Insights

Full-scale currency hedging

Diversification is nuanced and summary statistics, such as correlation, fail to capture complexities that lie below the surface. For investors, these complexities matter — accounting for them can make the difference between an effective or ineffective hedging strategy.

January 2024

In the case of currencies, investors often determine risk-minimizing hedge ratios based on the portfolio’s betas to those currencies or with mean-variance optimization. In both cases, the optimal solution depends crucially on the correlation between the currencies and assets in the portfolio. But correlation is an unreliable estimate of the diversification investors actually care about: the co-occurrences of the cumulative returns of the portfolio and currencies over the investment horizon.

We propose a new currency hedging technique called full-scale hedging, which addresses these challenges by considering the full distribution of co-occurrences between currencies and the portfolio.

Key highlights

As the adage goes, “A picture is worth a thousand words,” and the same is true for diversification. That’s why summary statistics, such as correlation, fail to capture complexities that lie below the surface.

First, there’s the challenge of divergence. This relates to the common practice of estimating correlations from monthly returns and assuming they hold for returns over longer horizons. However, this is true only if returns are independent from one period to the next. Empirically, this assumption is often misleading, sometimes dramatically so. Alternatively, we could estimate correlations from longer return intervals that match the hedging horizon. However, this fails to address another important challenge.

The efficacy of a hedging policy depends on the cumulative co-movements, or co-occurrences, of the currencies and portfolio over an investor’s specific investment period. But co-occurrences vary over time. While correlation captures the average co-occurrence between a pair of assets, it ignores other important features, such as the dispersion of co-occurrences throughout the sample.

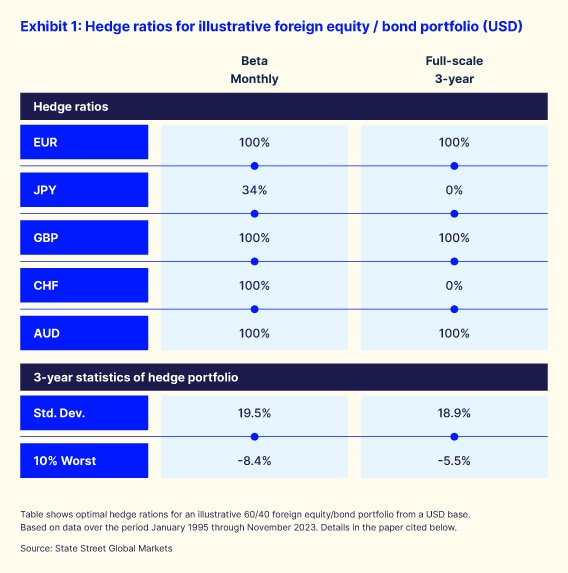

To address these challenges, we propose an alternative technique, called full-scale optimization, to determine currency hedge ratios. Rather than relying on full sample correlation estimates, this process considers the full distribution of co-occurrences between currencies and the portfolio. As shown in Exhibit 1, compared to the conventional beta-based approach, full-scale currency hedging can produce different hedge ratios with greater risk reduction.