Solutions

Private Capital Indices

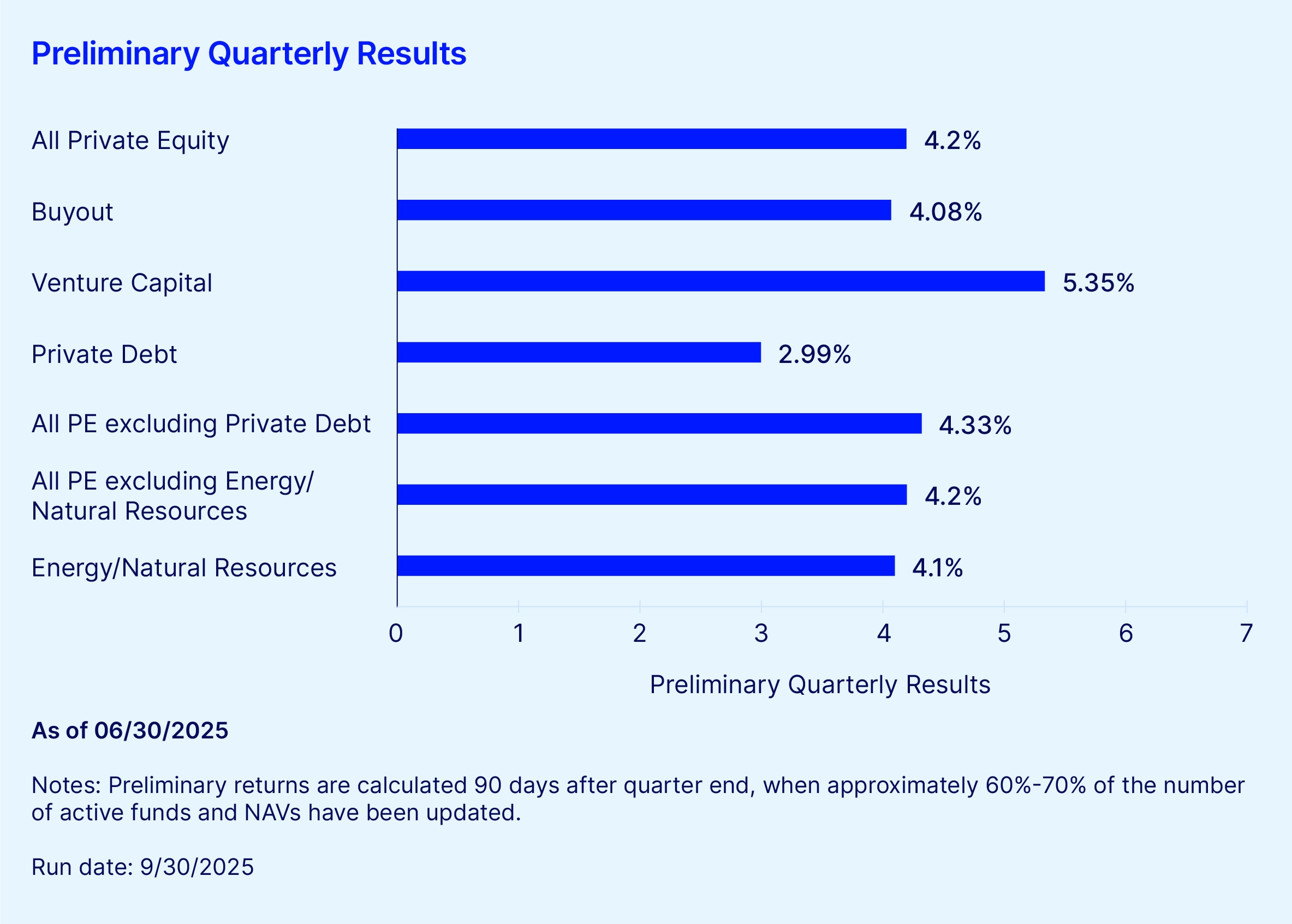

Navigating private markets requires trusted, data-driven insight powered by institutional investor analytics. Yet, the private nature of the industry makes benchmarking and uncovering opportunities difficult for investors. That’s why we created our Private Capital Indices: a powerful solution designed to cut through opacity and deliver comprehensive, high-quality analytics for private equity and private debt benchmarking.

Explore our capabilities

Our Private Capital Indices provide timely data access, deep market coverage and customizable analytics, giving you a powerful edge in private equity and private debt investing. Key features include:

- Actual daily cash flow data from more than 4,200 high-quality partnerships representing ~US$6.0 trillion in commitments1

- Timely data availability, typically within 100 days post-quarter (90 days for preliminary results), ahead of many index vendors

- Unbiased methodology built on actual LP performance data, not self-reporting or public data

- Customizable benchmarks tailored according to strategy, fund size, geography, vintage year and sector

- Granular analysis tools for filtering data across time horizons and fund characteristics

- Interactive portal and API access for near real-time benchmarking and portfolio insights

Request a demo

Discover how our Private Capital Indices help transform opaque private markets into actionable insights, so you can make better-informed investment decisions.

The State Street difference

US$6.0T

In capital commitments

4,200+

Carefully selected, high-quality primary private equity and debt partnerships

1980

The first vintage year of our comprehensive fund universe