State Street in Saudi Arabia

State Street in Saudi Arabia (Arabic)

Get the guidance you need to achieve your business objectives — in any market environment.

Introduction

A strategically important country for State Street, our office in Saudi Arabia is helping us to fulfil our ambitious growth plans for the region. As strong supporters of His Royal Highness Prince Mohammed bin Salman’s Vision 2030 strategy, with one of its pillars being that the Kingdom becomes a global investment powerhouse, we aim to help organizations navigate an increasingly complex global financial arena.

About Us

State Street Saudi Arabia Financial Solutions Company (”SSSAFS” and the “Company”) is a single shareholder closed joint stock company established under the Regulations for Companies in the Kingdom of Saudi Arabia.

The Company operates under Commercial Registration number 1010637423 issued in Riyadh on Shwal 16, 1441H (corresponding to June 6, 2020), Ministry of Investment of Saudi Arabia (“MISA”) license number 10211410592878 dated Jumad Al-Alwal 10, 1442H (corresponding to December 25, 2020) and the Capital Market Authority (“CMA”) license no. 19208-35 dated Dhul-Qadah 16, 1441H corresponding to July 7, 2020.

The Company is a direct and wholly owned subsidiary of State Street Corporation, and currently has paid up share capital of SAR 108,750,000.

SSSAFS does not have any subsidiaries and does not own or control any other company. SSSAFS is located on the 9th floor of the Al Tadawul Tower, KAFD in Riyadh.

Our clients include financial institutions, official institutions, large corporates and sophisticated family offices.

Our current activities

SSSAFS is licensed to conduct the following activity:

- Advisory

- Custody

- Dealing

- Managing investment

Global reach, local conversations

Our clients are all over the world, which means we need to be too. With us as a partner, you can benefit from the local knowledge of our teams on-the-ground, as well as the reach and scale of a global business.

Explore markets and exchanges where we work

Solutions

We understand the value of collaborative, long-term relationships with our clients, and will work closely with you to develop customized, effective solutions that meet your investment and business objectives.

Investment Servicing

To help you keep up with sweeping changes across the financial industry — globally and in Saudi Arabia — we can offer you an array of flexible and customizable investment servicing solutions, including:

- Global custody

- Depositary services

- Multi-currency valuation

- Financial statement preparation

- Fund accounting and administration

- Global transfer agency/share registration

- Regulatory compliance monitoring

- Establishment and support services from our legal, tax and corporate secretariat groups

- Offshoring fund services

We deliver these services to a wide range of investment funds, including:

- Money market funds

- Tax transparent funds

- Exchange traded funds

- Emerging market funds

- Derivatives funds

- Property funds

- Liability-driven investment funds

- Loan funds

- Specialist commodity funds

- Liquid alternative funds

Our breadth of servicing capability, combined with our expertise and local knowledge, bring transparency to the investment process. Working with us, asset owners and managers are in a strong position to measure, evaluate and objectively interpret their investment performance.

Alternative Investment Servicing

Hedge Funds

From full integration with your front office, through middle-office operations, collateral management, portfolio accounting, tax, investor servicing and all the way through to back-office accounting and administration, our services span the investment spectrum.

Private Equity

Across every stage of the fund lifecycle, we provide extensive expertise in private equity accounting, reporting, investor services and portfolio investment analysis.

Real Estate Fund Administration

We provide complete back-office services to support operations of fund structures across a range of jurisdictions. In addition, we’re a leading provider of corporate administration services for debt capital markets and structured finance vehicles, repackaging programs, specialist fiduciary products and bespoke corporate structures for large banks and institutional clients.

Investment Management

Through our investment management business, State Street Global Advisors (SSGA), we can deliver a wide range of disciplined investment strategies to help achieve your investment goals.

SSGA's range of investment solutions include passive and active global equities and fixed income strategies, cash management and alternative investments such as absolute return, currency overlay, infrastructure and real estate. SSGA builds multi-strategy investment solutions to client-specific risk/return needs. These include strategic and tactical asset allocation plans, liability driven investing and risk-based and target date-based solutions. Our dedicated team of professionals will work with you to understand your specific investment preferences, and give insight and perspective into local business practices — helping you make your investment decisions with confidence.

State Street AlphaSM

State Street AlphaSM is the first front-to-back asset servicing platform from a single provider for institutional and wealth management firms. Alpha brings together our clients’ choice of real-time data and asset intelligence across the investment life cycle to help them make better decisions and deliver growth for their clients. Together with State Street’s middle- and back-office capabilities, Charles River IMS forms the foundation of State Street AlphaSM.

With built-in flexibility and scalability, Alpha lets clients manage assets in any market and streamline their day-to-day processes — helping to facilitate innovation, better inform investment decisions, optimize returns and streamline business operations.

Investment Research and Trading

State Street Global Markets, our investment research and trading arm, helps enhance and preserve our clients’ portfolio values through original flow-based research, proprietary portfolio and risk management technologies, trading efficiencies and global connectivity. We develop strategies to make that happen. We back our trading and securities lending with our own technology to manage risk, and with flow research that shows how investors are behaving.

State Street Senior Executives in Saudi Arabia

Majed M. Al Hassoun

Chief Executive Officer – Country Head Saudi Arabia & Bahrain

Majed Al Hassoun is a seasoned financial services professional with over two decades of experience in investment banking and capital markets. In December 2024, he was appointed as the Country Head for Saudi Arabia and Bahrain at State Street Corporation, where he is responsible for driving and executing the firm’s Investment Services and Global Advisors strategy in these markets.

Prior to joining State Street, Al Hassoun served as the Head of Investment Banking and Chief Executive Officer at Citigroup Saudi Arabia, a position he held since 2017. During his tenure at Citigroup, he led numerous transactions across various industries for both public and private sector clients, significantly enhancing the firm’s presence in Saudi Arabia.

Before his role at Citigroup, Al Hassoun was a Director in the Investment Banking department of Saudi Fransi Capital, the investment arm of Banque Saudi Fransi.

His extensive experience encompasses mergers and acquisitions, as well as capital markets, having advised clients across different sectors and products. Al Hassoun holds Bachelor of Science degree, with distinction, in Electrical and Electronics Engineering, and MBA from London Business School.

Rasha M. Al Khaldi

Chief Financial Officer – Middle East and North Africa

With over 20 years of experience in the banking and financial services industry, Rasha is a seasoned financial leader known for operational excellence and a strong track record of driving results. Most recently, she served as Chief Financial Officer at The Northern Trust Company of Saudi Arabia, where she led financial strategy, regulatory compliance, and business growth initiatives across the Middle East region. Currently, she serves as MENA Chief Financial Officer at State Street Saudi Arabia.

Rasha holds an MBA from Murray State University in the USA and has consistently demonstrated a commitment to professional excellence and innovation throughout her career. Known for her integrity and leadership, Rasha continues to contribute meaningfully to the advancement of the financial sector.

Georges Hanna

Head of Asset Management Saudi Arabia

George Hanna is a Managing Director at State Street Global Advisors and head of the business in Saudi Arabia business he oversees all the firm’s activities across investments and distribution in the kingdom.

George has a track record of applying a dynamic blend of fundamental and systematic approaches in managing MENA Long-Only and Long/Short equity strategies.

Prior to joining State Street, George has served as Chief Investment Officer and portfolio manager at Al Ramz Corporation and at Abu Dhabi Investment Management. Before that he served as Head of Asset Management at Blominvest Saudi Arabia.

George holds a master's degree from HEC Paris and a Bachelor of Science in Finance from the American University of Technology in Lebanon. He is a CFA charter holder and a Certified Market Technician. He served as a Board Member of the CFA Society of Saudi Arabia and was a member of the Investment Managers Committee of Saudi Arabia.

Mohammed Halal

Chief of Compliance Officer Saudi Arabia

Mohammed Halal is the Chief Compliance Officer of State Street Saudi Arabia, bringing over 13 years of experience in governance, compliance, and anti-money laundering across financial services, sovereign wealth funds, and investment sectors. Mohammed Halal is committed to fostering a strong culture of compliance at State Street Saudi Arabia to support the firm’s growth and trusted presence in the Kingdom.

Before joining State Street, Mohammed Halal served at the Public Investment Fund (PIF), where Mohammed Halal led governance and portfolio oversight for more than 90 companies and projects across sectors including real estate, hospitality, space, and financial institutions. [Name] began a career at NCB Capital, holding senior compliance and anti-money laundering roles.

Mohammed Halal holds a Bachelor’s Degree in Marketing and has completed executive leadership programs with a focus on governance, strategy, and organizational leadership.

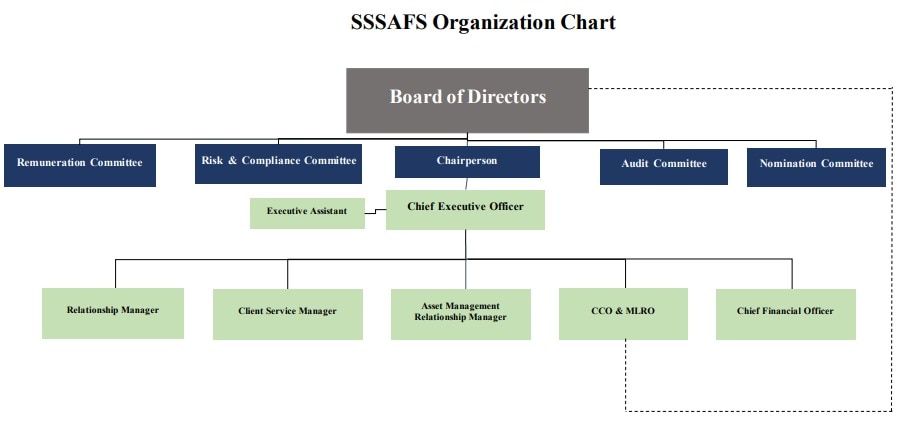

Board of Directors for State Street Saudi Arabia Financial

Dr.Khalid Al-Yahya

Chairperson – Independent

Dr. Al-Yahya has over 25 years of regional and global experience in government, business and international organizations, including serving as the Secretary General of the Federation of Saudi Chambers, Deputy Secretary General for Economic Policies at the Saudi G20, managing transformative projects in collaboration with governments in Saudi Arabia and UAE, United Nations, World Bank, and other global firms.

In addition to various directorships and fellowship at Harvard University Kennedy School, Dr. Alyahya held many senior leadership positions in global companies throughout his career including Public Sector lead in MENA at Accenture Strategy and partner at KPMG. He earned his Ph.D. MBA and MPA from the U.S.

Haifa Al Khaifi

ViceChairman - Independent

With a proven track record of international strategic leadership in corporates, governments and on boards, Haifa serves as the chair of the board. In addition to this role, she is the interim CEO of the newly formed Energy Development Oman SAOC, Oman’s flagship company for energy transition, and serves as the CFO of Oman’s leading oil and gas company, Petroleum Development Oman. Haifa is recognized as one of the region’s most prominent business leaders, and is regularly named as one of the most influential women in the Middle East by Forbes. She is a Fellow of the Chartered Institute of Management Accountants and the Chartered Global Management Accountants, and has also been certified by several institutions, including Harvard Business School, University of Cambridge, INSEAD and the World Bank.

Majeed Al-Abduljabbar

Board Member - Independent

With over 23 years of experience, Mr. Al-Abduljabbar held various positions in some of the major banks in Saudi Arabia, including Saudi Awwal Bank, Samba Financial Group and Arab National Bank. He is currently the Deputy Chief Executive Officer of the Saudi Real Estate Refinance Company, part of the Public Investment Fund of Saudi Arabia. Prior to his current position, as General Director, Mr Al-Abduljabbar helped establish the risk management function at the Capital Market Authority.

Besides a Bachelor of Science in Finance and Marketing from California State University East Bay, Mr. Al-Abduljabbar has received the Certificate in Global Management (CGM) certificate from INSEAD.

Abdullah Bakhrebah

Board Member - Non-Executive

Abdullah has more than 16 years of experience, gained by working with international and local financial institutions. Before joining TAIC, he was the CEO of State Street Saudi Arabia Financial Solutions. He also served as Head of Business and Product Development at Ashmore Investment Saudi Arabia from 2019 to mid-2020, where he chaired the Board of Directors of Ashmore Investment Funds and Taza Company Limited. From 2015 to 2018, he served as Head of Sales in Saudi Arabia at Gulf International Bank (UK). and GIB Capital where he led business development

Abdullah's professional journey also includes various roles at SABB, including structured derivatives and treasury risk consulting from 2008 to 2015. Abdullah was elected to the Financial Market Institutions Committee of the CMA in 2020 for a two-year term.

Abdullah holds a Master’s degree in Business Administration from London Business School and a Bachelor’s degree in Management Information Systems from King Fahd University of Petroleum and Minerals.

Stefan Gmür

Board Member

Stefan Gmür is executive vice president and global head of Official Institutions and international head of Asset Owners and Insurance Companies.

Previously, he was chief executive officer for State Street Bank International GmbH, Munich and before that, head of sector solutions for Europe, Middle East and Africa, where he was responsible for sales, cross-selling to existing clients, mergers and acquisitions, and large-deal activity across all our client sectors.

Stefan joined us in 2002 with 15 years of experience in new business development, securities operations, client service, cash management, trade finance, equity trading, securities lending, relationship management and marketing.

Before joining us, Stefan held senior-level positions at Bank Leu AG, JP Morgan, The Bank of New York and Deutsche Bank.

Oliver Berger

Board Member

Oliver is a executive vice president and head of the Middle East and North Africa for State Street Bank. In this role, he is responsible for strategic initiatives across the MENA Region both for existing clients and the development of new client relationships in the region. Oliver is a member of the firm’s Operating Group. He joined State Street in 2014 with 25 years of experience in new business development securities operations, client service, equities & derivatives sales, securities lending, relationship management and business management.

Emmanuel Laurina

Board Member

Emmanuel is a managing director and head of the Middle East and Africa at State Street Global Advisors. Supported by a team of 12 in Riyadh and Abu Dhabi, he heads SSGA’s operations, business development and relationship management activities. Emmanuel is the appointed senior executive officer of the State Street Global Advisors Limited branch in the Abu Dhabi Global Market and is a non-executive director on the board of State Street’s subsidiary in Saudi Arabia. He is a member of the firm's global Senior Leadership Team, EMEA Executive Management Team, EMEA Inclusion and Diversity Committee, and of State Street's Country Risk Committee and MENA Leadership Team. He serves as a Steering Committee member of the 30% Club’s MENA chapter, a non-profit organization for the advancement of women in business. Emmanuel joined State Street in 2005, and holds an Master of Arts degree in Translation Studies from the University of Mons-Hainaut, Belgium and has completed the Executive Leadership Program at Oxford University’s Said Business School.

Contact Us

State Street Saudi Arabia Financial Solutions

9th Floor, Tadawul Tower

KAFD, AlAqeeq District

Riyadh, Saudi Arabia

Office: +966 11 490 3889

Fax: +966 11 490 3897

How to Make a Complaint

You can report a complaint through one of the following channels:

- Email: Complaints.KSA@statestreet.com

- Fax: +966 11 490 3897

- In person, by submitting the complaint to one of our team members at any State Street Saudi Arabia Financial Solutions office during official working hours from 9 a.m. to 5 p.m.

Annual Report

To upload the following as PDF Documents: