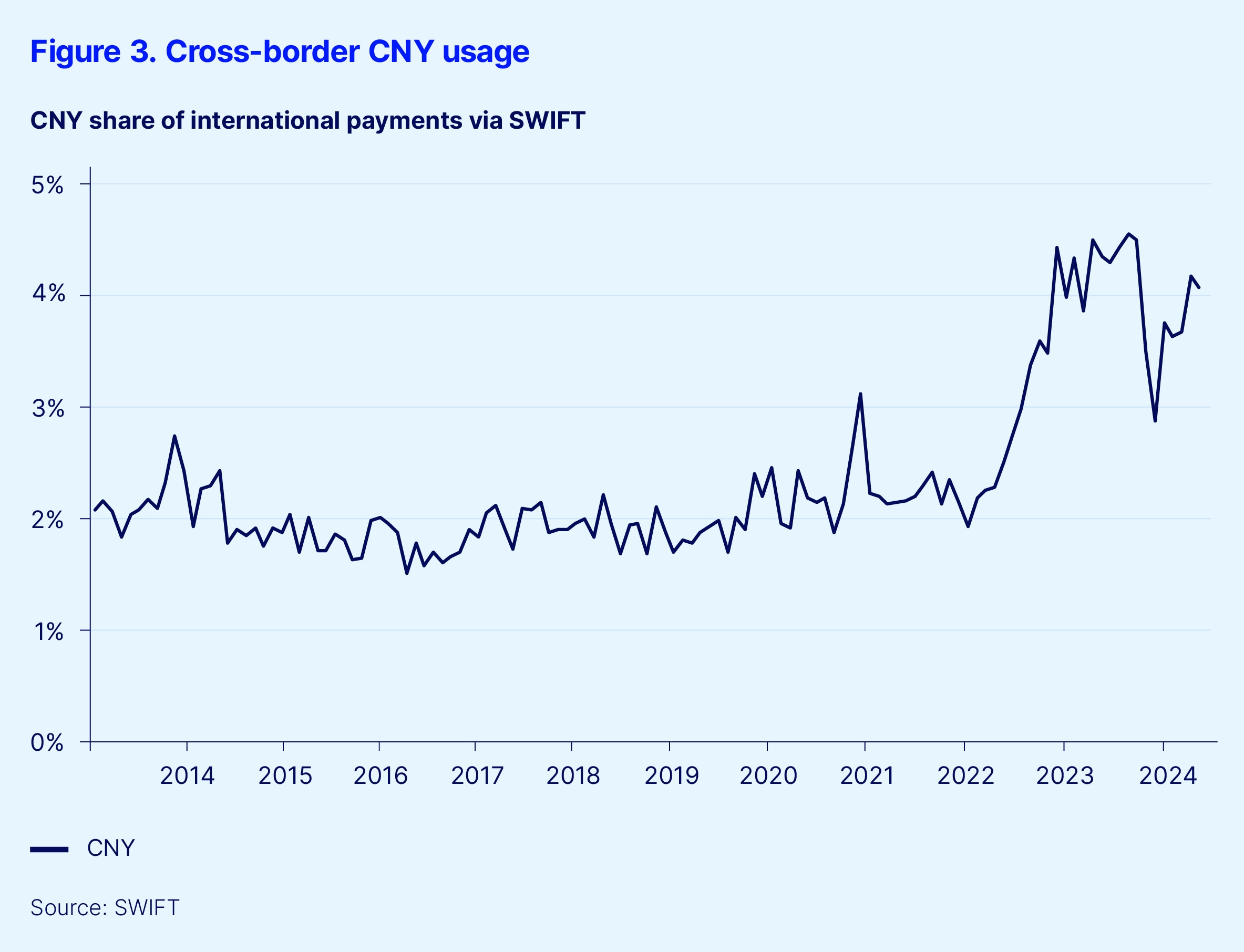

Above all, the digital euro may be a defensive necessity, countering foreign CBDCs (like China’s e-CNY) or dominant stablecoins (mostly USD-pegged). As shown in Figure 3, cross-border usage of CNY continues to rise, underscoring the growing relevance of China’s digital currency strategy in global payments. Without viable alternatives, blockchain finance could accelerate dollarization and erode eurozone monetary sovereignty. Currently, non-USD stablecoins represent less than 3 percent of global supply — with euro-denominated variants accounting for only a small faction.13

Left unchecked, the interplay between tokenization and dollarization could reinforce US dominance. Conversely, coupling a deeper, more integrated European capital market with a robust digital euro could reverse the trend and reinforce monetary independence.

Moreover, the EU’s Markets in Crypto-Assets (MiCA) regulation, fully in effect since December 2024, introduces a stringent framework for euro-denominated stablecoins. Under MiCA, non-EU issuers must be licensed within the EU, maintain full reserves backing and undergo regular audits to ensure redemption at par. These requirements, absent from current US regulatory proposals, create a regulatory advantage for the euro in digital finance, reinforcing tryst and compliance within the single market.

Nevertheless, while the digital euro could enhance cross-border payment efficiency and marginally erode some of the dollar's transactional dominance, it is unlikely to catalyze a structural shift in the global monetary order on its own. Any increase in international usage or reserve status for the euro is expected to be incremental, occurring at the edges of the system, rather than displacing the network effects, capital market depth and institutional trust that continue to anchor the dollar’s supremacy.

Recent developments, such as the downgrade of US sovereign credit ratings and the rise in political polarization, have prompted some investors to question the long-term credibility of US institutions. While the dollar remains dominant, these changes may increase interest in alternative monetary anchors.

Conclusion: A defensive advance, not a disruptive revolution

The Digital Euro Project is undeniably a significant undertaking for the eurozone, driven by the twin imperatives of adapting sovereign money to a digital economy and safeguarding European monetary autonomy. As a retail-focused central bank digital currency, it holds the potential to enhance payment efficiency, foster innovation and reinforce the euro’s role as a trusted anchor in an increasingly cashless domestic economy.

However, its capacity to reshape the global financial order remains constrained, at least over the medium term. The USD’s hegemony rests on enduring structural foundations, the depth and liquidity of US capital markets, entrenched network effects, and institutional credibility built over decades. These are formidable advantages that a digital euro, constrained by cautious design choices and operating within a still-fragmented European financial architecture, cannot easily displace.

At most, the digital euro may modestly enhance the euro’s international usage and improve cross-border financial infrastructures, especially if wholesale capabilities and interoperability evolve in parallel. But it is unlikely to dislodge the dollar’s supremacy in global reserves, trade invoicing or financial market activity.

Even so, that should not be mistaken for failure. In a world where digital finance is advancing rapidly, and where geopolitical frictions increasingly shape financial architecture, the digital euro is best understood as a necessary evolution — a defensive move to preserve relevance, resilience and sovereignty. It is not a revolution, but it may prevent Europe from being left behind.

Acknowledgements

The authors would like to thank Eric Garulay, Lisa Rossi, Sam ten Cate, and Hanbin Im for productive discussions and insightful comments on earlier versions of this paper.