Insights

The digital push: AI, blockchain and beyond

Emerging technologies like blockchain, tokenization and generative artificial intelligence (GenAI) are beginning to coalesce into investment institutions’ digital transformation strategies.

October 2025

The operational impact of distributed ledger technology (DLT) and AI is now evident not only in investment operations but also across a range of financial service firms and corporate functions. Additionally, firms acknowledge quantum computing’s potential, paying serious heed to its implications for their organizations.

All these trends come through strongly in the third annual State Street Digital Assets and Emerging Technology Study. This research is based on a global survey of more than 300 investment institutions, including traditional and alternative asset managers, nonprofit asset owners and insurance companies.

The digital transformation strategy

The first thing to note is the strong pan-industry consensus on digital transformation strategies (DTS). This is defined for our respondents as, “Greater use of existing and advanced/emerging technologies to automate manual processes and remove manual/physical touchpoints and frictions from automated ones, in order to improve process efficiency and interoperability across core operations.”

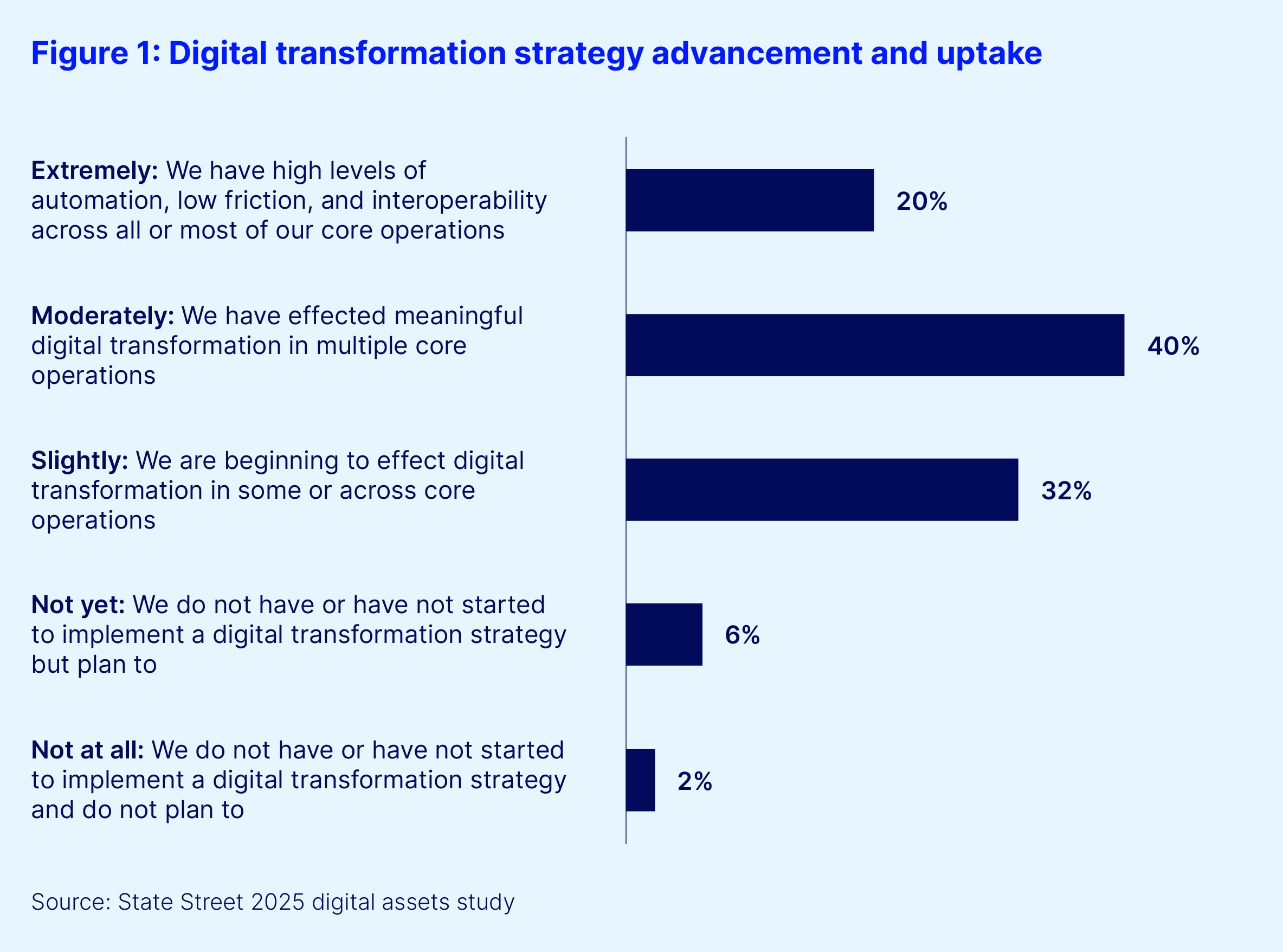

Across all regions and organization types, only 2 percent of respondents to our survey said they had no plans to enact such a strategy, and only about one-third (32 percent) were in the beginning stages of doing so. Meanwhile, 40 percent said they were “moderately advanced” in their DTS, while a fifth (20 percent) were “extremely advanced,” with “high levels of automation, low friction and interoperability across all or most of our core operations.”

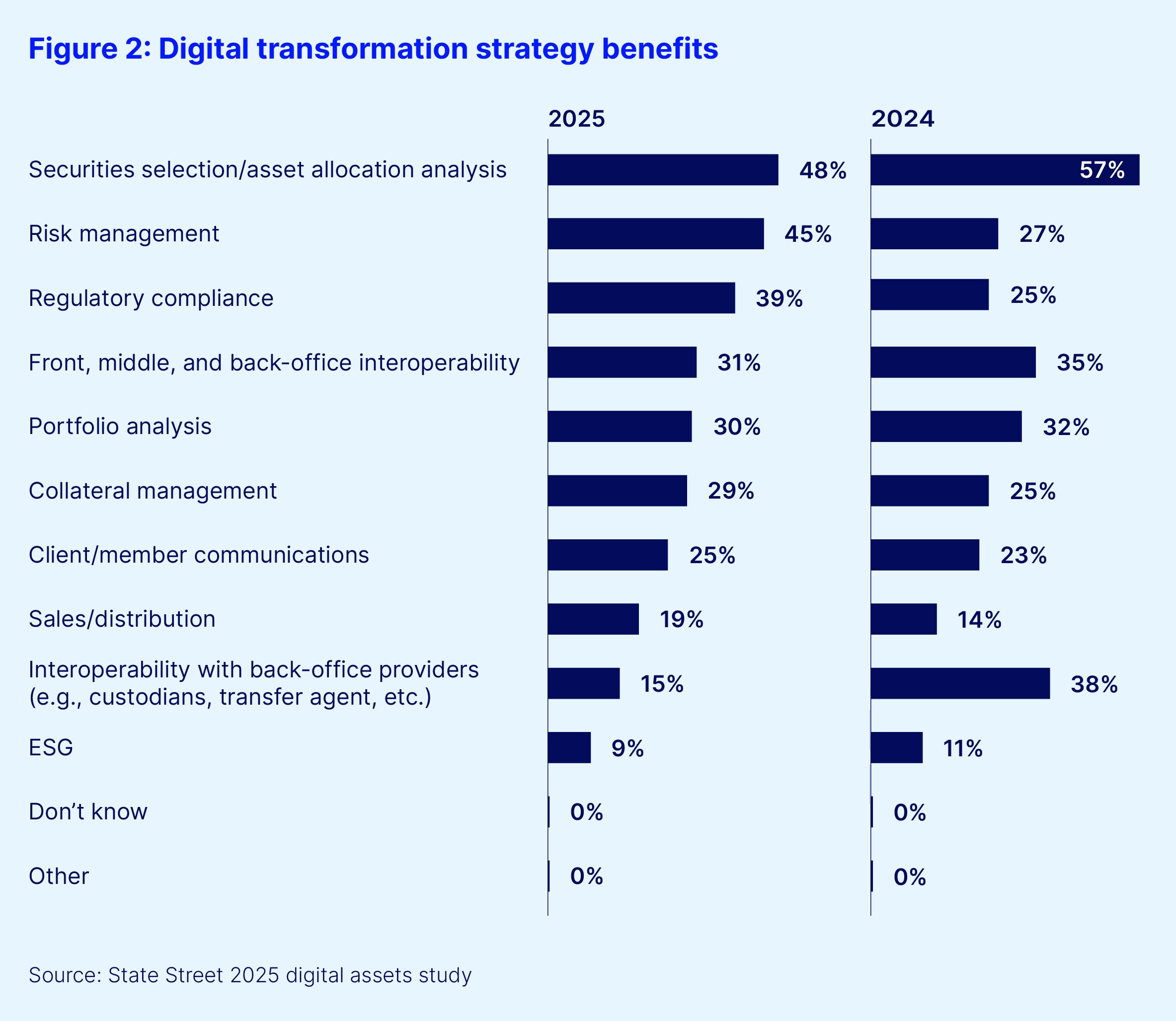

Respondents anticipate a wide range of benefits to accrue from their investment in DTS, across a range of front-to-back office operational areas. These include benefits in securities analysis and asset allocation (48 percent), risk management (45 percent) and regulatory compliance (39 percent).

The role of DLT and GenAI in DTS

Emerging technologies are core to DTS, both in standalone use cases and in conjunction with one another.

For example, blockchain was integral to these strategies for 29 percent of respondents, a significant part for nearly a quarter (24 percent) of those surveyed and a separate part of their tech approaches for 27 percent. This use of blockchain extends to wider corporate operations. Majorities of respondents (61 percent and 60 percent, respectively) were using or exploring the use of blockchain for non-investment operations related to cash flow and cash holdings and for non-investment operations related business data management. Nearly one-third (31 percent) were using or looking at using it for other business functions such as legal contracts and regulatory compliance.

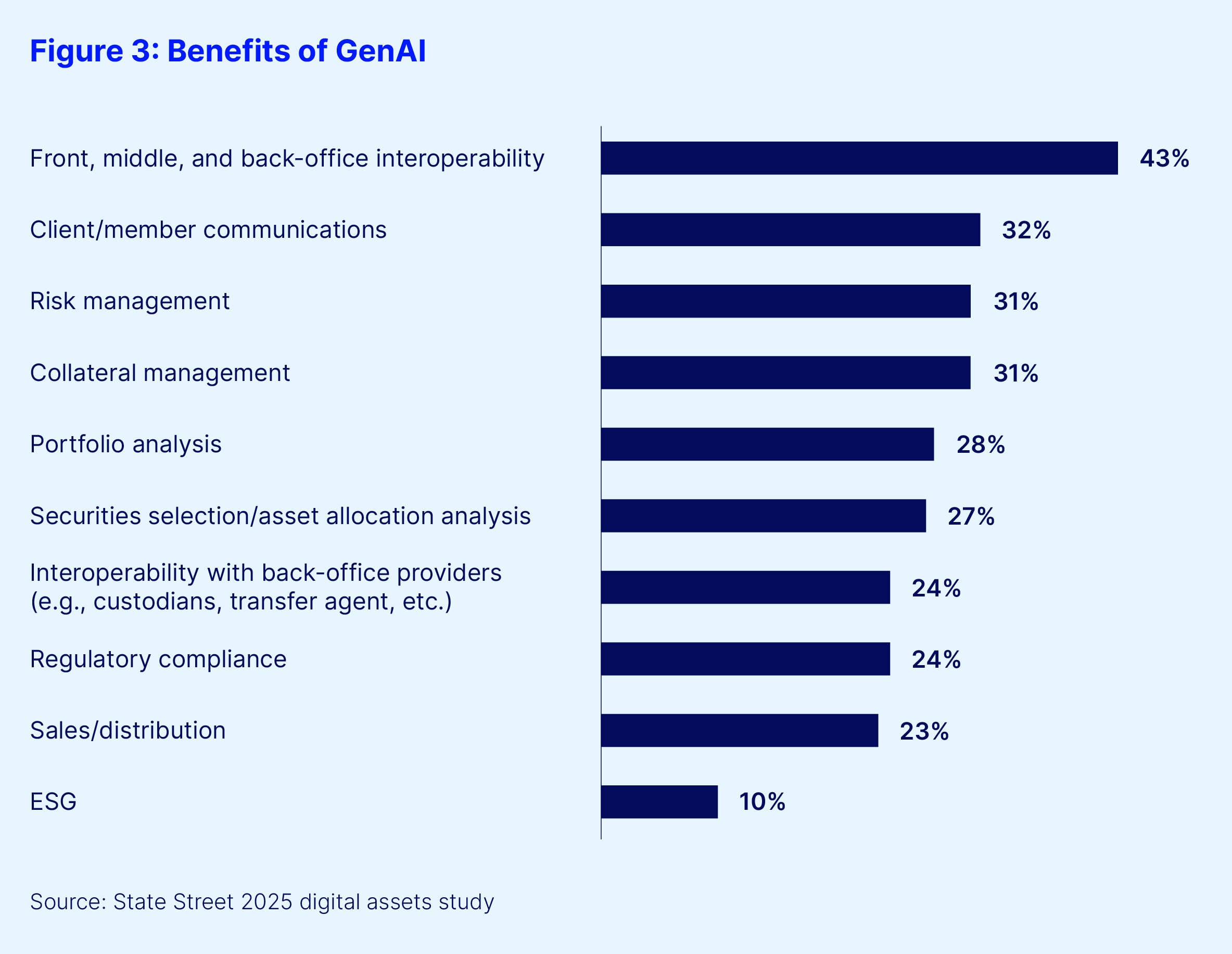

GenAI is also featured in several investment use cases. Substantial majorities of respondents reported beneficial impacts in front-to-back-office interoperability (43 percent), client or member communications (32 percent) and risk management (31 percent).

These results align with findings from our fourth annual Private Markets Study, which saw investment institutions making use of GenAI across a large and disparate range of private markets data management operations.

Institutions view DLT and GenAI as complementary pillars of a broader DTS. For example, 45 percent agreed that recent and sudden advances in GenAI will enhance and accelerate digital development as GenAI tools can create blockchains, smart contracts and tokens and provide other digital and tokenization services more efficiently, securely and at a lower cost. In contrast, just 32 percent disagreed with this view.

Looking further into the future, 39 percent agreed with a similar statement regarding the complementary nature of DLT and quantum computing, although 42 percent disagreed.

The regional view

North American respondents were most likely to be extremely advanced in their DTS (29 percent), compared to 22 percent in Europe and 13 percent in Asia Pacific. Notably, North America was the only region where all respondents plan to implement a strategy (just 3 percent in Europe and 1 percent in APAC said this). They were also significantly more likely than their peers in other regions to view DLT/blockchain as integral to their strategies (39 percent, compared to 29 percent in Europe and 25 percent in APAC). Conversely, North American organizations are also somewhat more likely to view the two as completely separate (33 percent, compared to 27 percent and 29 percent in APAC and Europe).

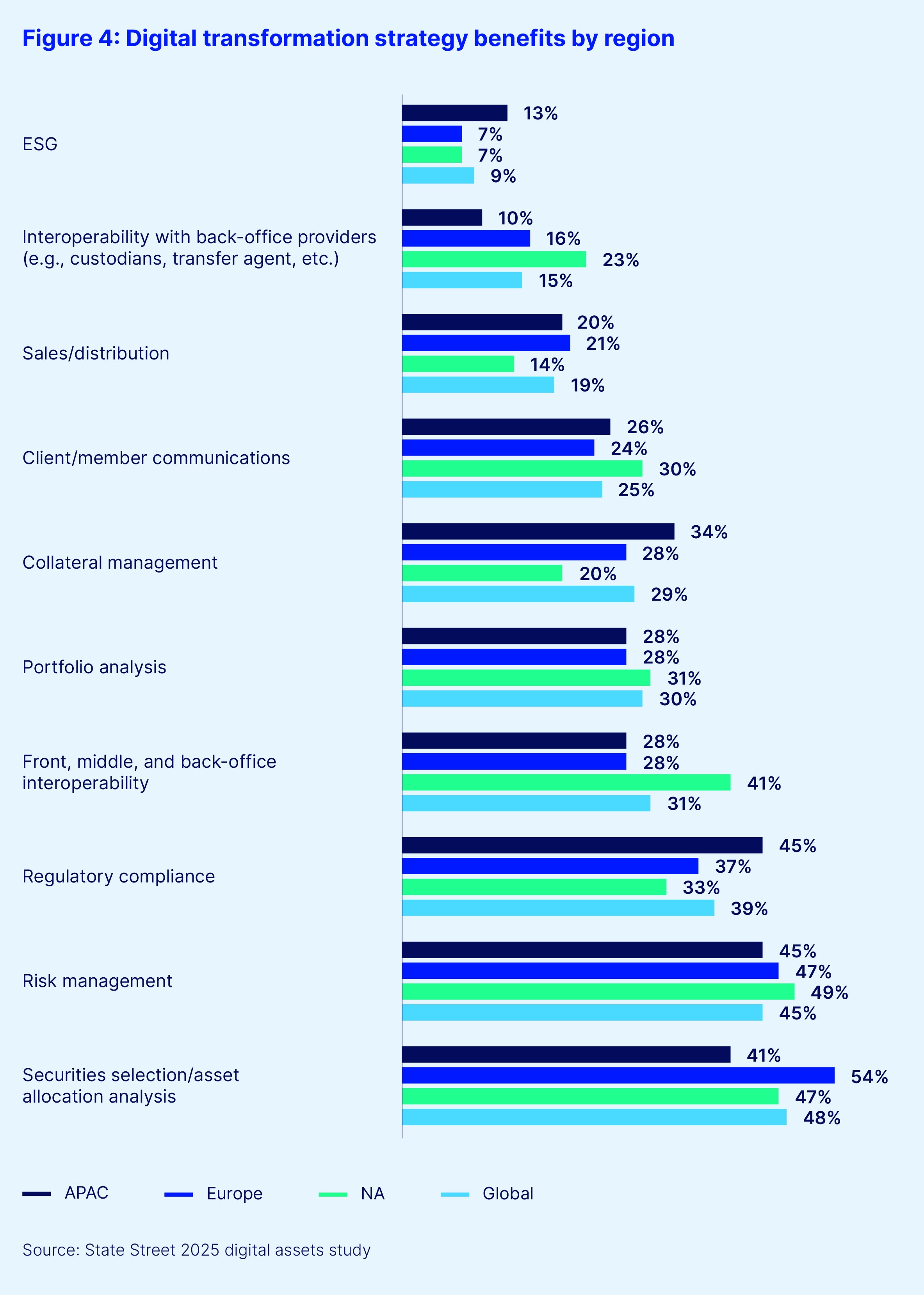

When it comes to operational areas set to benefit from DTS, there is broad regional alignment with some variations (see Figure 4). For example, European respondents are more focused than their peers on securities and asset allocation analysis, while regulatory compliance and sustainability are more important issues in APAC than other regions. North Americans are more focused on interoperability, both internal and with third parties.

Asian and European respondents were also more bullish about the potential for their AI strategies to benefit their blockchain initiatives. Nearly half (45 percent and 44 percent, respectively) agreed with the proposition, compared to 39 percent in North America.

An abridged version of this article, featuring data specifically focused on DTS in the global insurance industry, can be found in the current edition of Capital Pioneer Magazine.