Insights

On-chain adoption accelerates as doubt persists

While the investment industry grows increasingly bullish on the adoption rate of on-chain investment and digital assets, many firms remain doubtful that on-chain investments will ever fully overtake traditional trading and custody processes.

October 2025

The third annual State Street Digital Assets and Emerging Technology Study reveals how investment institutions view digital asset investments, including cryptocurrencies and tokenized mainstream assets. It shows that these institutions have significantly lowered their expectations for when they anticipate on-chain digital asset investments to become a widespread practice that is interoperable with traditional investment operations.

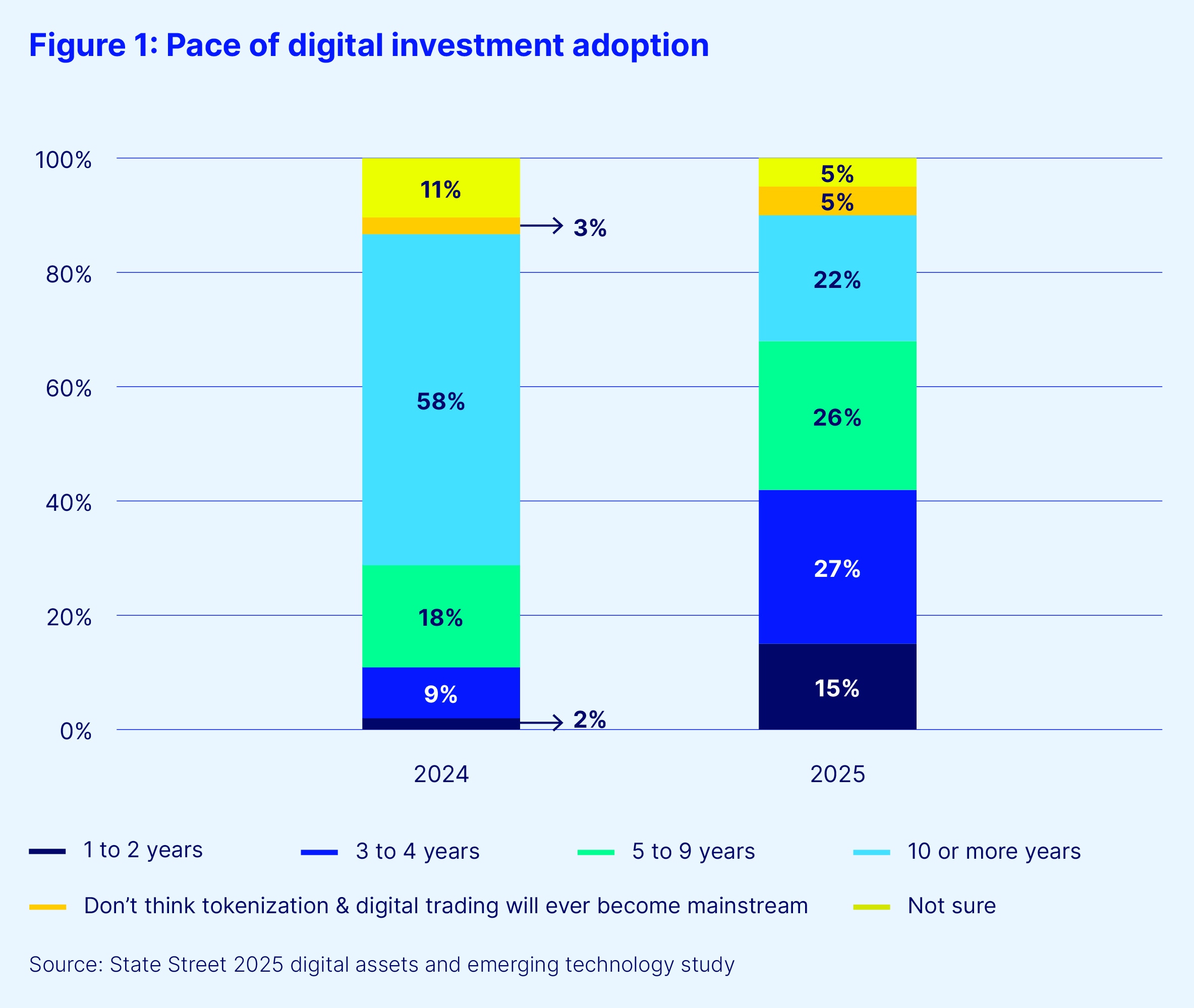

Over two-thirds (68 percent) of this year’s respondents anticipate digital investment adoption will become mainstream within 10 years – more than double last year’s 29 percent. Meanwhile, 58 percent predicted last year it would take more than a decade. Notably, 43 percent of respondents now believe hybrid decentralized finance/traditional finance (DeFi/TradFi) investment operations will be mainstream within five years, a sharp rise from just 11 percent last year.

One of the most striking findings from the new research is that when asked, “How long do you think this TradFi/DeFi interoperability will remain a widespread practice before being replaced by a fully digital investment environment?” 14 percent of respondents said they do not think this will ever happen, up significantly from just 3 percent in 2024.

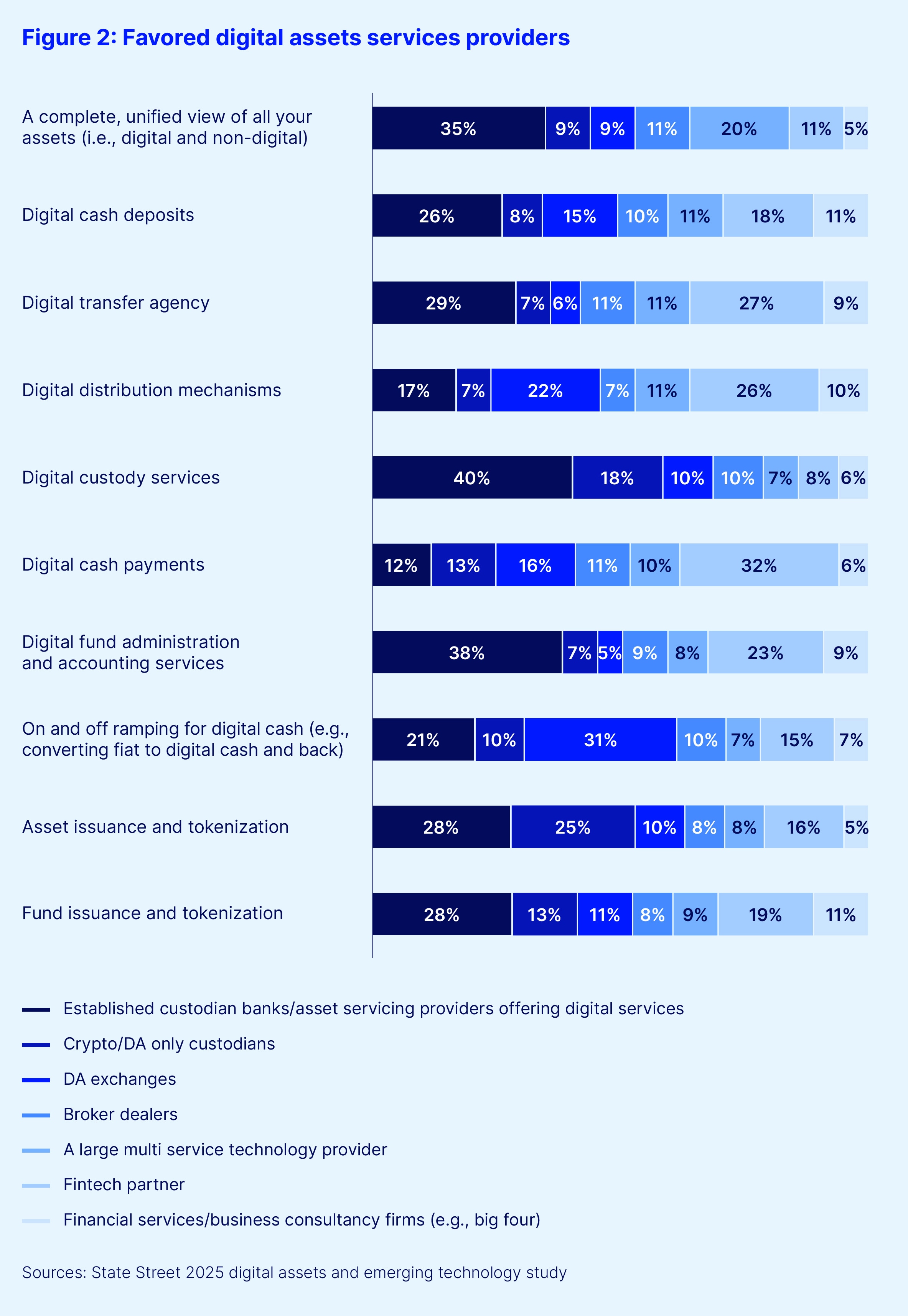

As allocation to on-chain assets grows, the complexities involved with providing institutional grade custody and trading becomes more apparent (as discussed in the July 2025 Digital Digest). This is leading a significant and growing minority to question whether such standards can be achieved without retaining some legacy practices. It could also explain why custodians and other established financial services providers are buy-side institutions’ preferred options for most digital assets-related operations (see Figure 2).

Across 10 service areas and seven potential provider types, custodians and established asset servicing providers were the top choice for all but three options. Digital cash payment architecture and conversion between digital and fiat cash were seen to be the domain of fintechs and digital asset exchanges respectively, and for distribution both fintechs and digital asset exchanges were favored.

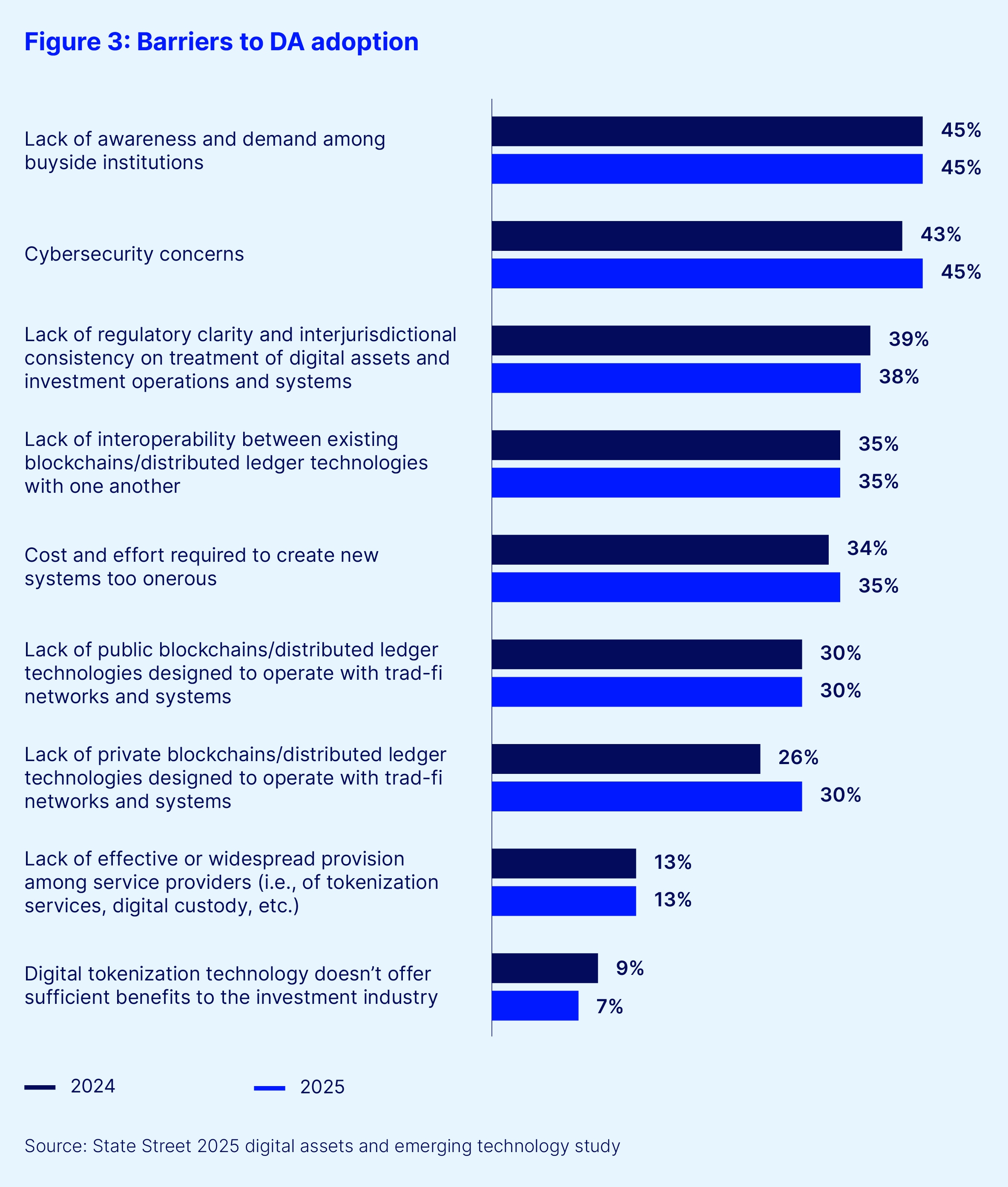

The industry sees the primary barriers to adoption of digital assets and infrastructure as largely unchanged. In 2024, lack of awareness or understanding of the technology, cybersecurity concerns and an absence of regulatory clarity were the top three obstacles. This remains the case this year, with very little difference in the percentages of respondents selecting these options.

In fact, the similarity in responses to this question between this year and last is striking (see Figure 3). While progress has clearly been made, as indicated by the increased expectations for pace of adoption, it has not been enough for much of the industry in a number of core areas.

When the type of organization is taken into account, some nuance does creep into the perceived barriers to adoption. Asset managers are significantly more concerned about lack of awareness than asset owners (53 percent versus 38 percent). Meanwhile, asset owners see a lack of appropriate service provision for institutional investors to a much greater extent than asset managers (42 percent versus 30 percent). Related to their concerns about institutional-grade provision specifically, owners were also somewhat more likely than managers to prioritize cybersecurity concerns (48 percent to 42 percent).

These results indicate a more cautious, risk-focused view of the obstacles from the asset owner community compared to managers whose main difficulties lie in the industry’s capacity to implement rather than concerns about the technology or infrastructure themselves. The desire to see improved education and awareness about digital assets and technology makes sense when considering the scope of the benefits the industry sees accruing from their adoptions.

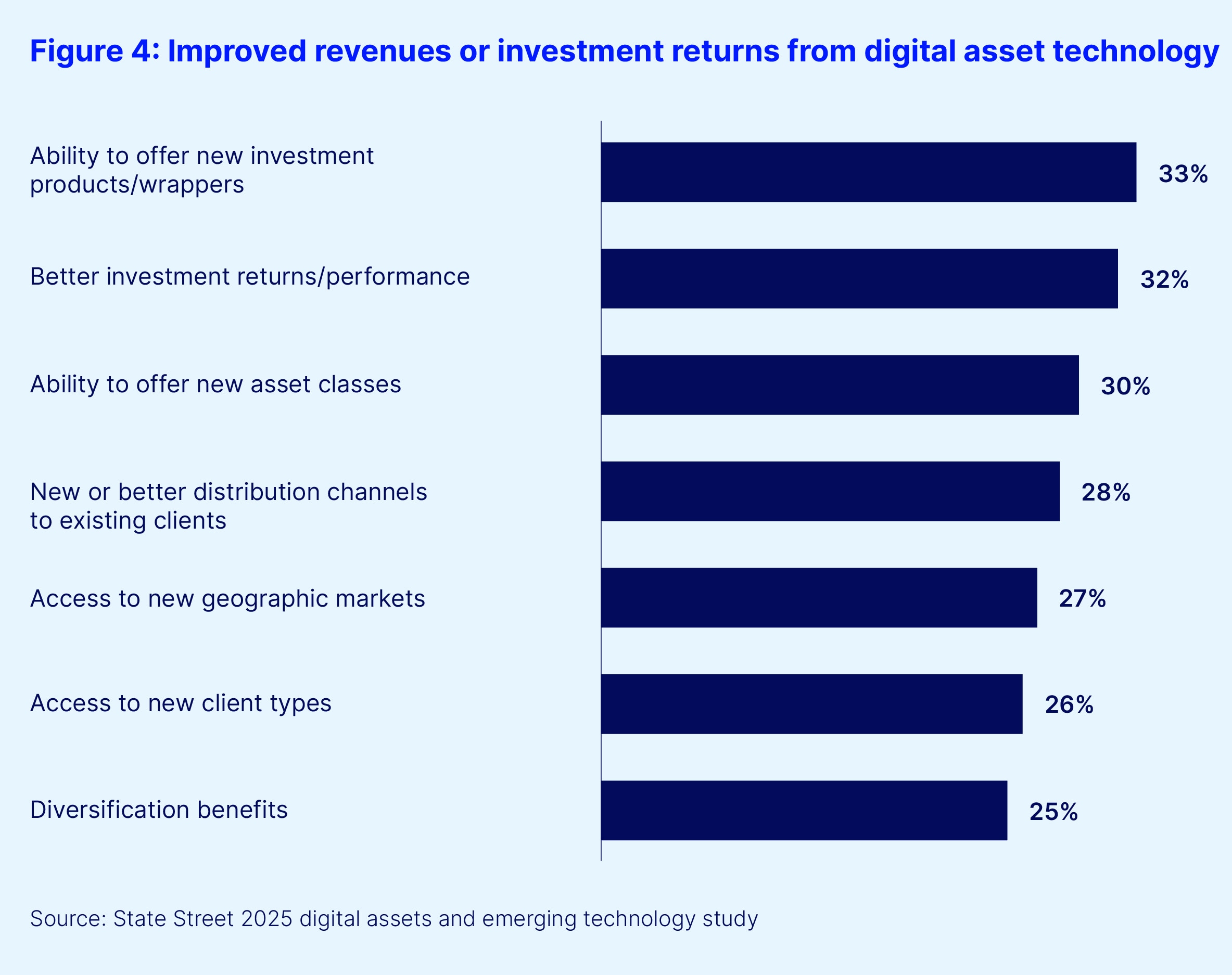

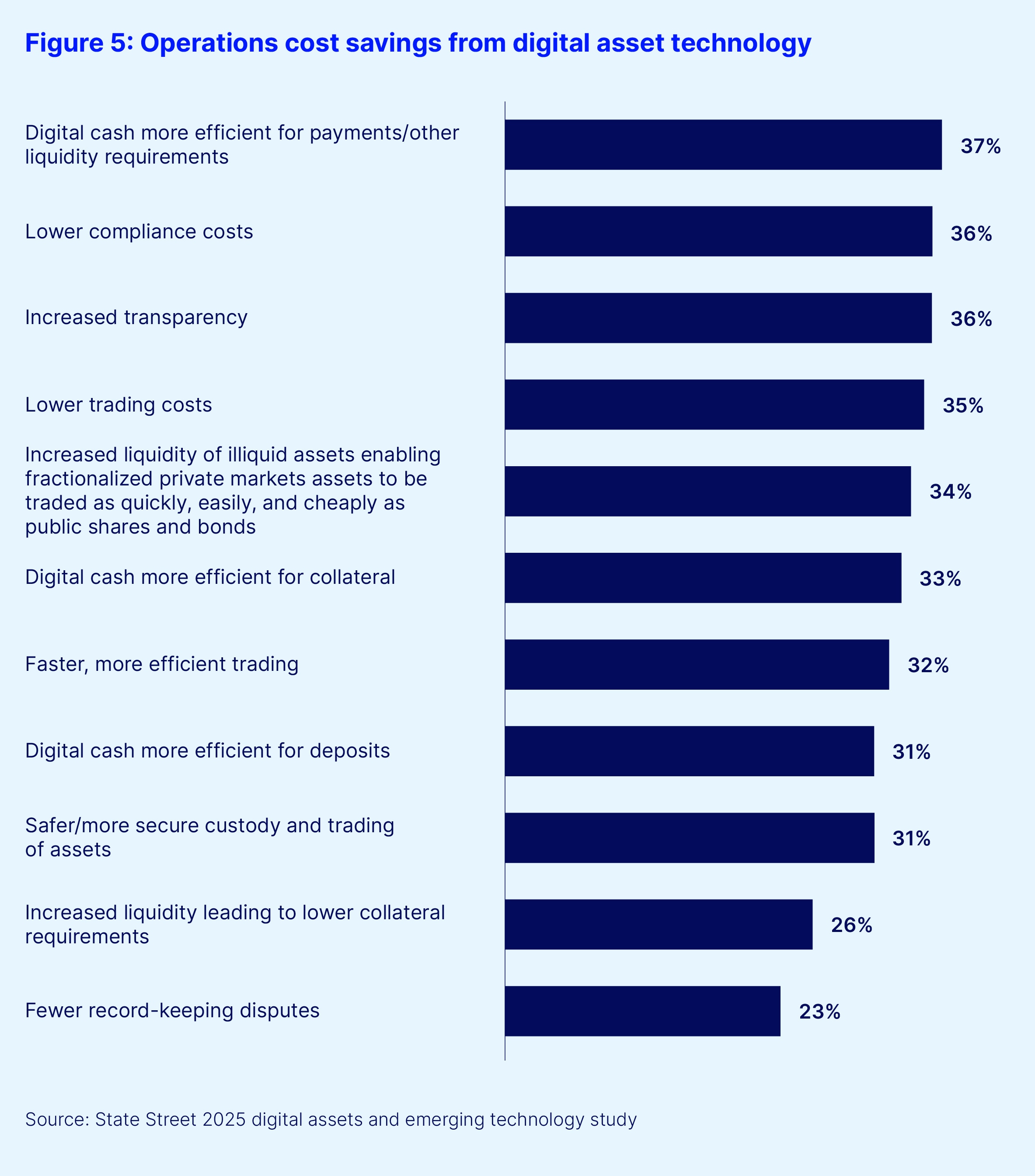

Respondents saw significant potential for cost savings from improved operational efficiency as well as increased revenues and improved investment returns. Organizations are slightly more inclined to view digital infrastructure as a driver of cost savings and efficiency rather than as a means to improve outcomes (36 percent to 29 percent). About a third (35 percent) said both were equally significant outcomes.

In both cases, the scale of anticipated benefits is large. Expectations of improved revenue or investment performance averaged between 25 percent and 33 percent, across the range of areas surveyed (see Figure 4). Savings of between 23 percent and 37 percent of current expenditures on average are expected across a large number of operational areas (see Figure 5).

Our latest research into digital assets technology and on-chain investment infrastructure adoption brings greater clarity to previous iterations of this survey. While some of the same hindrances and frustrations remain, the industry has evidently matured in its understanding of and approach to this technology. It is more optimistic about the near-term likelihood of adoption but is also more clear-eyed about its ability to simply wipe away longstanding practices and systems that exist to protect investors, and provide reliable services. This data suggests that the stage is set for a more pragmatic, and ultimately, more successful DeFi adoption environment.