Insights

The great repricing: Are US Treasuries still a safe haven?

US Treasuries have long been the cornerstone of global financial stability — but shifting fiscal and policy landscapes are challenging that status quo.

July 2025

Ramu Thiagarajan

Head of Thought Leadership, State Street

Hanbin Im

Global Macro Researcher, State Street

Marvin Loh

Senior Multi-Asset Strategist, State Street Markets

Prashant Parab

Macro Research Analyst, State Street

Priyaam Roy

Thought Leadership Research Analyst, State Street

This paper reassesses the role of US Treasuries as the global risk-free asset amid rising fiscal concerns, policy uncertainty and shifting market dynamics. It documents a secular decline in the convenience yield of Treasuries and shows how this erosion has weakened their traditional safe-haven function.

Key findings include:

- Diminished hedging power: Long-duration Treasuries no longer reliably offset equity drawdowns, especially post-2022.

- Structural drivers: Elevated US debt-to-gross domestic product (GDP), declining foreign demand and inflation volatility are undermining Treasury demand.

- Breakdown in correlations: The historical positive link between Treasury yields and the US dollar (USD) has fractured, signaling a reassessment of US credibility.

- Alternative safe havens outperform: Assets like the Japanese yen (JPY), the Swiss franc (CHF), gold and short-duration bonds have delivered superior downside protection in recent stress periods.

Investment implications:

- Diversify the defensive toolkit: A blend of safe-haven currencies, gold and short-duration sovereigns may offer more robust protection than a traditional 60/40 portfolio.

- Adopt a regime-aware approach: Asset correlations are increasingly macro-sensitive; dynamic allocation — based on inflation, fiscal signals and policy credibility — is essential.

- Retain Treasuries selectively: Despite reduced hedging value, Treasuries remain critical for liquidity and collateral purposes.

The paper calls for a recalibration of portfolio construction frameworks, urging institutional investors to rethink their reliance on long-duration Treasuries as the cornerstone of downside risk management.

Introduction

For decades, US Treasuries have been regarded as the cornerstone of global financial markets, offering unparalleled liquidity, safety and a reliable store of value. Their role as the de facto risk-free asset has underpinned everything from sovereign reserve management to institutional portfolio construction. However, recent market dynamics and emerging investor concerns suggest this foundational status may be undergoing a meaningful reassessment. Persistent fiscal strains within the United States — now compounded by anxieties regarding US policymaking and institutional stability — necessitate a re-evaluation, a shift also reflected in atypical market behaviors.

The US fiscal situation has deteriorated, with escalating national debt and persistent deficits highlighted by Moody’s US sovereign credit rating downgrade in May 2025. This trend is accompanied by declining foreign official holdings of US Treasuries, indicating a diversification strategy among global reserve managers. These existing fiscal pressures are further intensified by new investor concerns regarding the perceived volatility of US economic policy and the long-term sustainability of the nation’s fiscal trajectory in light of recent tax initiatives.

More than 50 percent of bond strategists surveyed by Reuters expressed concerns about the traditional safe-haven status of US treasuries.1 They highlight Trump 2.0 tariffs and abundant supply of bonds as the two key reasons for this demand decline. Consequently, rising US Treasury yields, which traditionally signaled robust economic conditions, are increasingly interpreted as an indicator of heightened risk — a pattern more commonly associated with emerging market economics.

These shifting perceptions are reflected in the “convenience yield” of US Treasuries, which represents the implicit premium investors accept for the unique liquidity and safety attributes of these instruments. This premium reflects the importance investors place on their liquidity, safety and collateral utility. A positive convenience yield indicates that investors accept lower yields on US treasuries compared to other investments with similar cash flows because of the additional benefits they derive from holding these safe assets. It reflects the market's perception of their value beyond just the financial returns.

Recent analyses showing a decline in this yield suggest that the premium is eroding. This shift is not merely theoretical — it is evident in market dislocations such as the recent breakdown in the historically positive correlation between US Treasury yields and the USD. Instances where rising borrowing costs coincide with a weakening dollar imply that the fundamental attributes of Treasuries, and the credibility of their issuer, are being re-evaluated by market participants.

This paper explores the evolving status of US Treasuries, examining the macroeconomic forces contributing to the decline in their safe-haven status. It also considers how institutional and policy-related concerns are reshaping investor behavior. Finally, it assesses the potential emergence of alternative safe-haven assets, offering empirically grounded insights for investors and policymakers navigating this shifting landscape.

Current state of US Treasuries convenience yield

The “convenience yield” of US Treasuries — representing the premium investors are willing to accept for their liquidity and safety — has long underpinned their role as the global risk-free benchmark. Longstaff (2004) emphasized the importance of liquidity in Treasury pricing, noting that investors accept lower yields in exchange for the safety and liquidity that Treasuries provide.

Krishnamurthy and Vissing-Jorgensen (2012) quantified this premium, estimating an average convenience yield of approximately 73 basis points (bp), linking it to Treasuries’ unique liquidity. However, recent analyses point to a declining trend, raising questions about the durability of this premium and its broader implications. Du et al. (2018) introduced the “US Treasury Premium,” measuring deviations from covered interest parity between US Treasuries and foreign government bonds.

Their findings revealed a secular decline, signaling a diminishing relative convenience yield. He and Krishnamurthy (2020) examined the spread between Treasuries and maturity-matched AAA corporate bonds, attributing the difference to the liquidity premiums. Their results showed a narrowing spread, reinforcing the evidence of erosion. Du et al. (2023) extended this analysis using swap spreads, linking the decline to structural changes in primary dealer balance sheets. Duffie (2023) similarly highlighted the role of dealer balance sheet constraints in weakening Treasury market resilience. These converging findings across different methodologies consistently point to a broad-based decline in the convenience yield of US Treasuries.

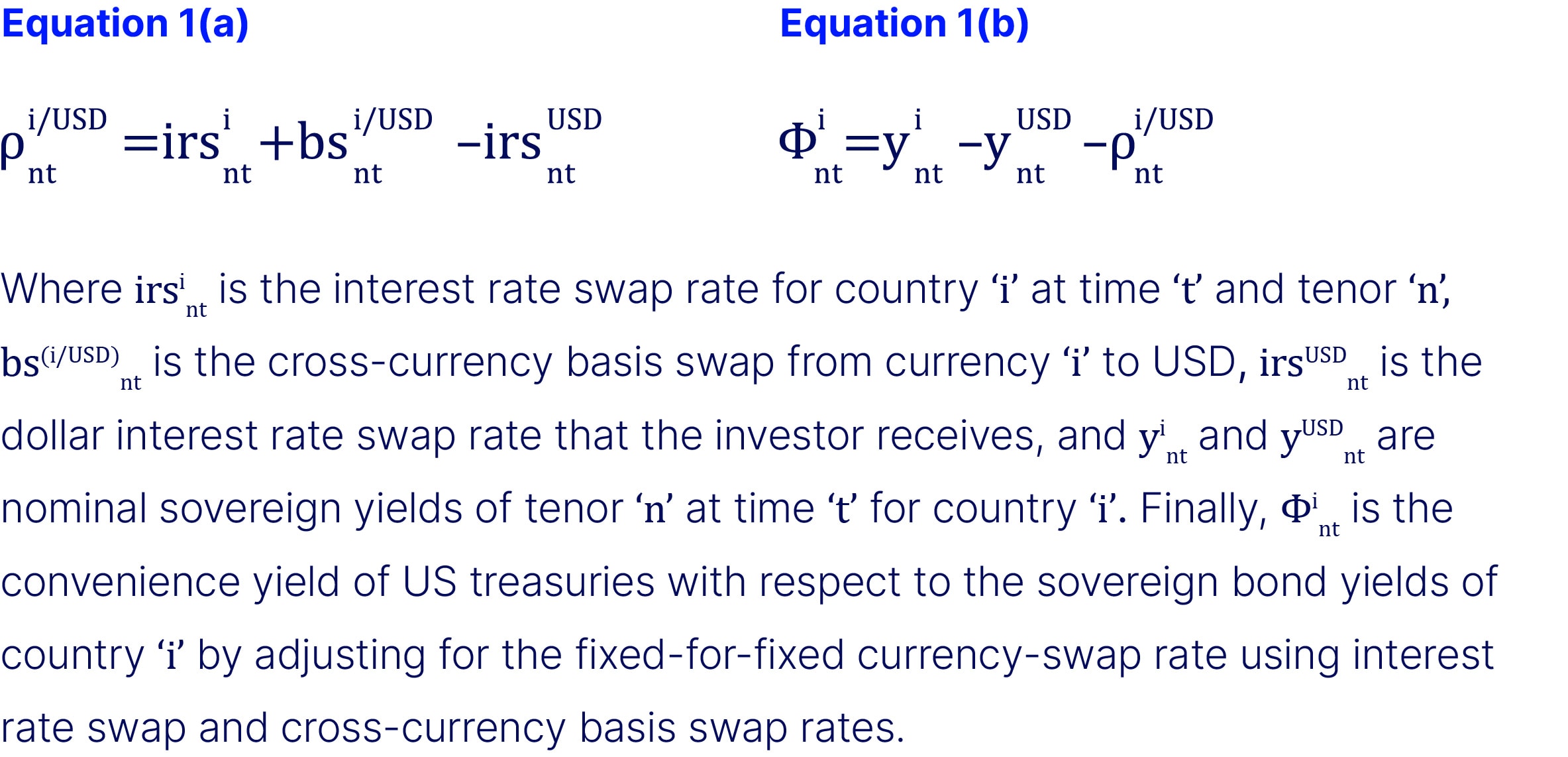

In this study, we follow the methodology incorporated by Du et al. (2018) to estimate the convenience yield. We construct an inter-sovereign convenience yield by synthetically creating a fixed-for-fixed currency swap rate using interest rate swap and cross-currency basis swap data. We construct the same, using averages across G10 currencies. Equations 1a and 1b outline the major factors that are used in construction of the convenience yield of US Treasuries with respect to country ‘i’, where “i” belongs to a set of G10 countries.

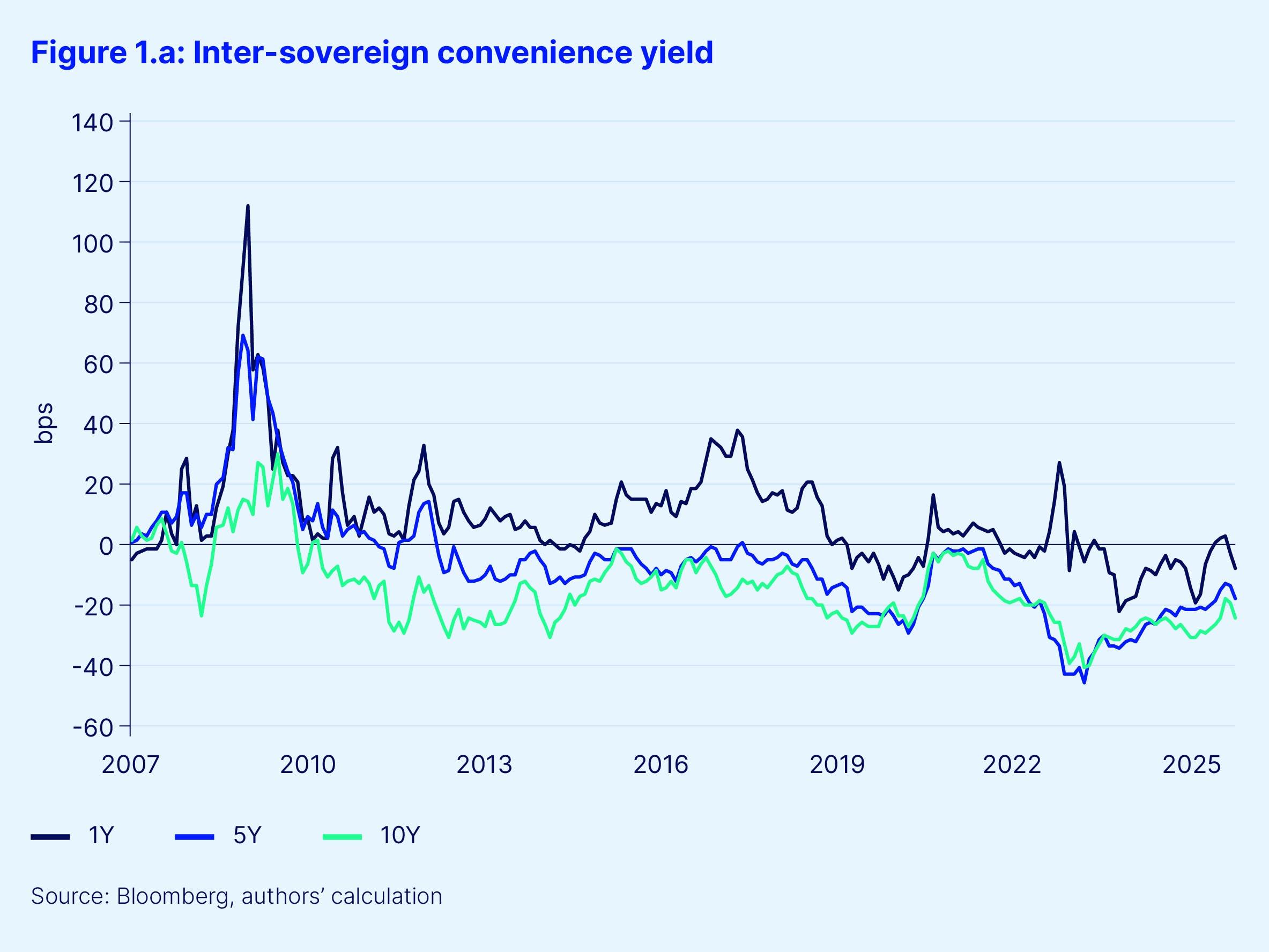

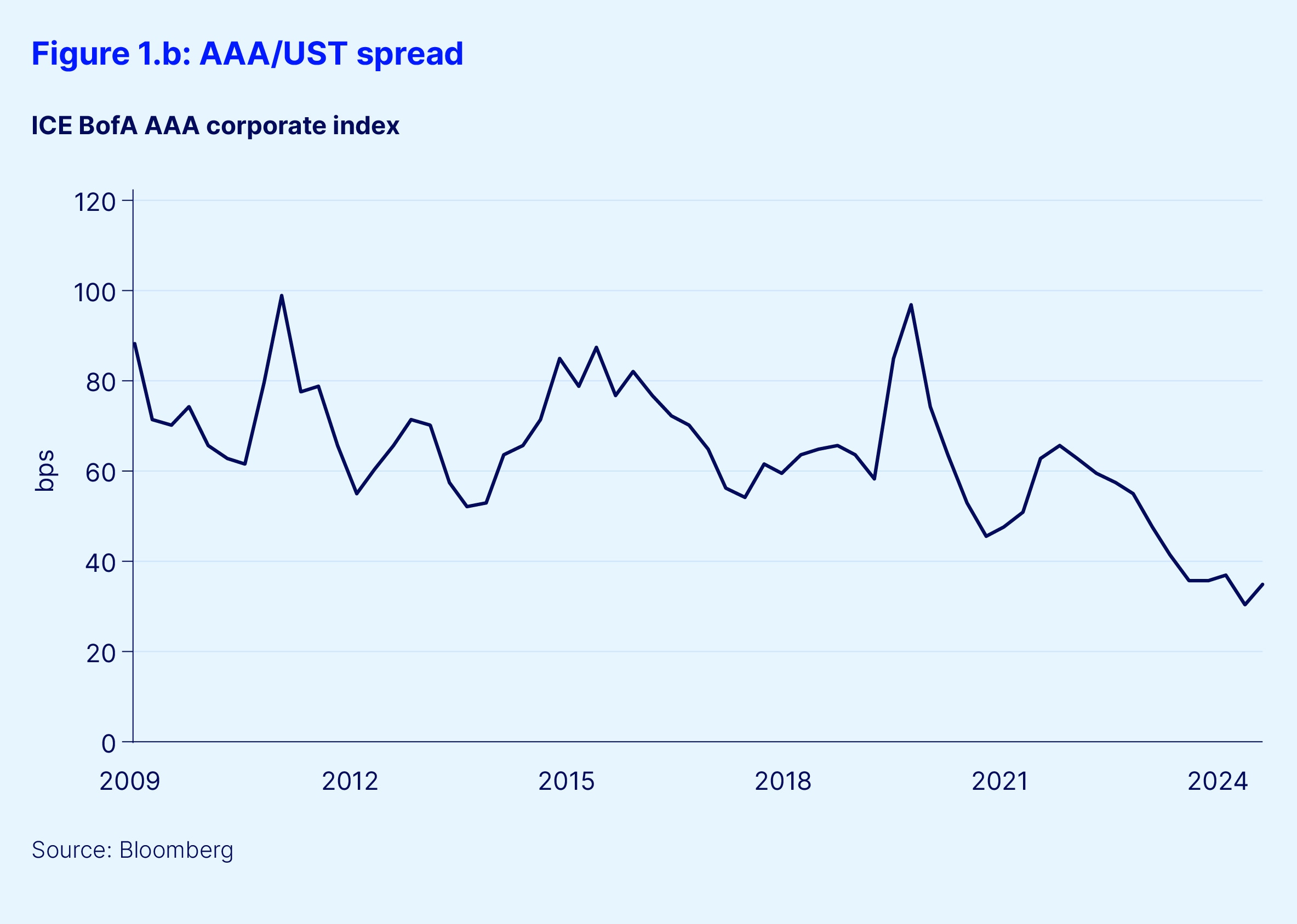

As can be seen in Figure 1.a and Figure 1.b, our extension of Du et al. (2018) and He and Krishnamurthy (2020) confirms this continuing downward trend. This shift raises concerns about the evolving structure of the Treasury market and its implications for investors and policymakers.

Recent developments have further intensified scrutiny. In May 2025, Moody’s downgraded the US sovereign credit rating from Aaa to Aa1, citing the nation’s growing debt burden, which stood at US$36.8 trillion, or approximately 123 percent of GDP. This downgrade reflects mounting skepticism among global investors about the US fiscal trajectory. Concurrently, data from the Treasury’s TIC system shows a decline in foreign official holdings, suggesting a diversification trend among global reserve managers. These shifts in demand, coupled with heightened policy uncertainty and evolving Federal Reserve balance sheet dynamics, underscore the need to reassess the convenience yield and its role in global markets (Thiagarajan et al., 2024; Schnabel, 2025).

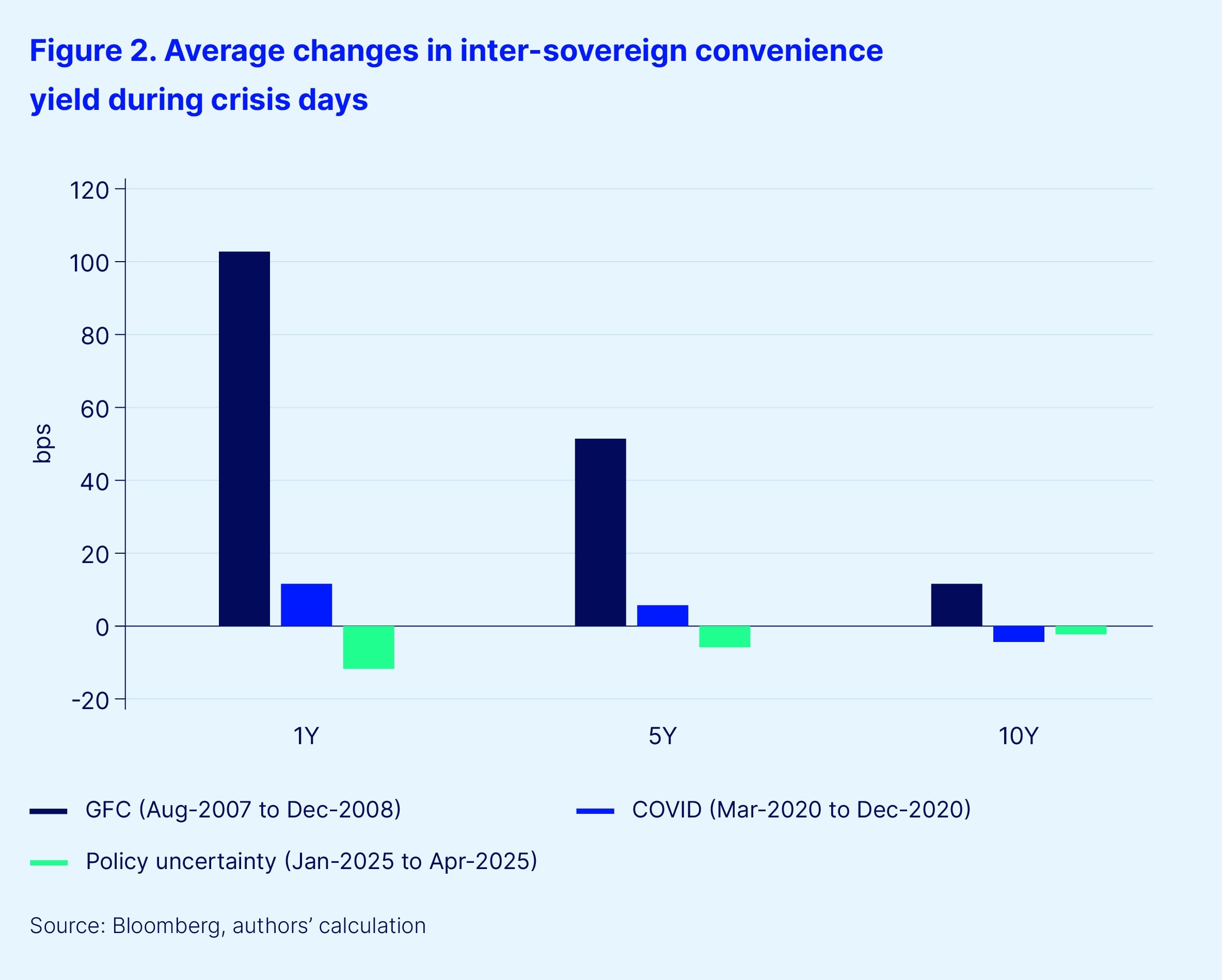

As illustrated in Figure 2, the behavior of convenience yields during crisis periods has changed markedly, from the Global Financial Crisis (GFC) to the present. This evolution signals a potential structural break in how Treasuries function as safe-haven assets.

In the next section, we examine the macroeconomic forces driving these changes, including fiscal policy, market volatility and investor sentiment — factors that are reshaping the foundations of the US Treasury market.

Macroeconomic drivers of US Treasury convenience yield

The convenience yield reflects the premium that investors are willing to pay for the privilege of holding safe assets like US Treasuries. It is also a key driver of the natural rate of interest — r* — the equilibrium real interest rate that balances savings and investment in the economy. Szoke et al. (2024) emphasize this relationship, arguing that the scarcity of safe assets such as US Treasuries can depress r*, while an abundance can elevate it. Understanding this dynamic is essential for interpreting interest rate behavior and monetary policy. A higher convenience yield signals stronger demand for safe assets, which can suppress real interest rates and support more accommodative policy settings.

The drivers of convenience yield are broadly categorized into three groups:

- Macroeconomic factors: Government debt levels, inflation expectations and economic uncertainty

- Financial factors: Market liquidity, credit risk, central bank credibility and investor risk aversion

- Geopolitical factors: Political stability, trade tensions and global financial crises

To better understand the macroeconomic influences on US Treasury convenience yield, we conducted a panel regression analysis following the methodology introduced by Du et al. (2018). Our model examines quarterly convenience yields of US Treasuries relative to government bonds from five developed markets — the eurozone, Japan, the United Kingdom, Canada and Australia — spanning first quarter of 2000 to first quarter of 2025. These countries were selected for their global market relevance and inclusion in the Bloomberg Global Treasury Index.

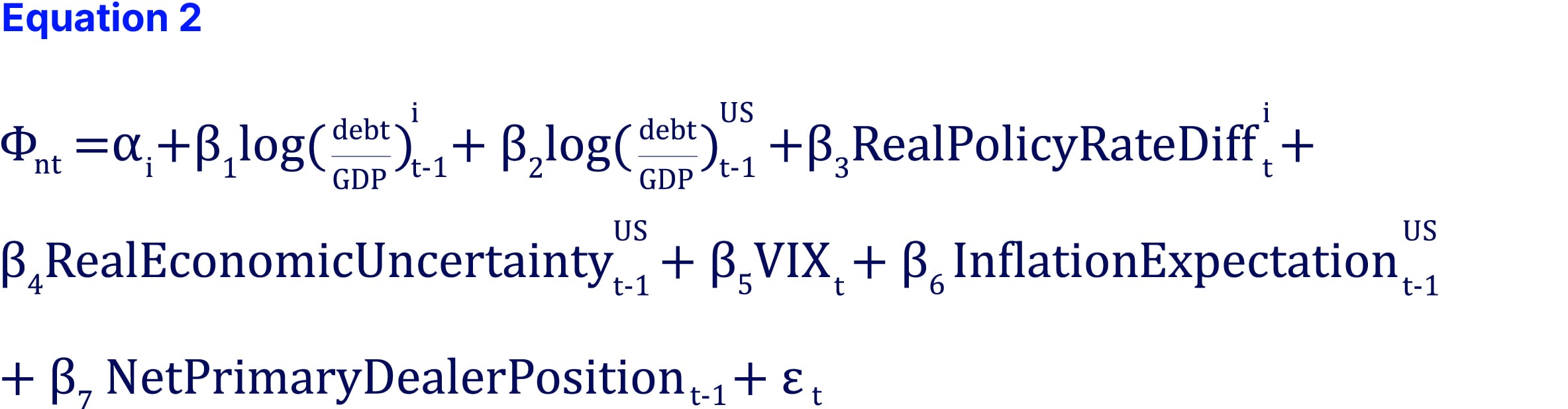

The empirical framework incorporates several key macroeconomic variables, as shown in Equation (2). Building on Du et al. (2018, 2023) and Krishnamurthy and Vissing-Jorgensen (2012), we model the convenience yield as a function of:

- Perceived credit risk, proxied by the debt-to-GDP ratios of the US and peer countries

- Monetary policy stance, captured through the real policy rate differential (inflation-adjusted policy rate differences), and both short- and long-term inflation expectations

- Flight-to-safety behavior, represented by the Chicago Board Options Exchange Volatility Index (VIX) and US real economic uncertainty

- Structural market dynamics, proxied by net primary dealer positions

This model is estimated with country-fixed effects to control for unobserved heterogeneity across jurisdictions.

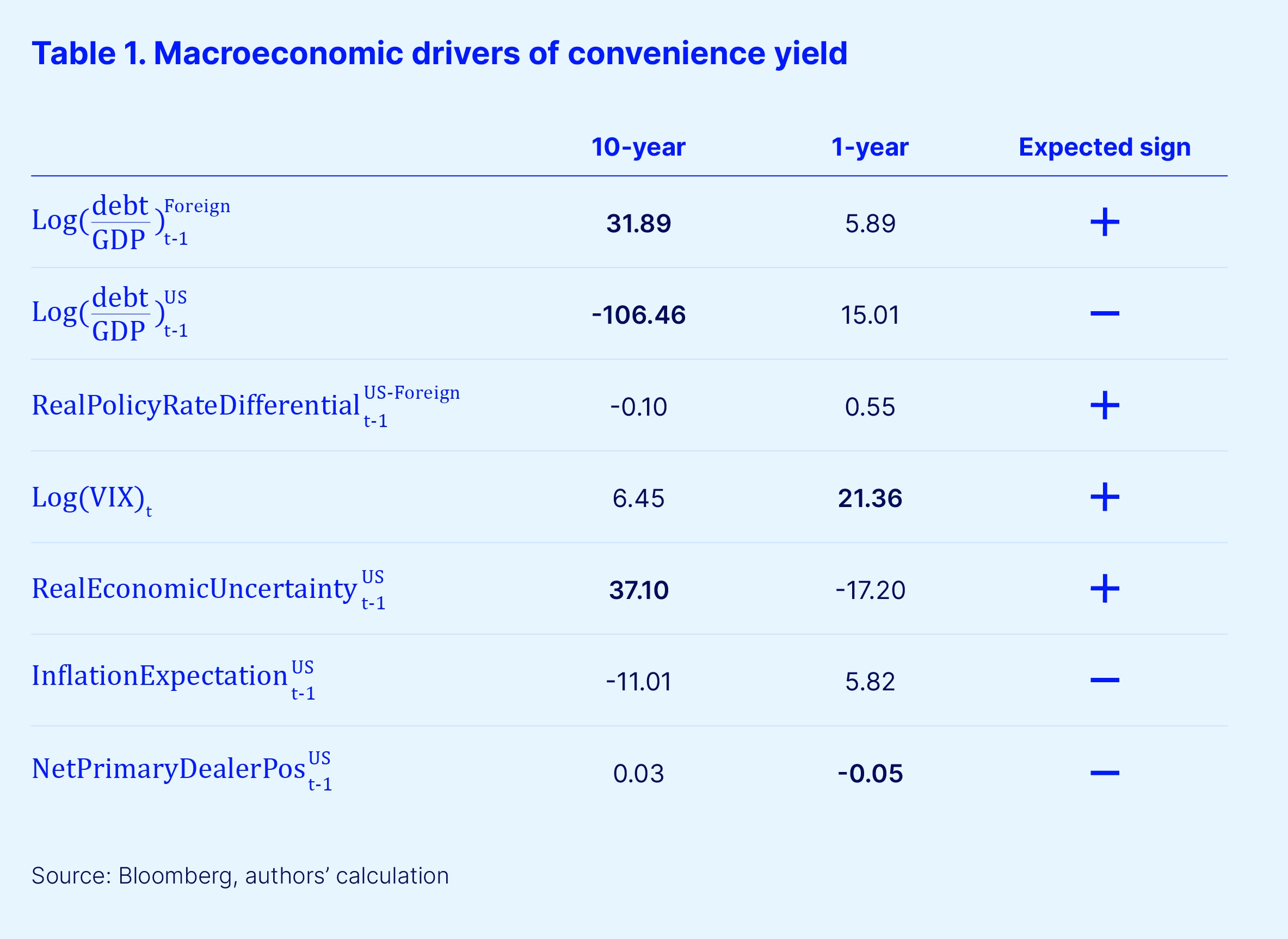

Our findings in Table 1 provide strong evidence of the macroeconomic factors influencing US Treasury convenience yields. The following results are particularly notable for the 10-year maturity:

- Higher US debt-to-GDP ratios are associated with a significant decline in the convenience yield, reflecting investor concerns about fiscal sustainability and its adverse impact on the scarcity premium traditionally attributed to Treasuries.

- Conversely, elevated debt-to-GDP ratios in foreign countries are positively correlated with US convenience yields, likely indicating that, in relative terms, investors perceive US Treasuries as more fiscally stable when foreign sovereigns face deteriorating fiscal positions.

- Rising economic uncertainty within the US increases the convenience yield, suggesting that Treasuries continue to serve as a domestic safe haven during periods of heightened macroeconomic risk.

- Greater global risk aversion, as proxied by the VIX, significantly boosts the convenience yield of short-duration Treasuries, while having a more muted effect on longer maturities. This pattern points to differentiated investor preferences across the yield curve, with short-term instruments favored during episodes of acute market stress.

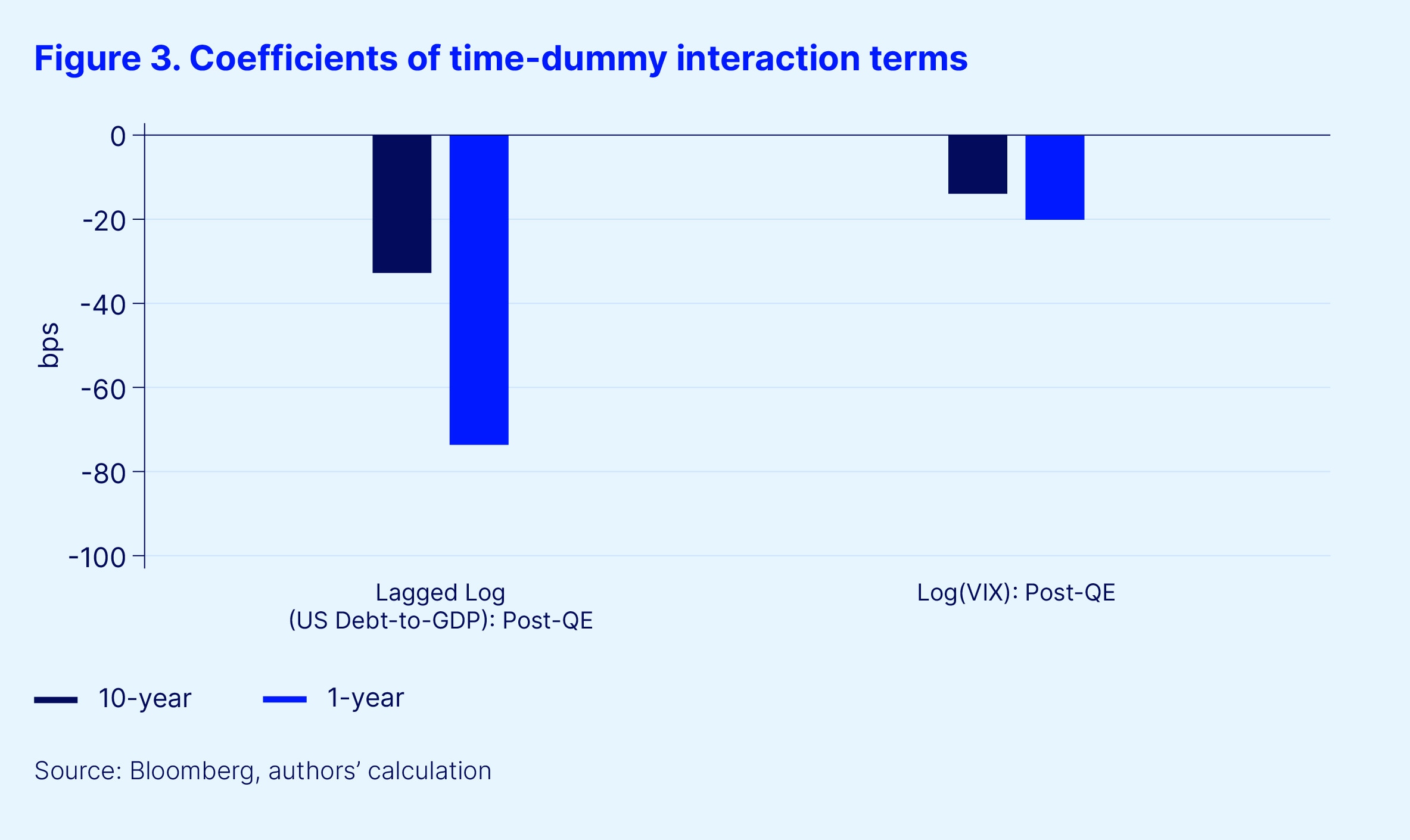

We also tested whether the impact of fiscal balance on attractiveness of US Treasuries has changed recently. To do so, we introduced time-dummy interaction terms for debt-to-GDP variables, while controlling for the potential time-varying effect of risk aversion measured by the VIX index. As shown in Figure 3, since 2022, the negative influence of deteriorating US fiscal balances on convenience yields has intensified. Meanwhile, the positive effect of risk aversion has moderated, possibly indicating a structural shift in investor perception of US Treasuries amid heightened fiscal challenges.

These findings collectively highlight the complex interplay between fiscal health, economic uncertainty and global risk sentiment in shaping Treasury market dynamics. The increased sensitivity of convenience yields to fiscal metrics and the diminished responsiveness to market volatility suggest investors may be re-evaluating the risk profile of Treasuries in the current economic environment. In the following section, we examine alternative assets that investors may increasingly consider to be safe-haven options amid these evolving dynamics.

Search for alternative safe-haven assets

What constitutes a safe-haven asset?

A safe-haven asset is an investment expected to retain or increase in value during times of market turbulence. These assets are sought by investors aiming to protect their portfolios from significant losses during periods of economic uncertainty or financial market volatility. The defining characteristic of a safe-haven asset is its ability to provide stability and capital preservation when other investments are declining.

Historically, investors have turned to US Treasuries during episodes of market stress, relying on their exceptional liquidity, perceived safety and stability as an anchor in turbulent times — often characterized as a “flight-to-safety” or “dash-for-cash.” However, as previously discussed, the declining convenience yield suggests that investors may be reassessing Treasuries’ role as the primary safe-haven asset. This shift prompts a closer exploration into alternative assets that may offer more reliable risk mitigation and capital preservation.

Evaluating alternative safe-haven assets

We evaluated safe-haven candidates by examining:

- Their relationship with risky assets — specifically equities — during periods of market stress

- Their overall risk-reduction capability within diversified portfolios

- The macroeconomic drivers that shape their correlations with risk assets

Relationship between risky assets and safe-haven assets at times of stress

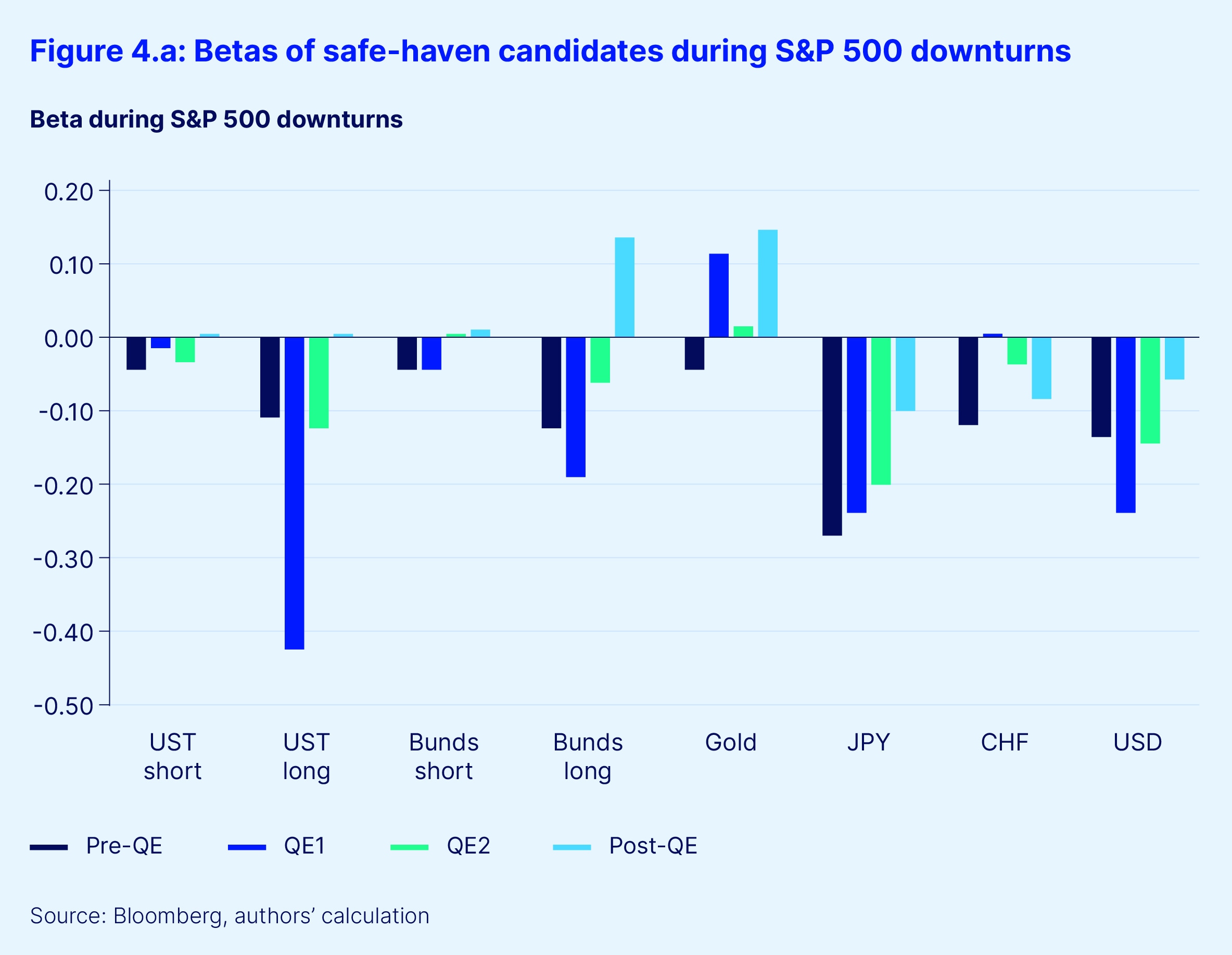

First, we assessed how various candidate assets performed relative to S&P 500 downturns across four key periods:

- Pre-Quantitative Easing (QE) (2000-2008)

- QE Phase I: (2009-2012)

- QE Phase II: (2013-2021)

- Post-QE: 2022-Present

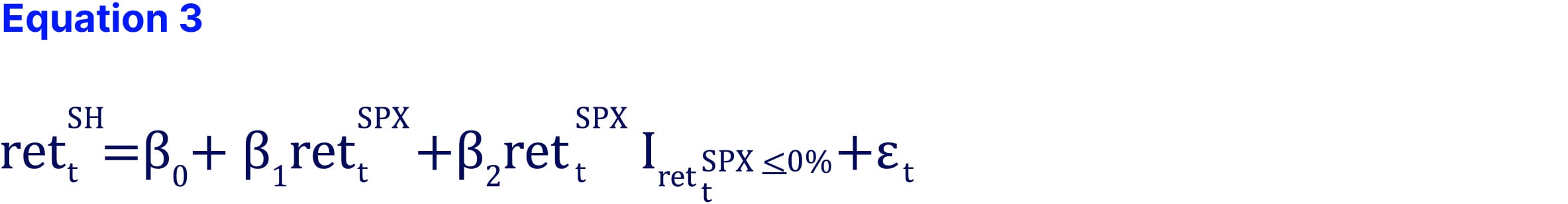

Specifically, we analyzed weekly return betas during periods of market stress using Equation (3), following the methodology of Chevallier (2023).

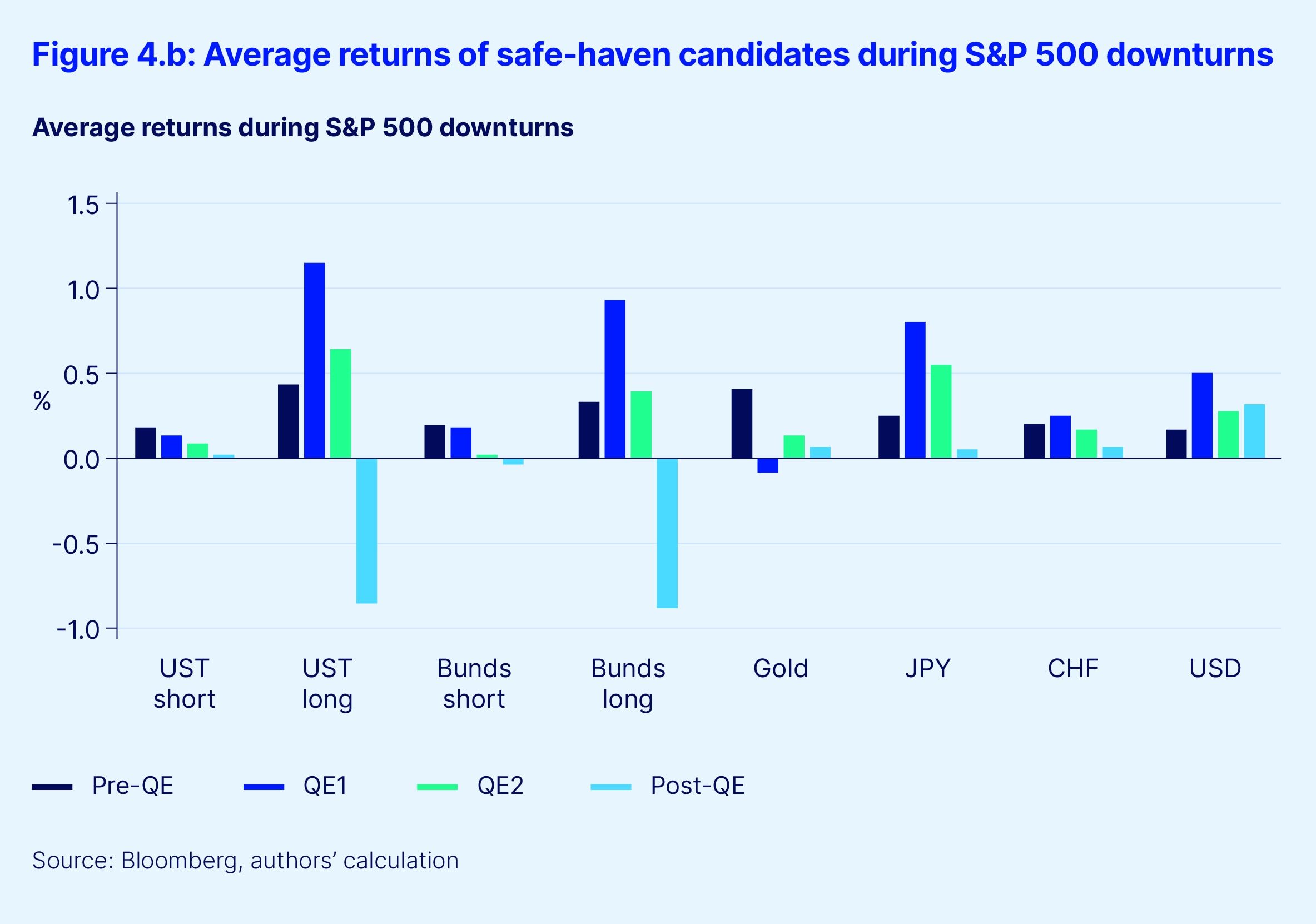

Our analysis covers short- and long-duration US Treasuries, short- and long-duration German Bunds, gold and currencies (JPY, CHF, and USD). As shown in Figure 4.a, short- and long-duration US Treasuries and German Bunds traditionally exhibited negative correlations to equities during market downturns, reflecting their safe-haven attributes. Yet, this hedging capability has largely disappeared post-2022, with the equity beta of US Treasuries effectively shifting to zero.

Notably, long-duration Treasuries have delivered negative average returns during downturns, as illustrated in Figure 4.b — a marked departure from historical norms. Short- and long-duration German Bunds have followed a similar pattern, further underscoring the erosion of traditional safe-haven performance. This deterioration likely reflects a combination of persistent inflationary pressures, aggressive monetary tightening and growing fiscal concerns that have undermined the perceived safety of Treasuries.

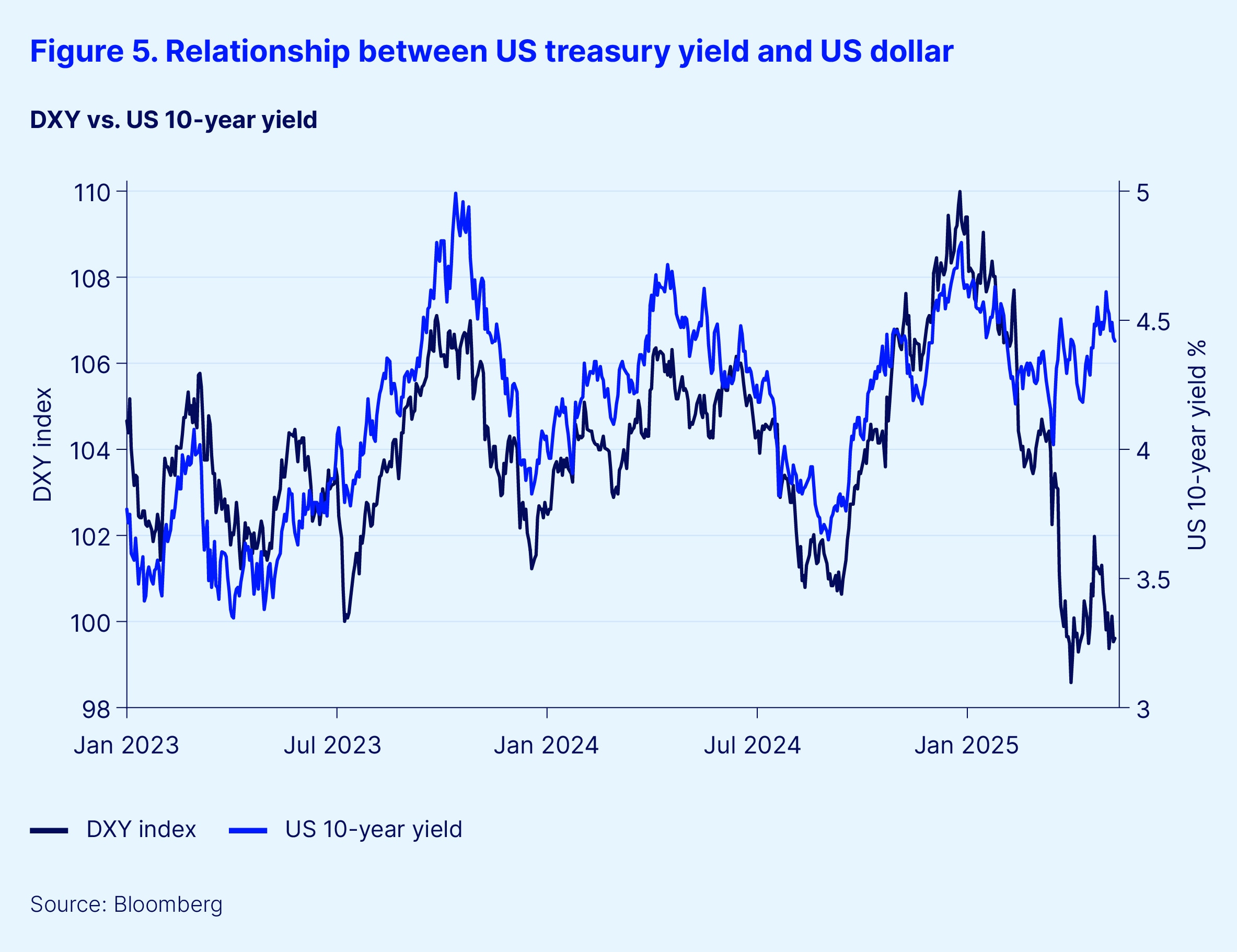

In fact, recent market behavior has sharply underscored this erosion. Since early April 2025, the traditional positive correlation between US government bond yields and the dollar has broken down, as shown in Figure 5. While the 10-year Treasury yield has risen, the dollar has concurrently fallen against a basket of currencies. This divergence suggests that rising yields are no longer perceived by investors as a signal of a strong US economy that would typically attract capital inflows, but rather as a reflection of increased risk associated with US debt, driven by fiscal concerns and policy uncertainty.

Conversely, safe-haven currencies — the JPY, CHF and USD — have demonstrated greater resilience. Post-2022, JPY and CHF maintained negative equity betas with modest positive returns during market downturns. Notably, the USD retained a negative beta and achieved significantly positive average returns, underscoring its enduring appeal as a global reserve and liquidity anchor.

However, the very recent breakdown in the dollar’s positive correlation with yields, and its decline despite rising yields, introduces a critical new consideration. If concerns about US institutional credibility and policy predictability are indeed weakening the dollar, its role as a reliable stabilizer in portfolios may be at risk. This recent phenomenon of dollar weakness alongside higher yields and lower equity prices poses a challenge to traditional portfolio hedging strategies. Investors are increasingly raising hedge ratios on existing dollar exposures, contributing to selling pressure on the currency.

Gold, though exhibiting a modestly positive equity beta post-QE, has continued to deliver positive returns during equity downturns. This suggests that while gold may not always move inversely to equities, it consistently preserves capital during periods of uncertainty, bolstered by its traditional role as a store of value amid inflation and geopolitical instability.

Shifting risk-reduction capacity of safe-haven assets

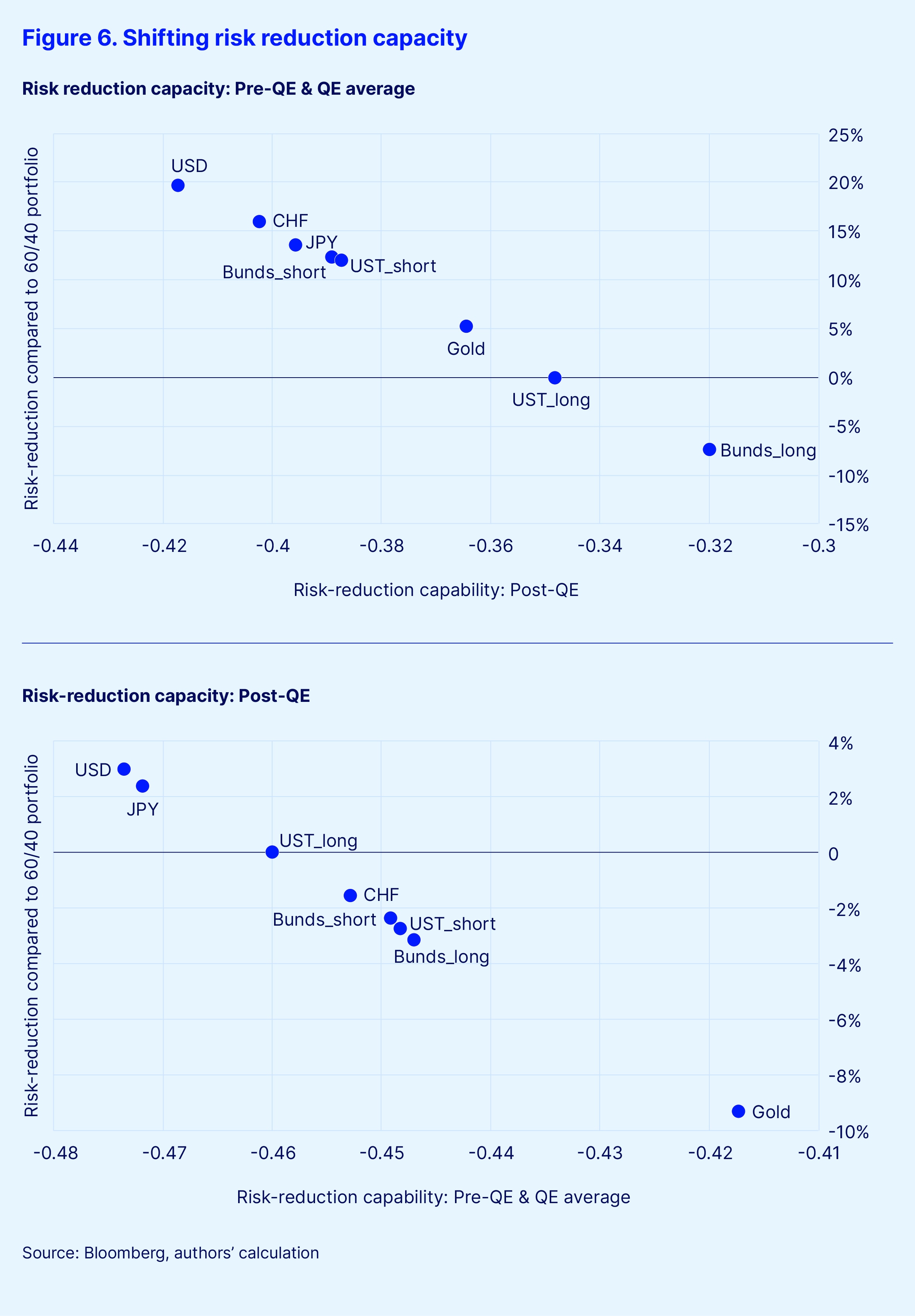

Second, we evaluated the portfolio risk-reduction capabilities of alternative safe-haven candidates using extreme shortfall (ES) measures, following the methodology of Conlan and Corbet (2024). The extent of downside risk mitigation achieved by adding a safe-haven asset to a portfolio containing the S&P 500 is assessed by comparing the portfolio's downside risk to that of holding only the S&P 500. The reduction in extreme risk is calculated using Equation (4).

The risk reduction (RR) metric indicates the proportion of downside risk mitigated by allocating a portion of capital to the safe-haven asset. Counterintuitively, a positive RR value suggests that including the asset has actually increased the portfolio's downside risk. We compared traditional 60/40 portfolios (60 percent equities, 40 percent long-term US Treasuries) with diversified 60/20/20 portfolios (60 percent equities, 20 percent long-term Treasuries and 20 percent alternative safe-haven assets).

Our analysis revealed compelling evidence, as shown in Figure 6. Before 2022, the 60/40 portfolio generally offered better risk reduction than most 60/20/20 alternatives. For example, replacing a portion of long-term US Treasuries with gold resulted in a 9 percent weaker risk reduction relative to the 60/40 benchmark. However, post-2022, the 60/20/20 portfolios that incorporated alternative safe-haven assets broadly outperformed those relying solely on long-term Treasuries.

Specifically, portfolios that included USD, CHF and JPY reduced extreme downside risk by approximately 20 percent, 16 percent, and 14 percent, respectively. While the data showed that USD improved portfolio resilience, current concerns about US policy suggest a more measured approach. In this regard, other currencies such as JPY and CHF may now be viewed as more reliable diversifiers than the dollar itself, at least in the near term.

Short-duration bonds and gold also enhanced risk-reduction capacity, reflecting investor preferences for lower duration exposure and assets less sensitive to inflation and rate hikes. This shift indicates that, in today’s environment of tighter monetary policy and increased fiscal uncertainty, investors may achieve better downside protection by diversifying away from traditional fixed-income havens into currencies and other assets that benefit from global liquidity stress and capital flight dynamics.

Macroeconomic determinants of correlation between risky assets and safe-haven assets

We explore the macroeconomic drivers behind the shifting correlations between equities and safe-haven assets using a dynamic conditional correlation (DCC) framework based on Engle (2002).

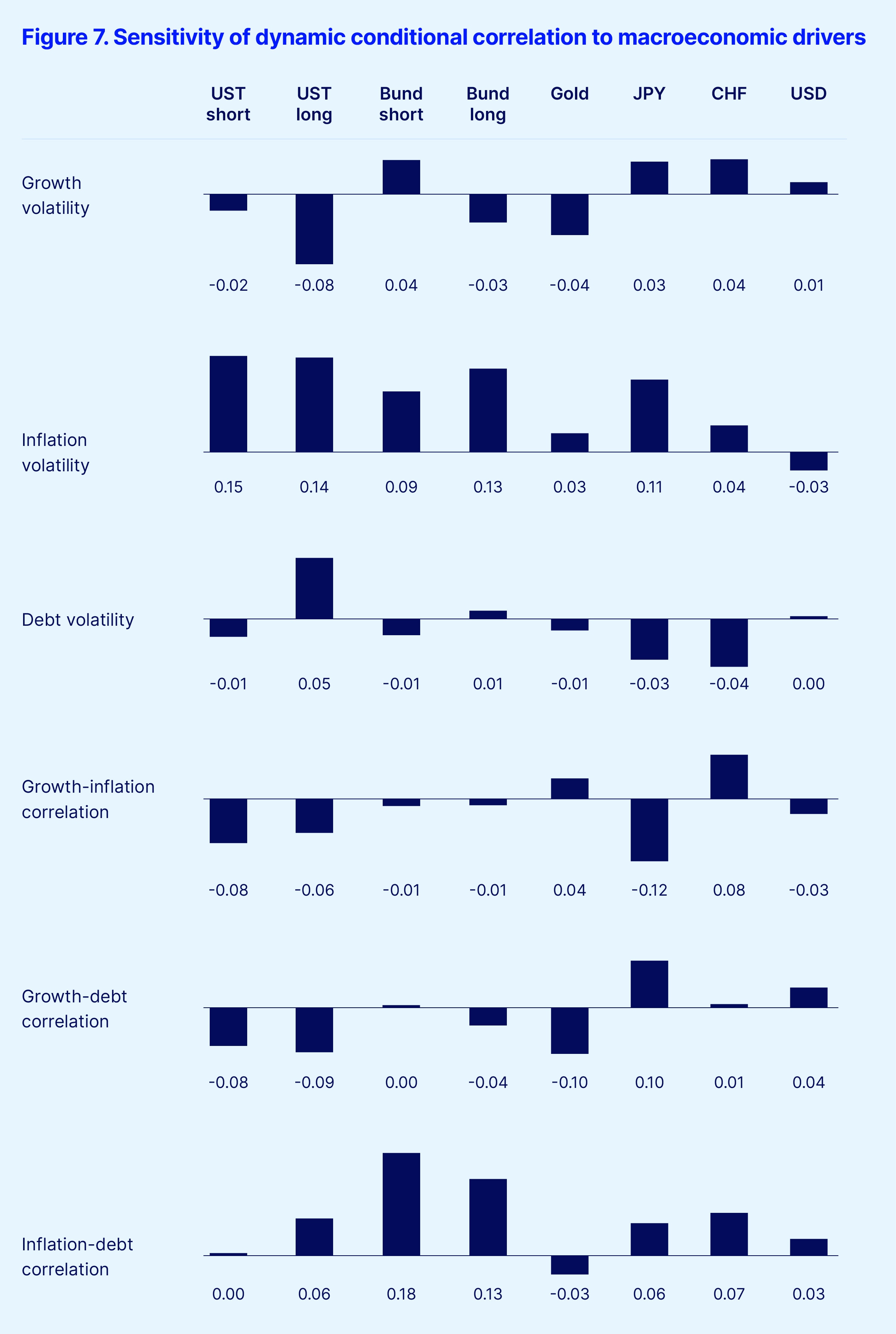

Specifically, we model DCC between S&P 500 returns and individual safe-haven asset returns as a function of covariances of growth, inflation and debt, following the approach of Brixton et al. (2023), as shown in Equation (5). We use year-over-year changes in industrial production, CPI and public debt outstanding to calculate 10-year rolling volatilities, and correlations of growth, inflation and debt using monthly data from January 2000 to April 2025.

Results from our analysis in Figure 7 reveal several critical determinants:

- First, inflation volatility emerges as a major driver of increased correlation between equities and government bonds, notably long-duration US Treasuries. Economic theory supports this finding — during periods of heightened inflation volatility, particularly when central banks are actively tightening monetary policy, both equity valuations and bond prices come under pressure due to higher discount rates. This dynamic undermines the traditional safe-haven role of Treasuries.

- Second, long-duration US Treasuries exhibit significant positive sensitivity to debt volatility. Rising uncertainty regarding fiscal sustainability appears to erode investor confidence in Treasuries’ defensive capabilities. As debt dynamics become more uncertain, Treasuries are increasingly priced based on fiscal risk rather than liquidity or flight-to-safety attributes. Recent market focus on the US deficit, tax policy and creditworthiness, coupled with concerns about policy predictability, reinforces these empirical findings. The market’s interpretation of rising yields as a risk signal, rather than a growth signal, is a direct manifestation of these concerns.

- Third, volatility in economic growth tends to reduce the correlation between long-duration Treasuries and equities. Greater uncertainty regarding growth typically reinforces Treasuries’ traditional role as a recession hedge. However, this benefit can be offset by concurrent inflationary pressures or fiscal deterioration, as seen in recent periods.

- Additionally, cross-correlations among macroeconomic variables offer further insight. A higher growth-debt correlation significantly reduces the equity-bond correlation, suggesting Treasuries retain their defensive value when economic downturns occur without concurrent fiscal stress. Conversely, a higher inflation-debt correlation increases equity-bond correlations, indicating that when inflation pressures coincide with rising fiscal risks — as observed post-2022 — Treasuries’ safe-haven properties weaken considerably.

Alternative safe-haven assets respond differently to these macroeconomic drivers:

- Gold enhances its hedging capability when growth volatility rises and when the growth-debt correlation is negative, underscoring its appeal in environments of broad macroeconomic uncertainty. It also exhibits lower sensitivity to inflation volatility than US Treasuries.

- JPY and CHF show more nuanced sensitivities, with negative sensitivity to US debt volatility and improved performance during periods of elevated growth-debt correlation.

- The USD uniquely improves its hedging quality during periods of high inflation volatility, likely reflecting investor preference for liquidity and relative yield differentials amid aggressive Fed tightening. However, the recent weakening of the dollar despite rising yields suggests that even this historical pattern may be overridden by concerns about institutional credibility.

Collectively, these findings highlight a fundamental shift in a safe-haven dynamics post-2022. The diminished reliability of long-duration Treasuries necessitates a recalibration toward alternative safe-haven assets, such as safe-haven currencies and gold. Investors should recognize that traditional assumptions — particularly regarding long-duration Treasuries — may no longer hold under conditions of elevated fiscal uncertainty and inflation volatility. A regime-dependent relationship between macroeconomic conditions and asset correlations calls for dynamic, responsive portfolio strategies.

Economic and investment implications

The erosion of US Treasuries’ safe-haven status carries significant economic and investment consequences. Historically, long-duration US Treasuries provided reliable hedges during equity market stress. However, our analysis shows that their hedging effectiveness has declined sharply in the post-QE era. Elevated inflation volatility, exacerbated by persistent supply-side bottlenecks and aggressive monetary tightening, has weakened Treasuries’ traditional inverse relationship with equities, causing both asset classes to fall in tandem during downturns.

Simultaneously, the heightened fiscal uncertainty, reflected in rising debt volatility and negative growth-debt correlations, has prompted investors to reprice Treasuries more as credit-sensitive instruments than as pure liquidity havens. As a result, investors can no longer assume that allocating to long-dated Treasuries alone will provide sufficient downside protection.

This decline in confidence has triggered a notable pivot toward alternative safe-haven assets, reshaping the global investment landscape:

- Gold has reemerged as a prominent refuge, with prices rising more than 9 percent in early April 2025 amid Treasury market instability and a weakening dollar.

- Safe-haven currencies such as JPY and CHF have reaffirmed their defensive roles, supported by global risk aversion and the credibility of their central banks.

Given this challenged safe-haven status, investors must broaden their defensive toolkit. No single asset consistently delivers optimal protection across all macroeconomic regimes. Our downturn-beta and risk-reduction analyses, along with recent market behavior, indicate that safe-haven currencies (JPY and CHF) have outperformed long-duration Treasuries and German Bunds as safe-havens since 2022. Gold, while occasionally moving in tandem with equities, continues to preserve capital during inflationary or geopolitical shocks. Short-duration government bonds also regained appeal by minimizing duration drag in rising yield environments.

A more prudent approach is to construct a diversified safe-haven sleeve — one that blends safe-haven currencies, gold and shorter-dated sovereign instruments, thereby reducing reliance on a single source of crisis protection.

These shifting dynamics also demand dynamic asset allocation. The standard 60:40 portfolio framework is increasingly insufficient. Instead, investors should adopt a regime-aware process that continuously monitors macroeconomic signals, such as inflation volatility, fiscal-sustainability indicators and central bank policy — and adjusts defensive tilts accordingly. For example, when inflation volatility is rising, a tactical overweight to gold may offer more reliable downside protection than Treasuries. Conversely, if fiscal concerns temporarily ease, a reallocation back into long-duration Treasuries may still be warranted.

This active calibration ensures portfolios remain aligned with evolving correlation patterns and risk premia, rather than static historical relationships. Higher frequency macroeconomic indicators and central bank sentiment measures can be particularly useful in this regard.

That said, these findings come with caveats. The post-QE period is relatively short compared to multiple decades of Treasury dominance, and some dynamics may revert under different macro shocks. Moreover, the unparalleled liquidity and depth of the US Treasury market still make it indispensable for large institutional investors, central banks and collateral-constrained entities. Even if Treasuries no longer offer the same convenience yield, their market infrastructure and role in central bank operations remain critical.

Accordingly, while broadening the safe-haven toolkit is essential, Treasuries should still be viewed as a core component of a multi-faceted defensive strategy that balances liquidity needs with evolving macroeconomic realities.

Conclusion

Over recent years — and particularly in the aftermath of the “Liberation Day” tariff announcements — the perceived role of US Treasuries as the world’s ultimate safe-haven asset has been steadily eroding, with far-reaching macroeconomic consequences. Once considered the de facto risk-free asset, Treasuries have come under pressure from a combination of geopolitical tensions, fiscal imbalances, and structural market vulnerabilities. The introduction of aggressive tariffs and the resulting policy ambiguity have prompted investors to reassess the reliability of US institutions and the long-term sustainability of its economic model. Our analysis demonstrates that US Treasuries’ traditional role as the premier safe-haven has indeed been undermined by a macroeconomic regime marked by heightened inflation volatility and growing fiscal uncertainty. Across multiple convenience yield metrics, we find a clear secular decline, particularly pronounced post-2022, driven by rising debt burdens, weakening foreign demand and inflation-induced policy tightening.

As a result, long-duration Treasuries no longer provide the same negative equity betas or reliable portfolio risk reduction that characterized earlier eras. Indeed, recent market dynamics have seen rising US Treasury yields interpreted not as a sign of economic strength that would traditionally attract capital, but rather as an indicator of elevated risk. This shift has contributed to a notable breakdown in the historically positive correlation between US Treasury yields and the US dollar, with the dollar weakening even as yields have risen since early April 2025. Such a patten challenges the dollar’s traditional stabilizing role in portfolios.

In this evolving landscape, alternative assets — including currencies such as JPY and CHF, along with gold and shorter-dated sovereign bonds — have exhibited more resilient safe-haven characteristics during recent market downturns. A view supported by current market analysis suggests positioning for dollar weakness against these alternatives and maintaining an allocation to gold. While our broader post-QE empirical analysis showed the US dollar itself performing well, the latest market developments, driven by US-specific policy and fiscal concerns, dampen expectations for its continued uncomplicated role as a haven.

Our analysis of macroeconomic determinants of asset correlations further underscores the need for a regime-aware allocation approach, as no single alternative will perform optimally across all macro regimes. The recent questioning of US institutional integrity and fiscal sustainability adds a critical, qualitative overlay to these quantitative drivers, reinforcing the need for vigilance. Thus, while Treasuries remain unmatched in liquidity and market depth, investors today should consider adopting a more diversified defensive toolkit. This involves actively adjusting exposures not only in response to evolving macroeconomic signals but also to shifts in perceptions of policy stability and institutional strength. Although the post-QE environment is still unfolding, these structural shifts suggest that reliance on a static 60/40 portfolio centered on long-duration Treasuries is increasingly insufficient for robust downside protection.

Acknowledgements

The authors thank Eric Garulay, Sandra Connolly, and Amar Jyoti for their invaluable contributions to the development of this paper. Their thoughtful critiques, constructive feedback, and engaging discussions on earlier drafts significantly enriched the clarity, depth, and rigor of our work.