Anna Bernasek: I'm Anna Bernasek, head of thought leadership at State Street. And I'm talking today to Jesse Cole, State Street's global head of private markets product. Jesse, great to be talking with you today. As you know, we've commissioned a survey of more than 500 global institutional investors. What have we learned from that in terms of their strategies this year across those different asset types? Yeah, I.

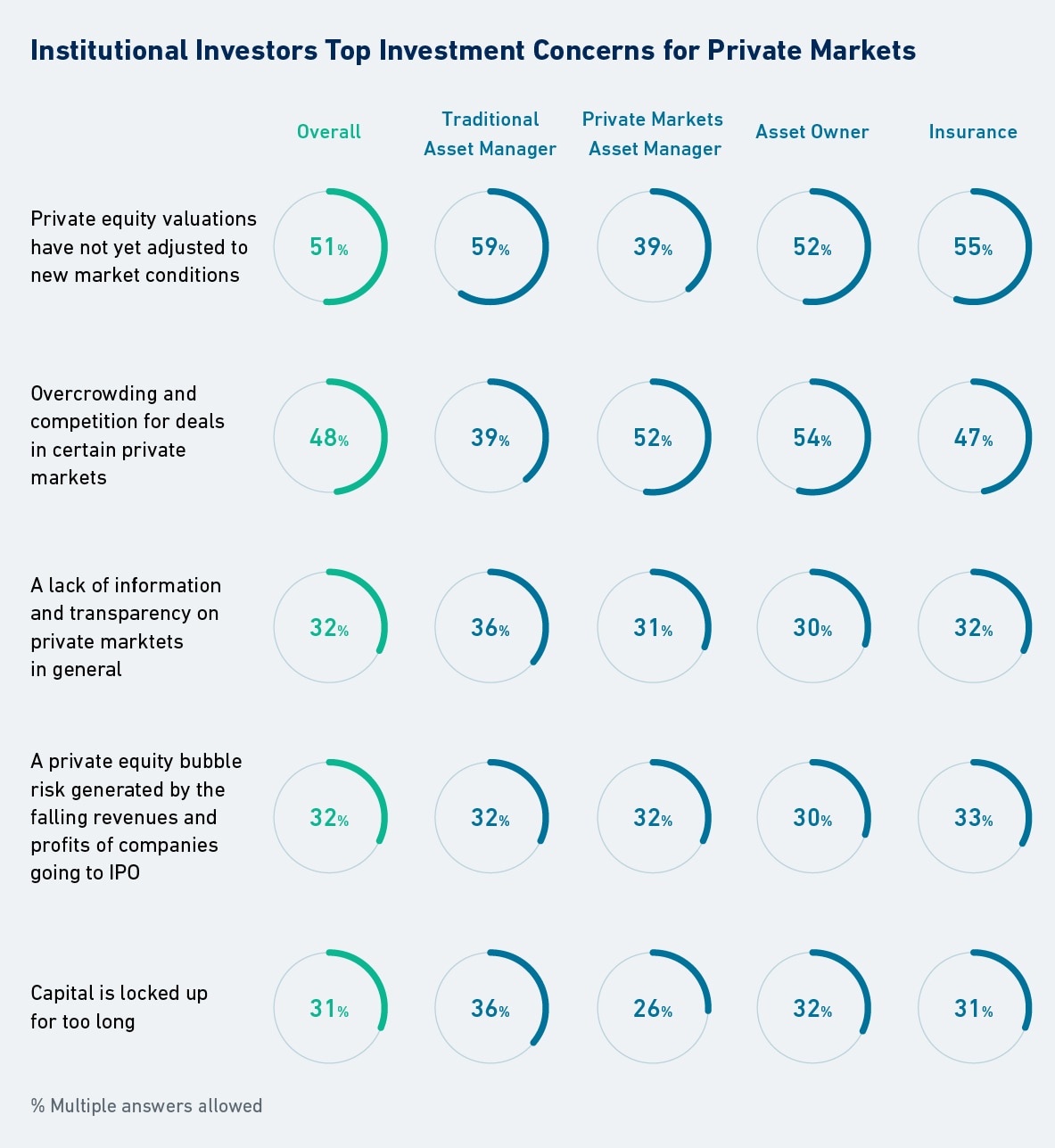

Jesse Cole: Think and it was obviously a pretty timely survey. I think a couple of key themes came out of that from and again, we spoke to a wide range of investors. So everything from an asset owner, an insurance company, an asset manager. So it was a good representation because not all of them will behave the same. And by doing that, what we saw was a pretty consistent theme that overall clients were going to be investing in allocating more into the private market space and it would be growing. I think there are some nuances you could see in the feedback we got relative to maybe more emphasis in feeling more confident about investing into private equity, venture and infrastructure and maybe a little less confidence in allocating more into private credit or in certainly in the case of real estate, I think people are a little bit more mixed as to whether they're going to increase 50 over 50 increase or decrease their allocation. But I think the message that's been loud and clear in that feedback from our clients was that they do continue to expect to see growth in private markets and they intend to continue to invest in it.

Anna Bernasek: Can you talk to us a little bit, tell us about the challenges with data and what are the potential solutions.

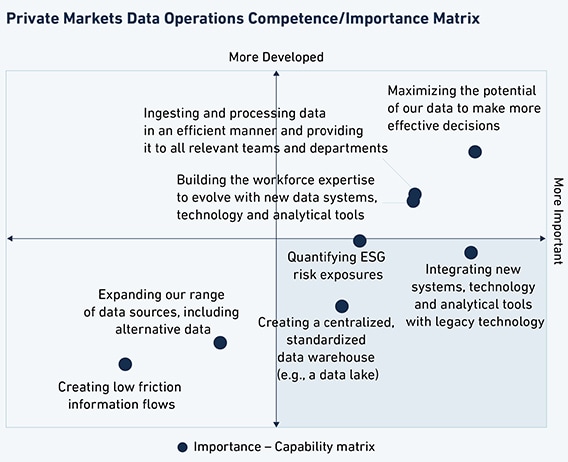

Jesse Cole: At the end of the day, How do we move data efficiently, effectively and maintain the quality of the data? And so you'll see and certainly in the feedback we got from the survey that many, many, many of our clients are investing in technology and or pushing service providers to really make investments in technology and to create more really transparency to the data, more efficient operations so that we can get valuations sooner. And really the data issue is is around it's just a lot of unstructured manual data maintained in lots of places and it just hasn't matured as an infrastructure like has happened in the public markets. The other thing I'd say on on data that is really interesting is, you know, clients want to know more about their investments and link things together. There's many of our clients who will tell you that data and mastering the data and having good data is a competitive advantage to not only their performance, but also their ability to make good investment decisions. So it's really a combination of getting the data being more efficient and more timely and valuations, but then having a data strategy or a capability to allow you to look through investments and start to look across your portfolio because you don't just have private investments, you have public you know, if you're an asset manager and you're raising a fund, your clients, whether they're wealth management clients or individuals, are always struggling with this idea of, well, how much is my investments worth? Well, your public side is worth this. Sorry. Your your private side is stale by three months, you know. And so how do I understand that? So underpinning all of it is data and being able to make it more or less like the public markets at the end of the day. Right.

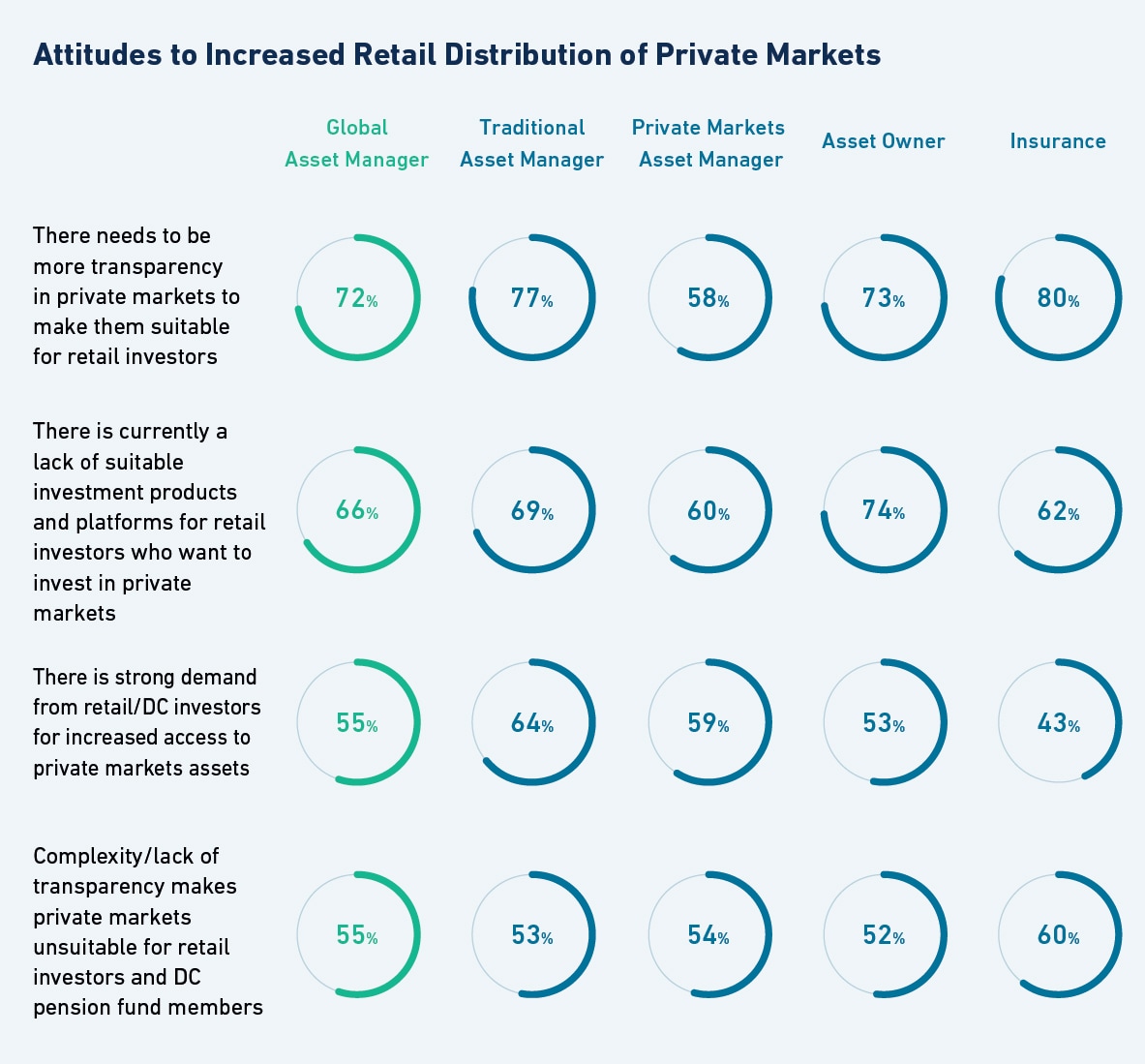

Anna Bernasek: So let's go back to the volatility on markets. Clearly, everybody is looking for return as well as retail investors that typically will invest in public markets. How realistic do you think it is that we'll see retail sort of widespread retail investment in private markets?

Jesse Cole: Yeah, that's that's a good question because we see a little bit of both happening in the sense that, you know, I would tell you that there already are products in the private market space that we support here at State Street that clients have launched that are more registered in style, but they also hold private investments and those are being distributed to the more mass affluent, I would say, or high net worth through wirehouses broker dealers, RIAs. So there is exposure happening. I'd say that, you know, going mass retail sort of let's go to the fidelity.com and log on and and buy a private fund. I think we what feedback I've seen is mixed. I think some people are very optimistic and. Pro, it's going to happen. I think others are more of a view that until there's a little bit more transparency and some frameworks around suitability, I think it's it's there's a feeling that it's a little bit of ways away before you see that happen. And it's certainly I think it's one of the bigger challenges for us is, is how do we actually drive through and get the level of transparency, disclosure and suitability that allows for us to avoid what unsophisticated agents might run into, which is the illiquidity of the product. And and even there, there's innovation that needs to happen, whether it be a secondaries market or something that makes it available for retail investors in a closed ended fund to actually be able to exchange or transfer ownership.

Anna Bernasek: Okay. So Jesse, now I'm going to ask you to look in your crystal ball and tell us what do you see for private markets in ten years time?

Jesse Cole: Yeah, I'd say this. Listen, I think, you know, everything can change, but at the end of the day, I do think that people want to be able to invest in the whole economies of the countries that we have. And so I do think we will find a way it will require investments in technology, a willingness to sort of innovate around how we move and manage data support from the regulators as far as how we ought to properly frame it to maintain the integrity of of investing and the confidence of investors. But I am pretty confident that there is enough creative, smart people that want to figure out how to make this happen, that it's going to happen. And I would not be surprised if in ten years you see a more similar framework for private securities or private investments that compares equally to public securities.