Insights

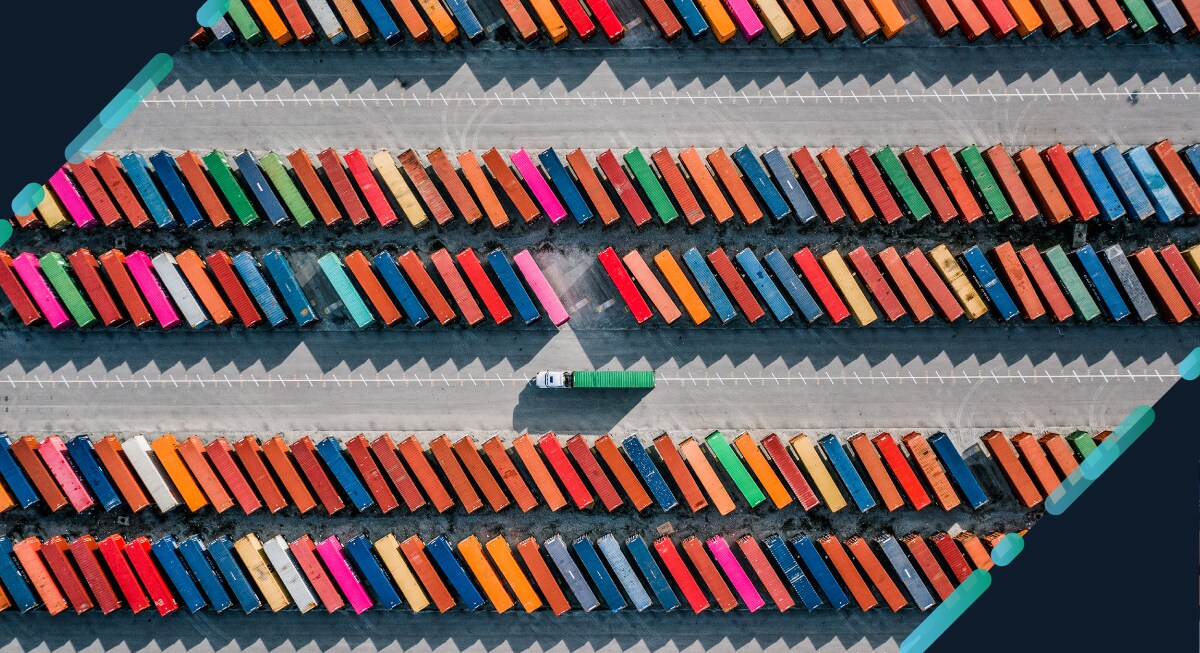

Going Modular: Why Outsourced Trading Is No Longer an All-or-Nothing Option

Outsourcing trading execution used to be a binary decision.

July 2023

Fund managers were either focused entirely on portfolio construction and strategy – and outsourced trading to a third party – or they built an in-house trading desk to manage their liquidity requirements and potentially create an extra avenue for alpha. Fund managers and asset owners have become more receptive to a modular approach of outsourced execution solutions, as it enables them to selectively choose the building blocks they desire to create their execution model. Outsourced providers with extensive capabilities are well placed to help them gain access to new markets, new asset classes and/or customers.

Evolving industry needs and regulations

Outsourced trading is no longer seen as an alternative, but more as a partner solution that offers a broad range of products and services for fund managers and asset owners to choose from. The everchanging regulatory landscape, rising costs and unprecedented market volatility are primary drivers for organizations to rethink their outsourced trading strategy.

A recent Bloomberg survey showed that traders are more willing to outsource specific markets, asset classes and account types — rather than the whole trading desk.1 Quantitative asset managers and hedge funds are more open to this than traditional fundamental funds.

Investors are embracing outsourcing for a variety of reasons, some of which include:

- Funds that are newly launching, and may not have the scale to justify building an internal trading desk

- Managers who are expanding into new markets or asset classes and lack the necessary trading expertise or infrastructure

- Smaller-sized firms facing one-off events such as managing an unusually large cash flow

- Managers who want to take advantage of a short-term opportunity in a new market, where setting up internally would take too long

With regulatory environments across the globe constantly evolving, the requirement for investment in both people and technology is significant. The risk of breaching regulations can be catastrophic for a business, hence organizations tend to partner with experienced outsourced providers. An accomplished partner is able to provide quick access to global teams, equipped with local regulatory and compliance expertise.

Cost efficiency and performance optimization

For many managers, the expense of building a trading desk to access global markets from a single hub – or moving into other asset classes – is not a cost-effective option. Some of the bigger outsourced trading desks offer multi-asset class trading capabilities, which provides fund managers flexible access to trading expertise across multiple asset classes, or within a specific asset class, without the costs and risk of building their own desk.

Outsourcing also provides the economy of a variable — rather than fixed — cost structure, which can be scaled up or down depending on the level of utilization. A trading solution is available whenever managers need it, but unlike building an internal capability, there is no cost involved when not in use.

Meanwhile, organizations are rethinking their business models and operational priorities. Managers are seeking efficiencies to keep up with technological advances to deliver transparency and expand their product offerings. Therefore, transaction cost analysis (TCA) has become an integral part of the investment process for asset managers and owners. This transparency around execution outcomes should be expected from a well-resourced outsourced trading partner.

Identifying and improving poor execution outcomes is a key component of keeping execution costs in check and understanding the impact of trading on portfolio value. Some outsourced trading businesses have recognized the importance of analytics and have invested heavily in market-leading analytics products to measure and identify trading costs.

Lessons from the pandemic

Through the pandemic, some firms found that traders did not need to work in the same location as their team members. In some cases, firms saw benefits from outsourcing part of their trading to other locations or time zones, opting to shift away from operating out of a single location.

Another realization was the flexibility in almost everyone’s business continuity plans (BCPs). BCPs were based on the premise of providing a separate workspace in the instance where the primary location is not functional or available; however, now we face the reality that personnel can and may need to operate from various locations.

Change in business models

Fund managers and asset owners are constantly investing in technology to stay relevant with evolving market structures and changes across the various global regulatory requirements. Larger outsourced trading firms are able to invest significantly in technology to stay ahead of the curve, due primarily to their global footprint and scale.

Choosing the right partner for any outsourcing requirement is central to the success of your model. Distinguishing between different outsourced execution providers in terms of access to liquidity venues, asset classes and markets will help with this decision. Some will be more experienced in managing cross-asset class trading, derivatives, overlays and foreign exchange, while others may only offer a more limited service. Having an experienced partner who is able to offer both modular and end-to-end outsourced trading services is important to support your entire trade lifecycle and foster a successful partnership from day one.

With over a decade of experience in outsourced trading, we can provide you with a solution that allows your team to focus on adding value through portfolio management while leveraging our scale, insights, liquidity and technology today, and in the future as your business grows.

Click here to learn more about our outsourced trading capabilities.